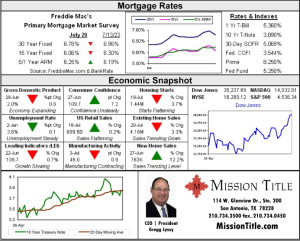

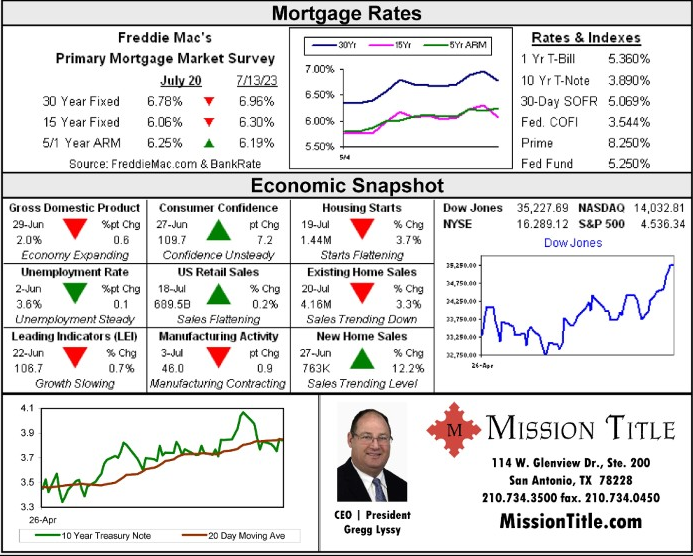

Mortgage rates continued to press downward last week after the previous week’s CPI data pointed toeasing inflationary pressures. Only a few weeks ago, the market was expecting the Federal Reserve toraise rates by another half-point at its meeting that takes place on Tuesday and Wednesday. Nowmarkets are universally convinced that the Fed will only raise rates by one-quarter of a point. RetailSales and Industrial Production also helped generate downward pressure by coming underexpectations. While many economists believe that the economy is cooling off, inflation still remainsabove the Fed’s target rate, and the job market remains very hot.

Assuming that the Fed raises rates as expected, the market is likely to focus on the wording of thepolicy statement and Fed Chair Powell’s after-meeting press conference. The more hints we see thatthe Fed is growing satisfied that its efforts are finally bringing inflationary pressure under control, themore likely we are to see mortgage rates remaining around last week’s level.

Mortgage Rates and Economic Snapshot

Mortgage Rates and Economic Snapshot