With declining home inventory across the U.S., an increase in flipped properties may actually be helping to provide more livable properties that entry-level and experienced homebuyers alike wouldn’t otherwise consider.

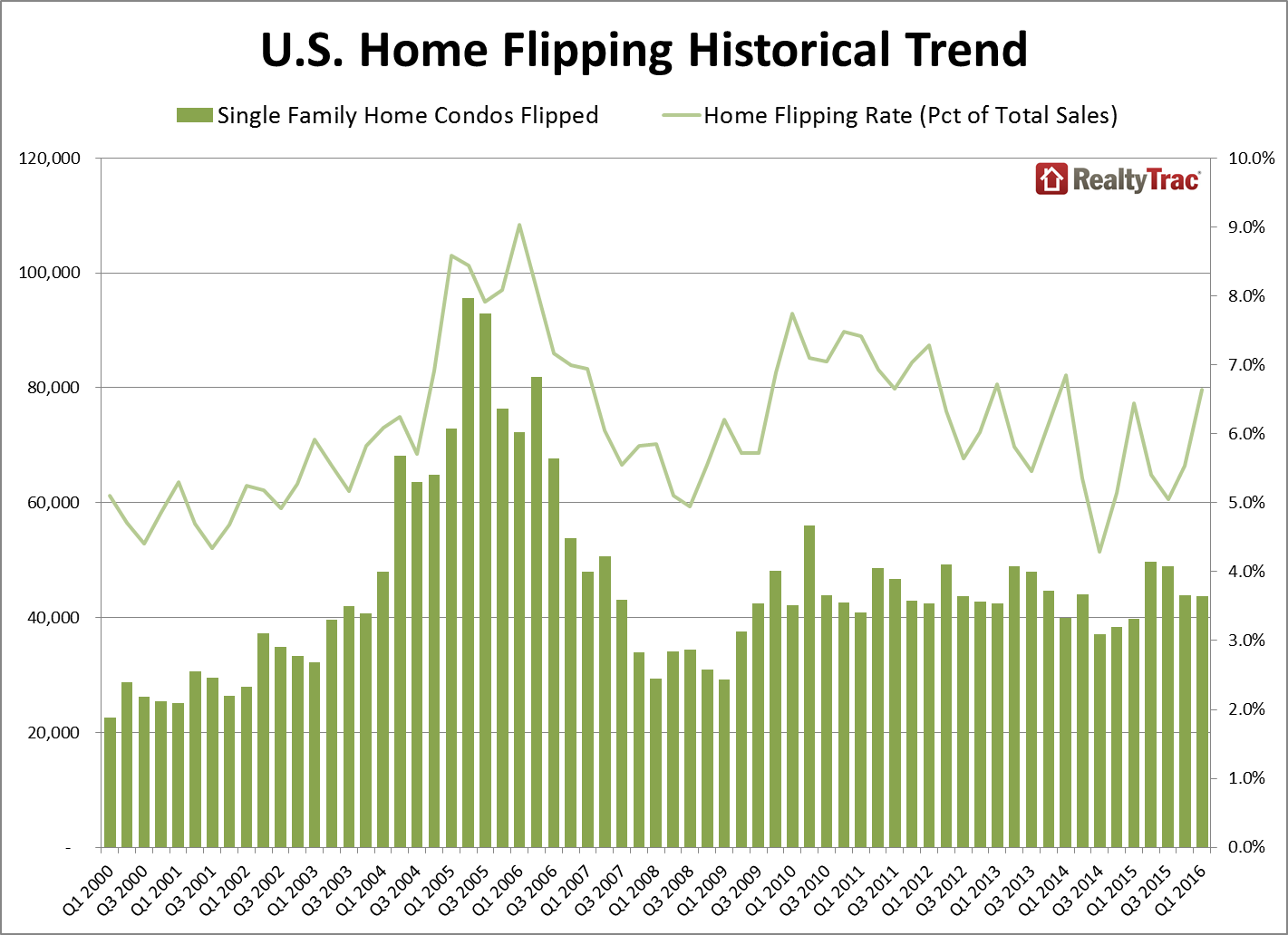

RealtyTrac’s Q1 flipping report reveals that flips have picked up steam. Flipping as a share of all home sales jumped 20 percent since Q4 2015 and 3 percent year-over-year to reach 6.6 percent of all single-family and condo sales. Home flip shares are at the highest level since the first quarter of 2014.

Home flip shares are at the highest level since the first quarter of 2014.“I see flipping as a positive, healthy sign right now — especially in a market without a lot of inventory in good condition,” said Daren Blomquist, senior vice president of RealtyTrac. “Flipped homes are somewhat stepping in to the gap left by the lack of home building in the country.”

Although some might assume the high quarterly increase is related to seasonality, the first quarter jump is almost double the 15-year typical quarterly increase this time of year of 11 percent.

Home flippers are acting rationally in most markets by opting for all-cash transactions. Blomquist notes that 71 percent of homes were flipped using cash in the first quarter, compared to 37 percent of flippers who purchased with cash when flipping was at an all-time high.

Home flips at 6.6 percent of all home sales is 26 percent below the peak during the first quarter of 2006, when flipping held a 9 percent share of national sales.

Baltimore and Chicago: Does more flipping help the market?Flipping increased in two-thirds of states and 59 percent of metro areas in the study. But 7 percent (or 9 out of 126) of the metropolitan statistical areas stood out more than others with new all-time highs.

Baltimore, a metro with a high share of distressed properties, had about 9 percent of home sales as flips in the first quarter, which is right around the national peak.

“Nationwide, we saw 9 percent of homes being flipped as an all-time high. We’re basically at that in Baltimore,” said Blomquist. “I believe that’s crossed the threshold and could potentially overheat the market.”

Baltimore is in dangerous territory, but it includes a high level of distressed inventory that buyers may not otherwise consider on their own.

While dramatic increases in share of flips can be concerning, many markets are still within the healthy threshold, especially compared to the national averages.

Chicago hit a 36-quarter (or 9-year) high, but flipping only encompasses 5.8 percent of all home sales — below the national average.

“Chicago has a lot of those areas where flippers can go into some of the neighborhoods and buying properties that are in poor condition and fixing them up,” he said.

“Of course they are making a large profit, so it’s not all altruistic, but it’s definitely helping in a city like Chicago.”

South Florida sees higher shares of flipsIn Tampa and Miami, flip shares were higher than the national average at 10.8 percent and 9.5 percent, respectively.

“I think Miami is starting to get into dangerous territory,” said Blomquist. “It’s not back to the 14 percent high, but 9.5 percent in the first quarter was the highest level since the third quarter of 2006.”

Other markets with higher shares than the overall U.S. market include Las Vegas (10.3 percent), Virginia Beach (9.9 percent) and Jacksonville (9.4 percent).

Meanwhile, Memphis held the highest share of flips in the first quarter at 13.3 percent. Fresno also reached 11.3 percent, the fourth highest in the U.S.

Profit highest out EastThe average gross flipping profit in Q1 was $58,250 — the highest since Q4 2005.

Average gross flipping profit does not include rehab costs or other expenses, which typically cost between 20 percent and 33 percent of the property’s rehabbed value.

The Q1 profit average is a 47.8 percent return, the highest ROI since the third quarter of 2012.

Three markets in Pennsylvania held the highest ROI in Q1. East Stroudsburg (212.1 percent), Reading (136.4 percent) and Pittsburgh (126.8 percent) topped the list.

Other markets with high ROI included Flint, Michigan (105.8 percent) and New Haven, Connecticut (104.8 percent).

Philadelphia reached 103.7 percent average gross ROI. Cincinnati (88.5 percent), Buffalo, New York (85.1 percent), Cleveland (83.8 percent), Jacksonville (81.8 percent) and Baltimore (80.8 percent) were the remaining high-grossing markets in the first quarter.

Could returns push markets into danger?“I think the bandwagon flippers will be attracted to the market, which can dilute the quality of flipping going on,” Blomquist said.

However, Blomquist added that flipping, for the most part, is healthy. The share of cash buyers is going down slightly, but still remains high.

Another gauge for a healthy flipping market is the level of discount flippers purchase at — which is positive nationwide. But, some markets show flippers buying at minimal discounts and even steep premiums.

In San Antonio, flippers are actually buying at 8 percent above market value, compared to the national 27 percent purchase discount. In Austin, they are buying at a 1 percent premium. In Salt Lake City, they are only buying at a 2 percent discount.

“The flippers are kind of compromising on the core principals of flipping: to buy at discount and sell at or above market value,” Blomquist said. “In a really hot market, flippers can get by with that strategy, but it’s an indication that flipping is becoming too speculative in some cases.”

Source: click here