Last week, Zillow announced a major strategic shift: Along with a new CEO, it made clear that its top focus is its Zillow Offers iBuyer business. Let’s talk about the highlights of that announcement.

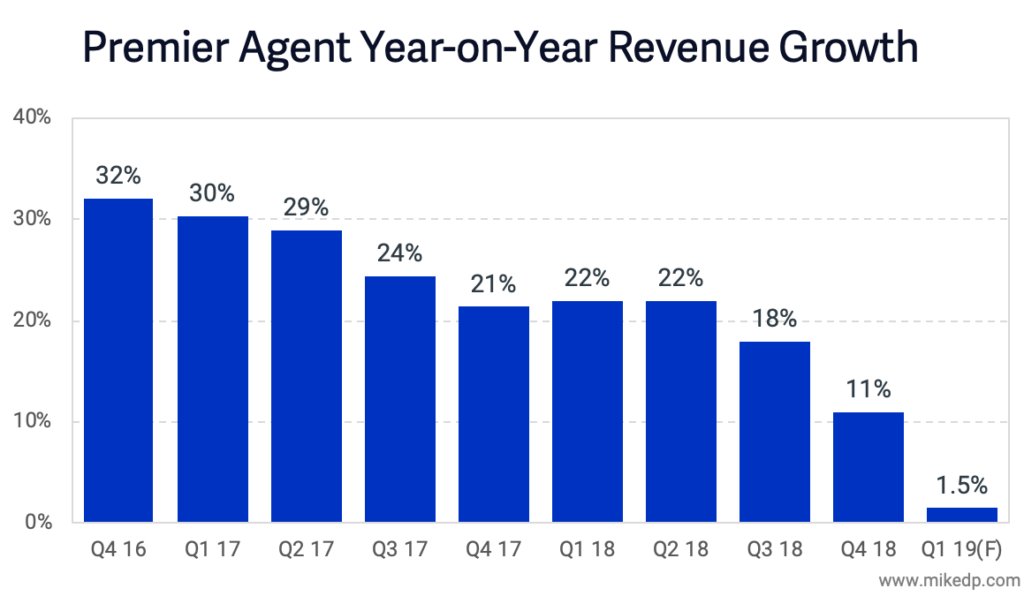

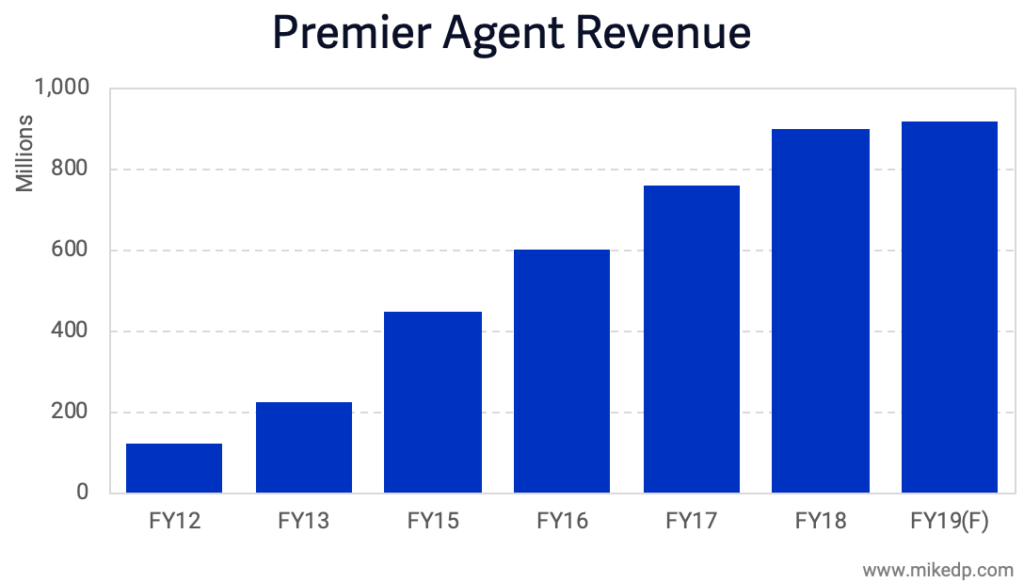

Premier agent growth grinds to a haltThe most striking statistic from Zillow’s results is the lack of projected growth in its flagship, billion-dollar Premier Agent program (which accounts for 67 percent of its revenue). Guidance for the first quarter of 2019 is only 1.5 percent — a steep decline from past quarters.

And on a full-year basis, Zillow projects its Premier Agent program will grow at 2 percent — a flattening from past, double-digit growth.

Both of these projections come on the back of difficulties rolling out new Premier Agent products focused on lead quality over quantity.

Build your pipeline with new home sales

This segment represents over 10% of the sales market, so how can you leverage it to grow your business? READ MORE

Build your pipeline with new home sales

This segment represents over 10% of the sales market, so how can you leverage it to grow your business? READ MORE

But what’s most striking is the suddenness of the decline. Going from double-digit to flat growth in the span of a year is significant. More than rollout issues, I believe Zillow has reached the upper limit of what it can charge agents for leads, which is what’s driving such a significant shift in strategy.

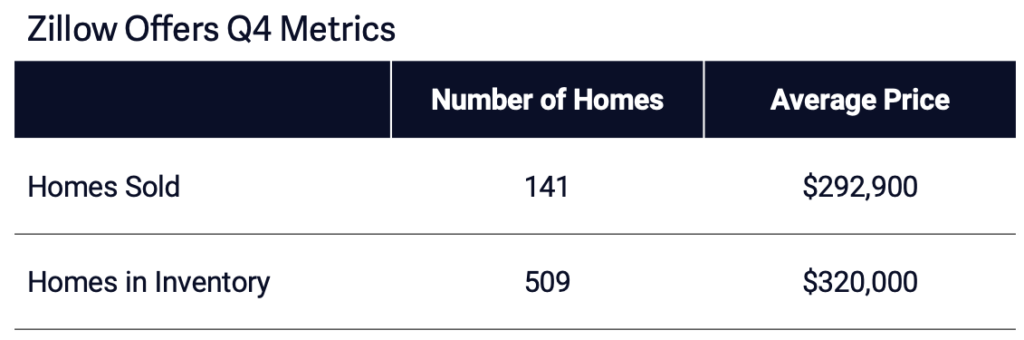

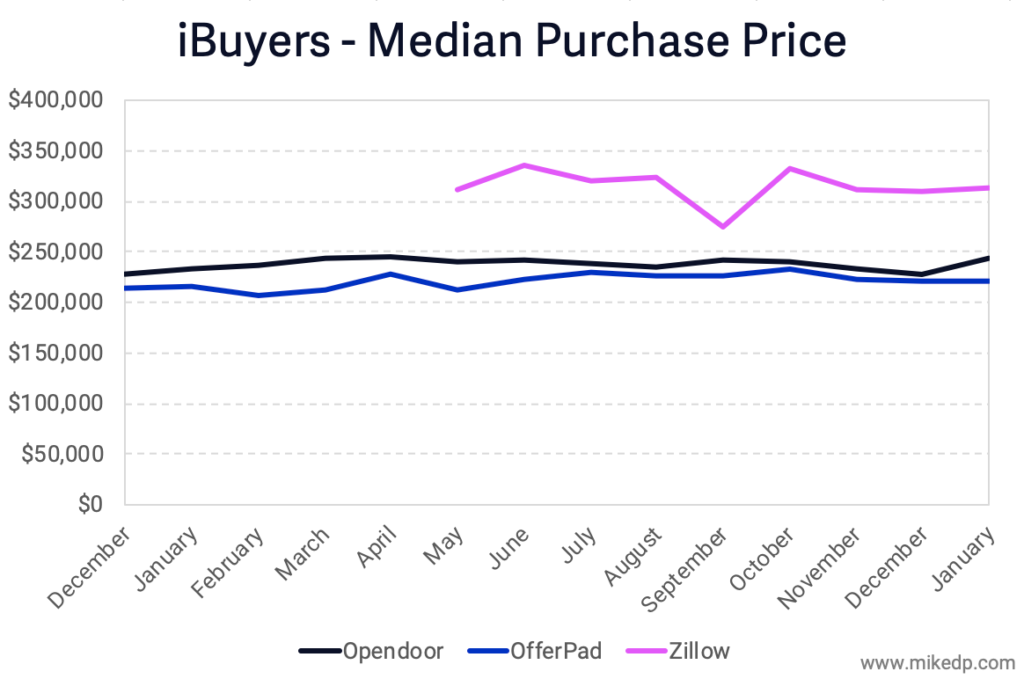

Expensive homes and a longer hold timeLast week, I wrote about Zillow’s unsold inventory in its Offers program, and the significance of longer hold times. The latest data highlights the same challenge.

The homes Zillow sells are less expensive: an average sale price of $292,000. However, the houses it holds in inventory are considerable more expensive, with an average value of $320,000.

This data point matches up exactly with the latest data from Phoenix, which shows a considerably higher average purchase price for Zillow compared to the other iBuyers.

The more expensive the home, the higher proportion of unsold inventory. It takes longer to sell more expensive homes, and it looks like Zillow is more than dabbling in the expensive end of the market.

This is a key metric to watch.

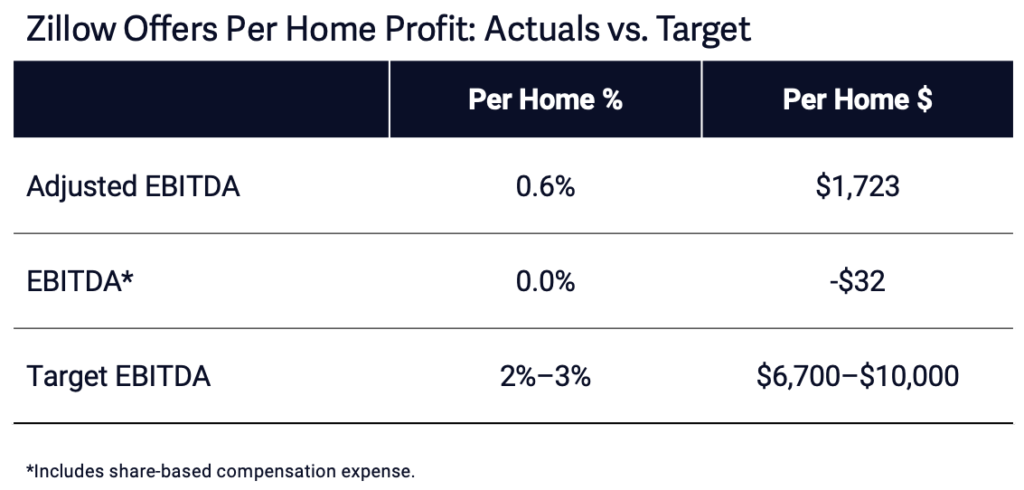

Profit projectionsZillow released a detailed financial breakdown for its Offers business, including initial profit margins on its sold homes.

Adjusted EBITDA, which backs out a number of costs including stock-based compensation, shows a per-home profit margin of 0.6 percent, lower than the stated goal of 2 percent to 3 percent.

(As a form of employee compensation, I believe stock-based compensation should be included in a true EBITDA calculation, so I’ve provided both options above.)

It’s still early days, but this benchmarks current performance compared to where the business needs and wants to go in the future.

Strategic implicationsI believe Zillow’s guiding strategic principle is that it must be consumers’ first destination in the homebuying and selling process. Zillow’s sustainable competitive advantage lies in its massive audience and strong position at the start of the consumer journey.

Think of this latest move as “Zestimate 2.0.” The original Zestimate gave consumers a fun and helpful starting point when thinking about moving or buying a house.

Now that online valuations are a commodity, Zillow needs to up the game: Instead of an estimate of value, how about an actual offer on your house? It’s a compelling consumer proposition — even if it simply serves the same purpose as the original Zestimate (attracting consumers at the start of the journey).

Mike DelPrete is a strategic adviser and global expert in real estate tech. Connect with him on LinkedIn.

Source: click here