Real estate agents are teachers, and their wisdom doesn’t have to putter out at the closing table: they can also leave clients with lessons for the future.

Like how to manage mortgage debt.

That’s where startup Earnup can come in handy. It helps consumers manage debt by automating saving and loan payments.

While a number of startups may be honing similar products, Earnup recently achieved some notable recognition. It was honored as a winner of the Financial Solutions Lab, an initiative co-founded by JP Morgan Chase. And, today, it announced a $3 million funding round led by Blumberg Capital, Kapor Capital and Camp One Ventures.

Earnup helps consumers absorb “financial shocks related to income volatility where their income doesn’t match up with when loan payments are due,” said EarnUp Co-Founder Matthew Cooper in a statement.

The startup constantly siphons off small amounts of a user’s income to a stash earmarked for loan payments. It makes loan payments automatically on behalf of users and “in a way that reduces debt faster,” according to EarnUp.

EarnUp didn’t immediately respond when asked about the cost (if there even is a cost) of its product for consumers.

This tool could help your leads and clients manage their debtDavid Blumberg, managing partner of Earnup Blumberg Capital, said in a statement that EarnUp helps consumers “reduce interest expense,” “budget better, and save more in a simple and elegant service.”

As digital marketing increasingly connects agents with consumers who are months or even years away from buying or selling, referring prospective clients to budget-management tools like EarnUp might be a way to add demonstrate value right off the bat.

Millennials, who have grown up using digital tools and often are shackled by student loans, might be particularly receptive to such tools.

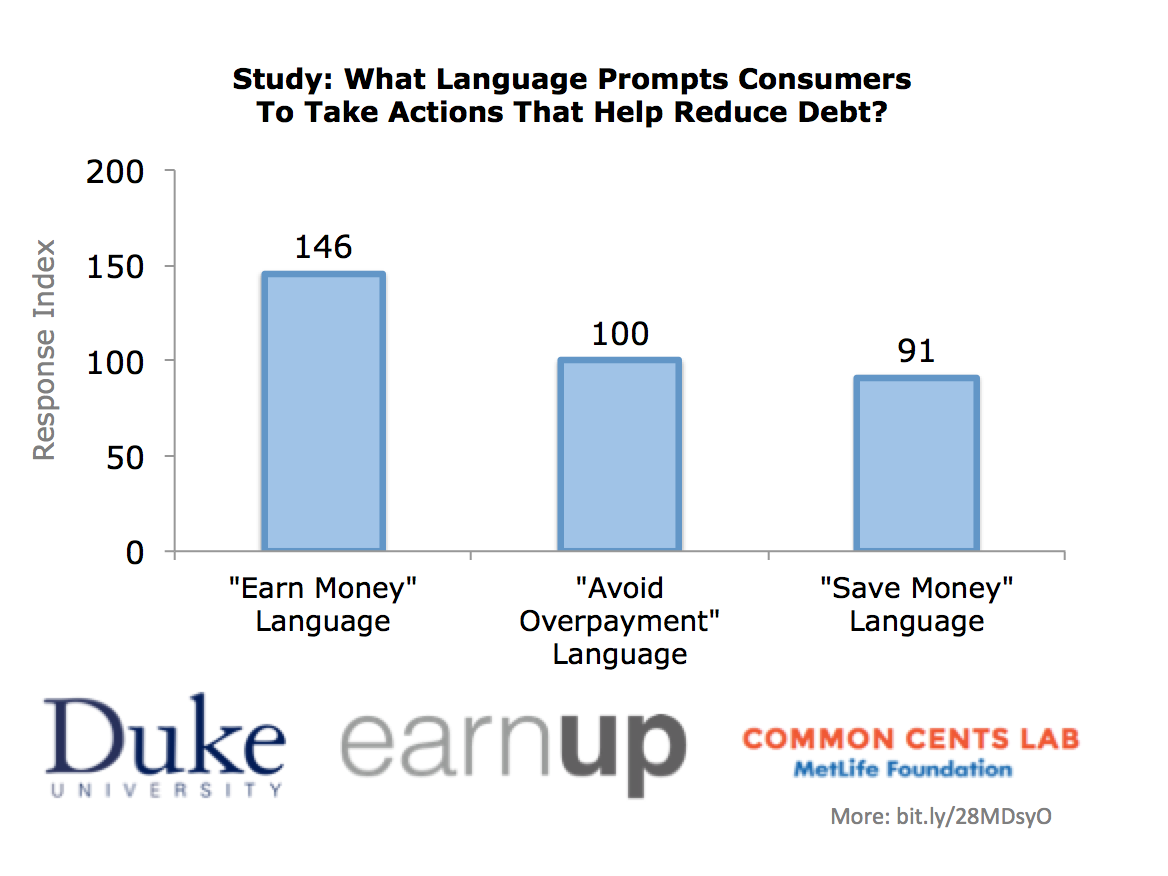

EarnUp’s branding and product design has been influenced by its conclusion — based on a study Earnup conducted in partnership with a Duke University professor — that consumers are 59 percent more interested in taking actions to reduce debt when pitched with “earn money” language, rather than “save money” language.

EarnUp hasn’t officially launched yet, but claims to already manage more than $500 million in consumer loans .

Source: click here