It’s been said again and again — a home will be the largest and most important purchase most a person makes in their lifetime. And for many buyers, the process comes with plenty of confusion about home prices, down payments, mortgage loans, taxes, insurance rates, and understanding what’s affordable.

That’s why realtor.com on Tuesday released three new affordability tools on its iOS, Android, and desktop platforms that provide buyers with a realistic estimate of what they need to become homeowners.

“At realtor.com, we go beyond listings search to help people figure out what homes are right for both their lifestyle and budget,” said realtor.com Chief Product Officer Chung Meng Cheong in a prepared statement. “The fear of overextending themselves financially is one of the biggest concerns for today’s home buyers.”

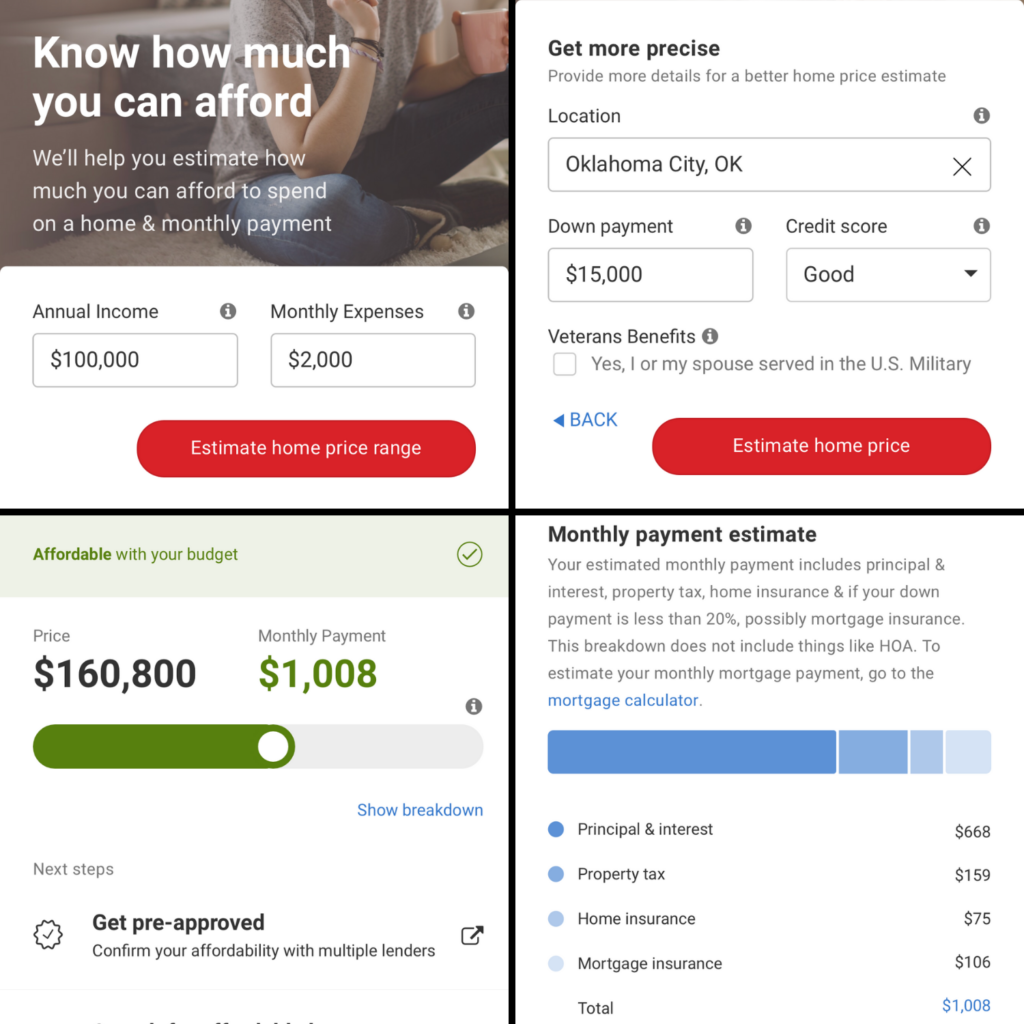

The first tool, “How Much Home Can I Afford?” helps buyers identify their perfect price point by having them provide their net annual income, monthly expenses (e.g. student loan, car, and credit card payments), desired neighborhood, expected down payment, and credit score.

The “How Much Home Can I Afford” tool

After providing the information through the mobile app or desktop site, realtor.com gives buyers an affordable price point and monthly payment. Realtor.com does note that some buyers may not receive an estimate because their debt-to-income ratio is too high based on the annual income, monthly expenses and credit score they provided.

How to leverage culture for growth

Why the environment you create is the key to attract and keep the best talent READ MORE

How to leverage culture for growth

Why the environment you create is the key to attract and keep the best talent READ MORE

The tool also provides a breakdown of the monthly payment, which includes principal and interest, property tax, home insurance, and mortgage insurance. Lastly, buyers are prompted to search for homes in their price point, compare mortgage rates, and get pre-approved with a lender.

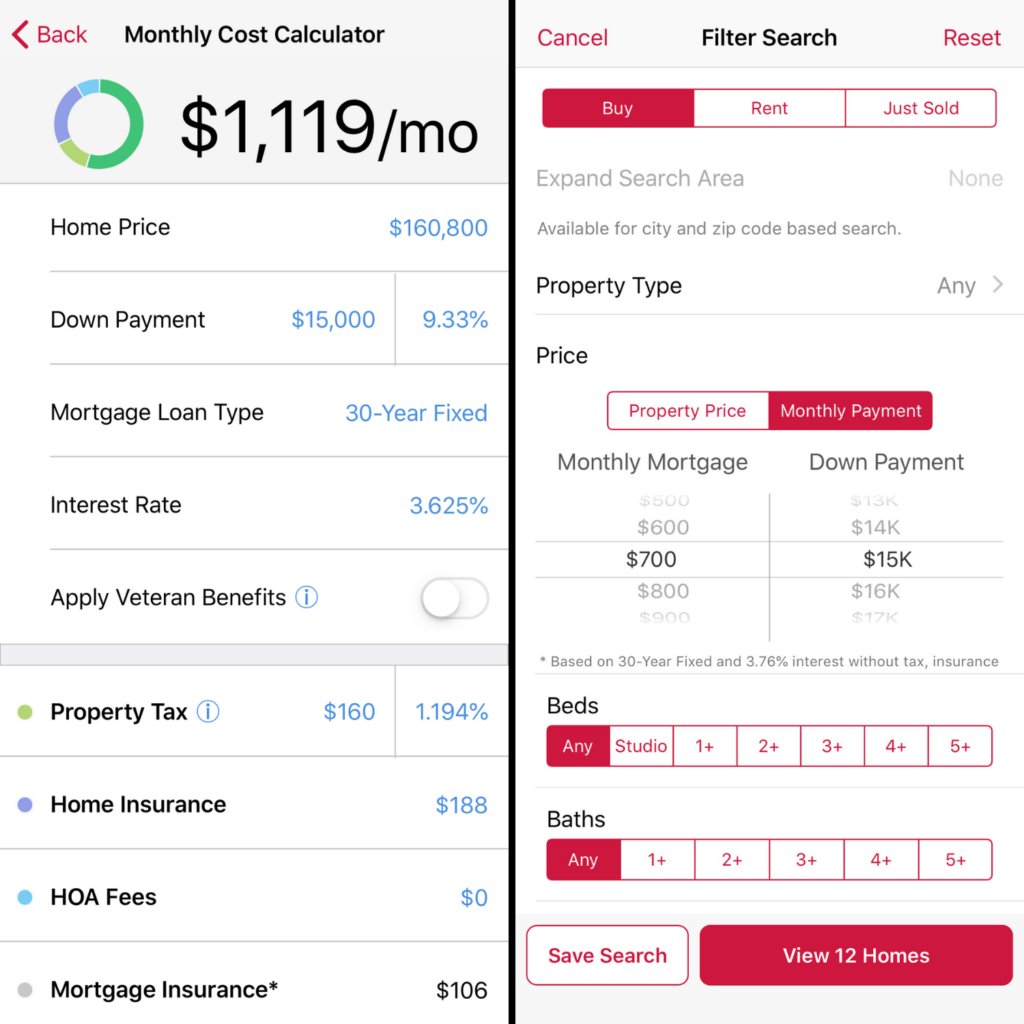

Next, buyers using realtor.com’s iOS or Android app can check out the “Monthly Cost Calculator,” which provides a more detailed estimate of the monthly payments they can expect. This tool provides the same information as the “How Much Home Can I Afford?” estimate, except it also factors in the mortgage loan type and interest rate, and allows buyers to adjust the property tax rate.

The “Monthly Cost Calculator” and “Monthly Payment Filter”

Once buyers have determined an affordable price point and monthly cost, they can use the “Monthly Payment Filter” to find listings that fit the estimates provided by the previous two calculators.

Available only on the iOS app, buyers must go to the home search section and tap the “filter” tab in the upper right corner. Then, buyers must scroll to the “price” section, tap on “monthly payment” and choose the appropriate monthly mortgage and down payment. From there, realtor.com provides a list of homes that fits into the buyer’s budget.

At each step realtor.com notes the calculators are for “initial information purposes only,” and suggests buyers contact a lender or loan professional who can pre-approve them based on an exact credit score, debt-to-income ratio, and other financial information.

“Our new cost calculators give buyers deep insights into what specific home prices mean for their bottomline, while our new monthly payment filter prevents them from seeing homes outside their monthly budget so they can stay on track financially,” said Cheong of how all three calculators work together.

Source: click here