Earlier this month, Purplebricks announced its full-year financial results for 2018 with revenues doubling to £93.7 million.

Why does it matter? This is the first public glimpse into Purplebricks’ U.S. launch, and across the entire group there are a number of key takeaways:

The U.K. business is materially profitable. The U.S. launch is very expensive and tracking behind Australia in key metrics from the first eight months. Marketing return on investment (ROI) in the U.K. is flat. Coverage of PurplebricksThe media and the overall industry’s response to Purplebricks’ really grinds my gears.

The headlines are all negative and revolve around “mounting losses” for the business. Some alternate — and just-as-true — headline suggestions:

Revenues double (again) at Purplebricks Purplebricks’ international expansion makes gains Purplebricks maintains steady growth and profitability in the U.K.But none of these are as sensational, nor do they play into the existing narrative of mounting losses for a doomed business.

Yes, there is such a thing as too much real estate tech

Brokerages that pile on the tech might be hurting their business READ MORE

Yes, there is such a thing as too much real estate tech

Brokerages that pile on the tech might be hurting their business READ MORE

Then you have the inevitable “the sky is falling” comment from the investment bank Jefferies, whose singular achievement has been being consistently and definitively wrong on the sector for the past three years. (If you invested money on their recommendation you would have lost 88 percent).

It’s alarming that they still have enough credibility to be the go-to quotable source for these matters.

The narrative of ‘mounting losses’What’s most surprising about the “mounting losses” narrative is that it is unsurprising. Purplebricks recently raised £100 million from Axel Springer. The value of £1 sitting in the bank is exactly £1. Wouldn’t you expect Purplebricks to spend it instead?

And like all growing businesses (the financial markets still like growth, right?), you need to spend today to make money tomorrow. The majority of growth-stage businesses are in the same boat — which is exactly why they are raising money and spending it.

When you spend money today in an effort to grow your business, it’s called investment. It’s “losing money” in the same sense that you are “losing flour” when you bake bread. It’s not about “mounting losses” in your flour reserves; it’s about what you can make with that flour.

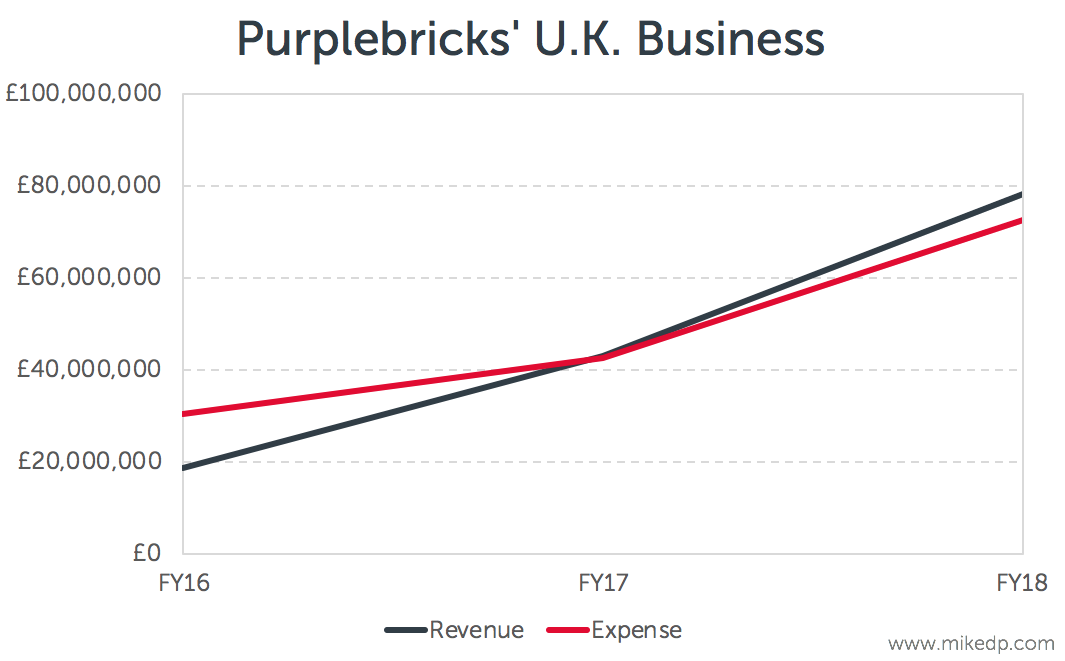

Materially profitable in the U.K.Now on to the analysis! The first and most important takeaway from the results is that the U.K. business is materially profitable. The model works, it makes money and — at scale — is profitable.

Whether you look at operating profit (£4.2 million), adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), which is £8.1 million, or my preferred EBITDA with stock-based compensation added back in (£5.7 million), the business is finally generating profits after years of investment.

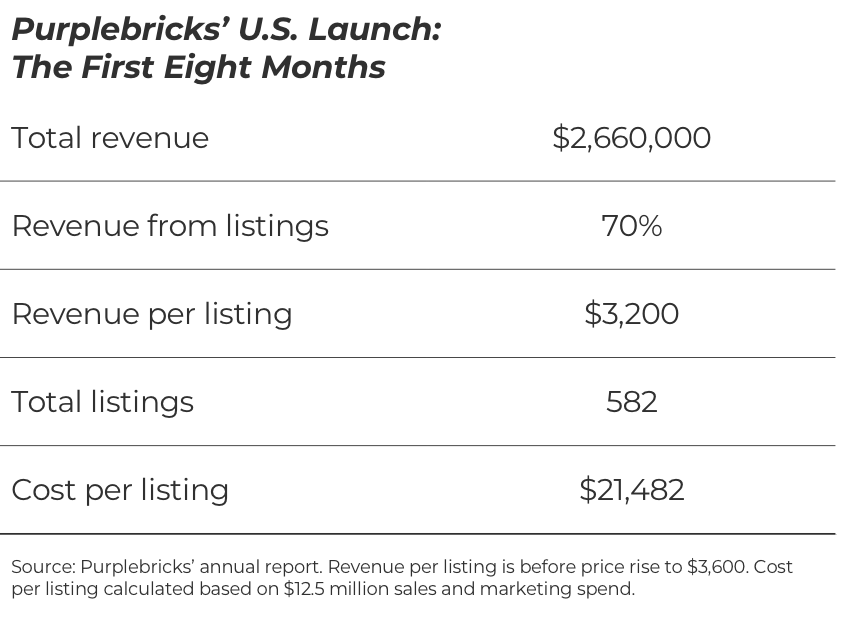

The U.S. launch takes shapeThe big question on everyone’s mind is how the U.S. launch is tracking. Based on the numbers reported in its full-year results, Purplebricks USA generated $2.6 million in revenue from around 580 listings.

That comes out to a hefty cost per listing of around $21,000 (compared to around $400 per listing in the U.K.). To put that into context: it’s still early days, so that number should be high — and, wow, is it high.

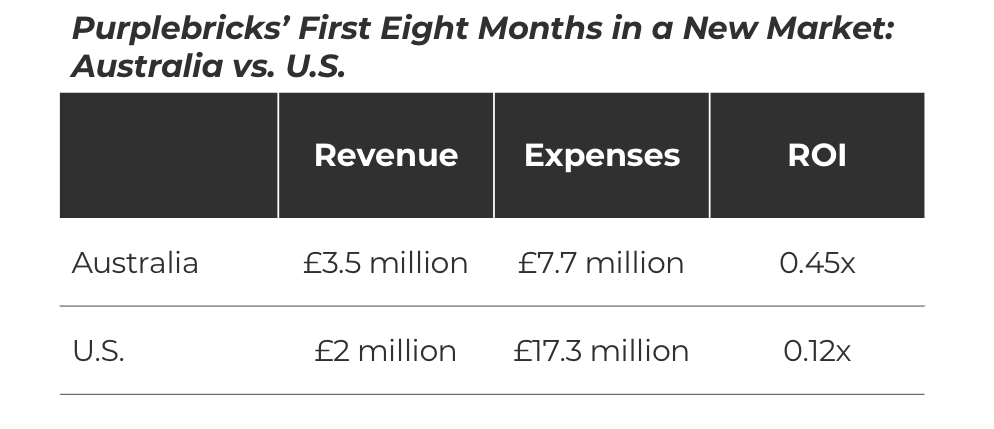

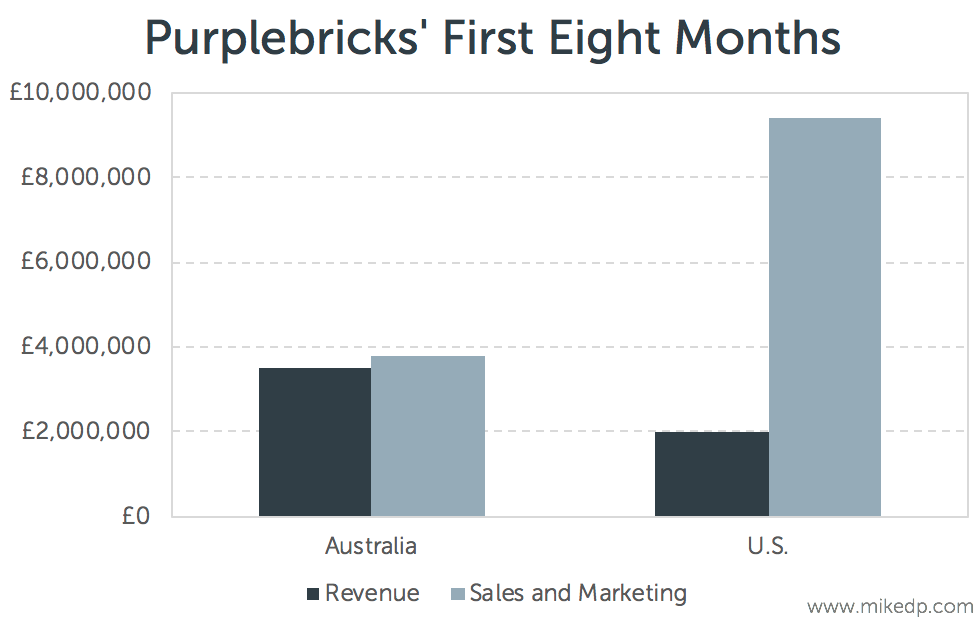

Comparing the first eight months in a new market: Australia vs. the U.S.What I find most interesting is a direct comparison of Purplebricks’ first eight months in Australia and the U.S. It’s clear that Purplebricks is going big in the U.S., spending more than double what it spent for its Australian debut.

But the increased spend isn’t yielding results (yet). Despite the massive spend, revenues in the U.S. are still small, with a return on investment about 1/4 of that in Australia. Remember: this is a direct comparison of the first eight months in a new market.

You’re probably wondering why. It’s a complex situation, but for starters, Purplebricks may have launched in the wrong U.S. markets (as I’ve written about previously).

A few other points to note when comparing launch markets:

The price points are about the same: $3,200 in the U.S. compared to $3,300 USD in Australia at launch. The first eight months in Australia yielded around 1,050 listings, compared to around 580 in the U.S.One factor that’s really driving costs in the U.S. is the sales and marketing spend, which is expensive in the launch markets of Los Angeles and New York City. Compared with its Australian launch, Purplebricks is spending more than double.

One impressive aspect of the Purplebricks operation is its marketing efficiency. I’ve always been interested in the customer acquisition cost, as it’s a critical key performance indicator (KPI) for the online agency model.

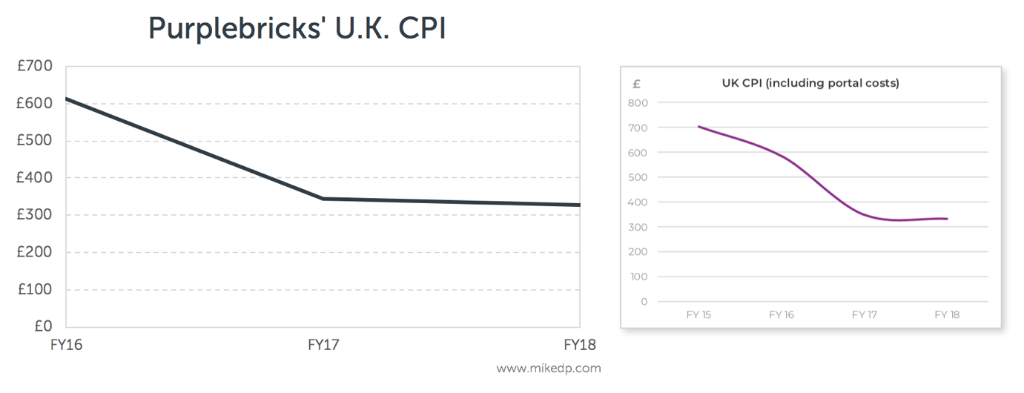

As we can see, the cost per instruction (CPI) has improved slightly from last year, but is relatively flat. (My chart is on the left, with Purplebricks’ own chart on the right.)

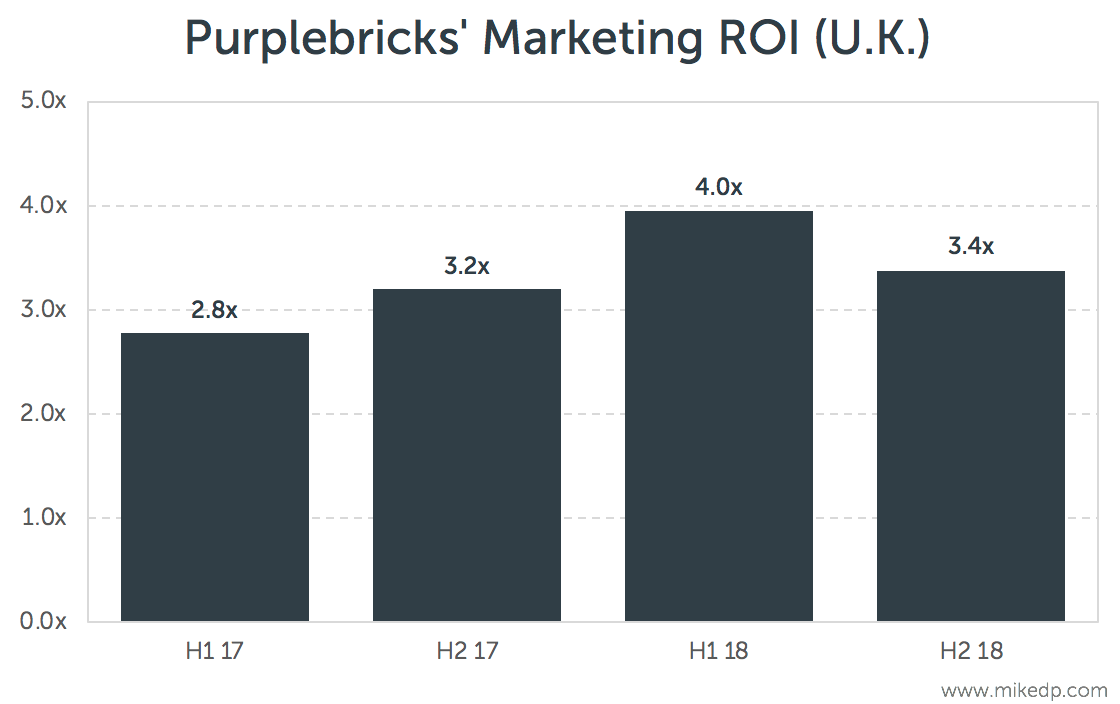

A more granular view of the overall marketing ROI (revenue/sales and marketing) shows an overall improvement, but with a recent dip.

This is no cause for alarm. Marketing ROI is still positive and a number of factors may be at play here, including the overall housing market in the U.K. But the data does show a change from what we’ve seen in the past. Keep an eye on this.

Mike DelPrete is a strategic adviser and global expert in real estate tech. Connect with him on LinkedIn.

Source: click here