Have suggestions for products that you’d like to see reviewed by our real estate technology expert? Email Craig Rowe.

ClosingLock is a wire fraud prevention software for real estate transactions.Platforms: Browser, mobile-optimized Ideal for: Title companies, all agents and parties to closing activities

Top selling points: No account setup required. Multi-factor authentication. Quick connection to seller’s bank. Does not use encrypted emails. Consumer-friendly user experience. Top concerns:No software can fully prevent wire fraud, only move the needle. Always communicate the risk clearly to buyers.

What you should knowEarlier this year, a couple lost close to $800k in a wire fraud scheme.

Wire fraud is not going away. Title and software companies can only do so much to prevent it, knowing it’s an ongoing effort with the bad guys always looking for ways to beat them. The situation is best described as Sisyphean.

ClosingLock is one the latest companies looking to prevent that rock from rolling back down to the bottom of the hill. And given that it averages $2 billion a month in transaction security, I’d be hard-pressed to not say they’re doing good work.

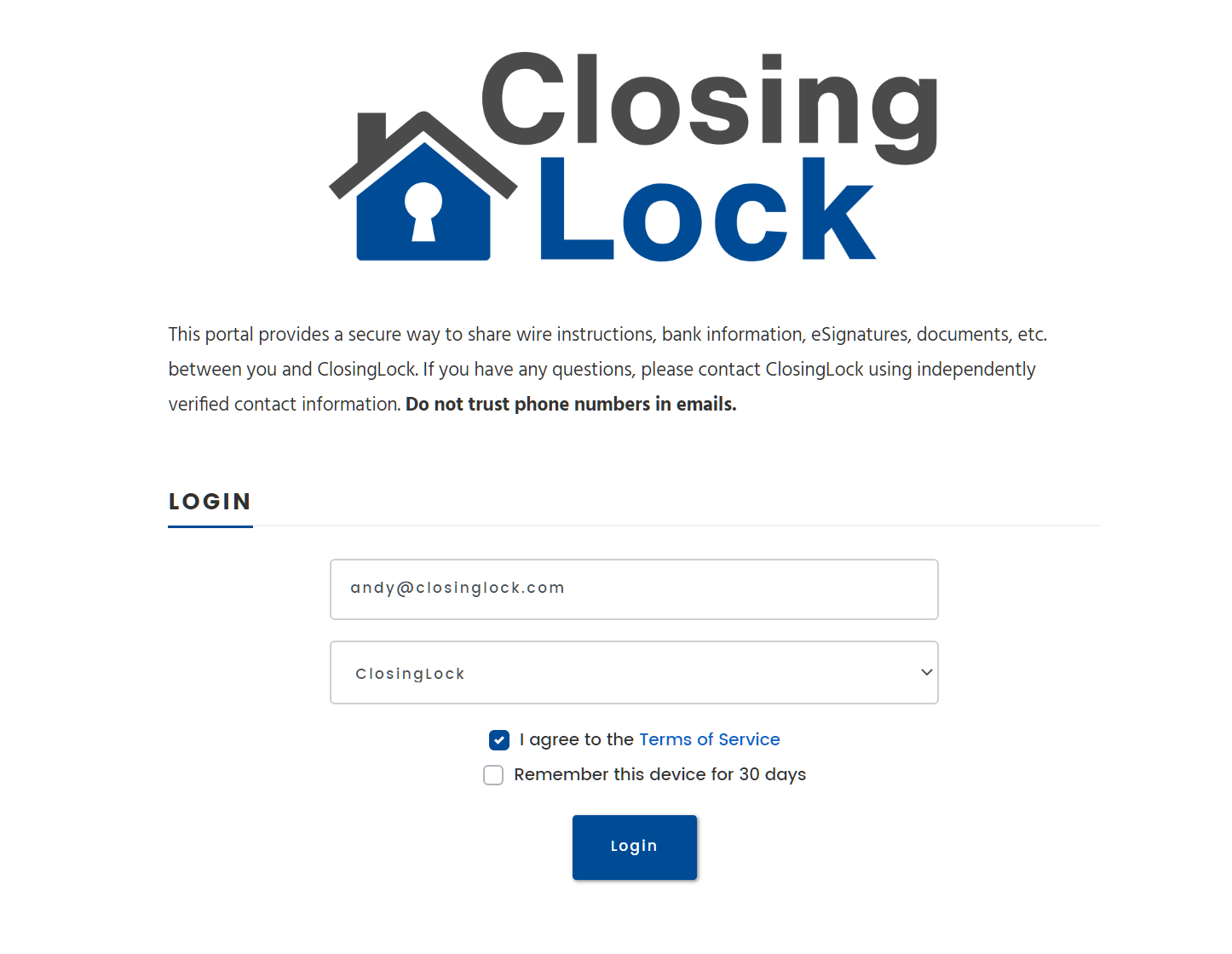

A title company representative uses it to send an email to the buyer, but the software doesn’t rely on encrypted email, because, well, they’re not quite as safe as they once were. However, if the receiving email client supports it, it’ll be sent accordingly.

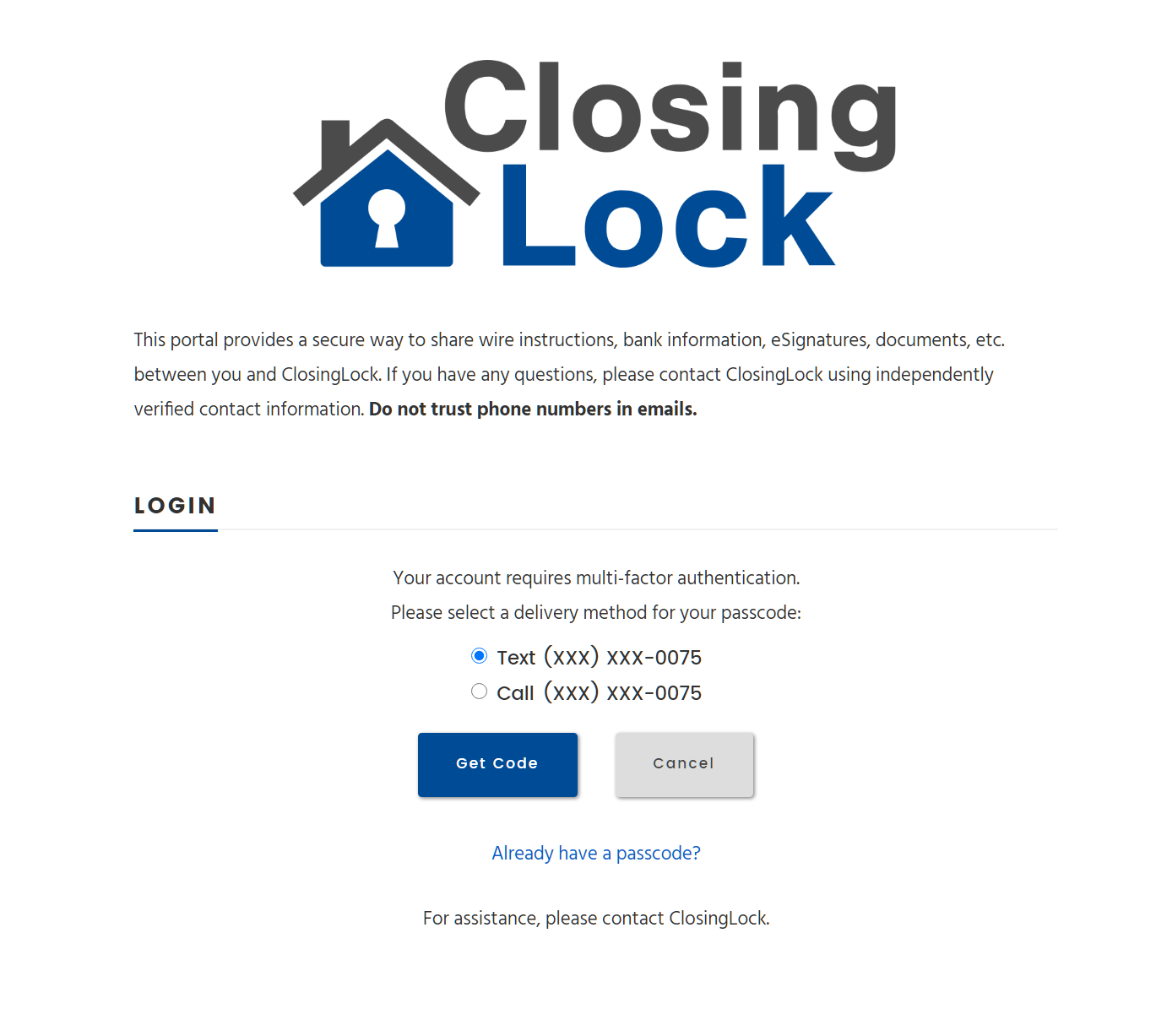

The email includes an authenticated URL, and the recipient is verified through multi-factor authentication: email, then phone number, then bank account.

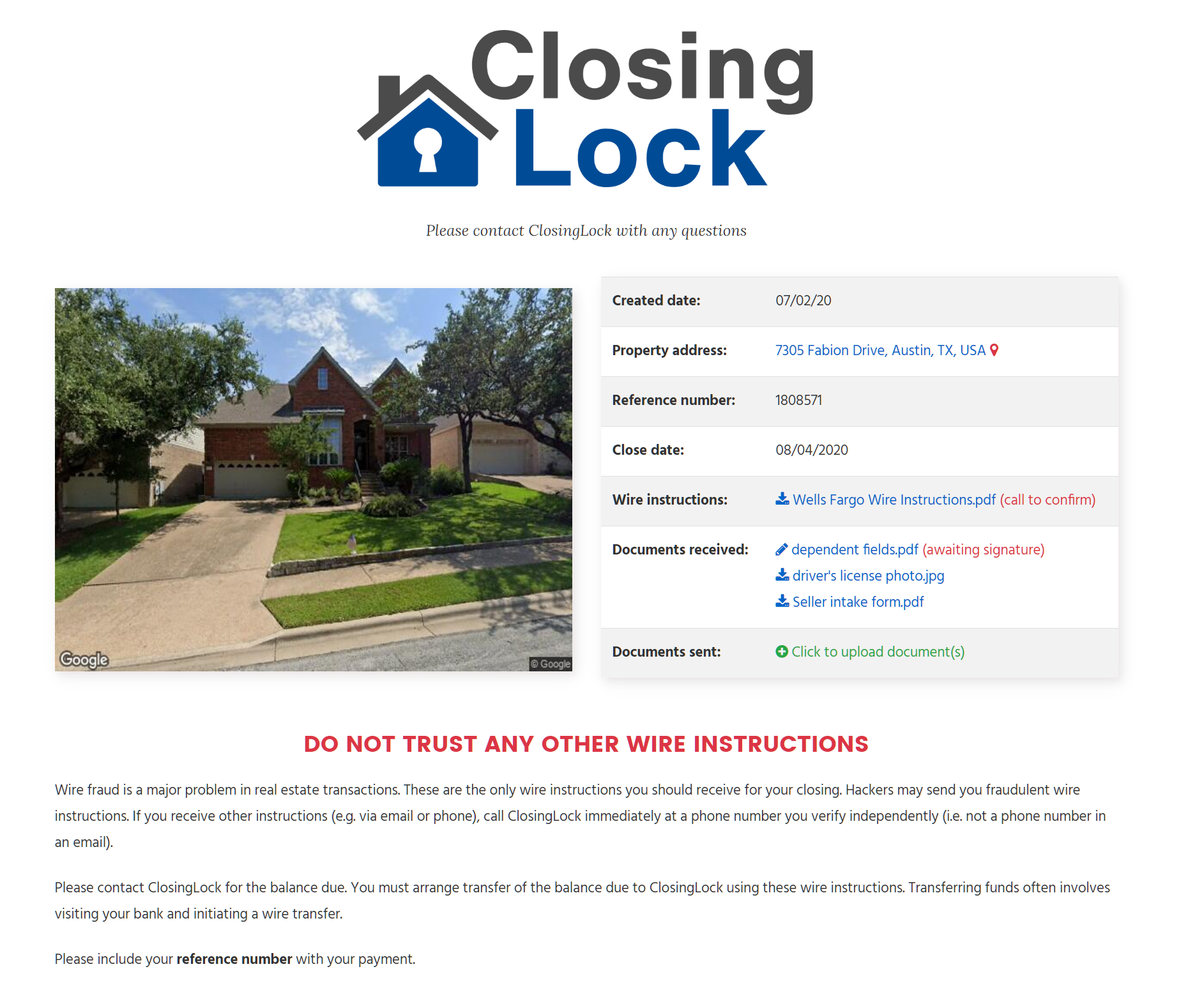

The tokenized URL (which verifies user identity) lands on a page with an image of the property and its transaction details, essentially a portal where the wiring instructions are held.

Thus, the wiring instructions are never in the body of an email, nor attached. Email only serves to deliver the portal’s web address.

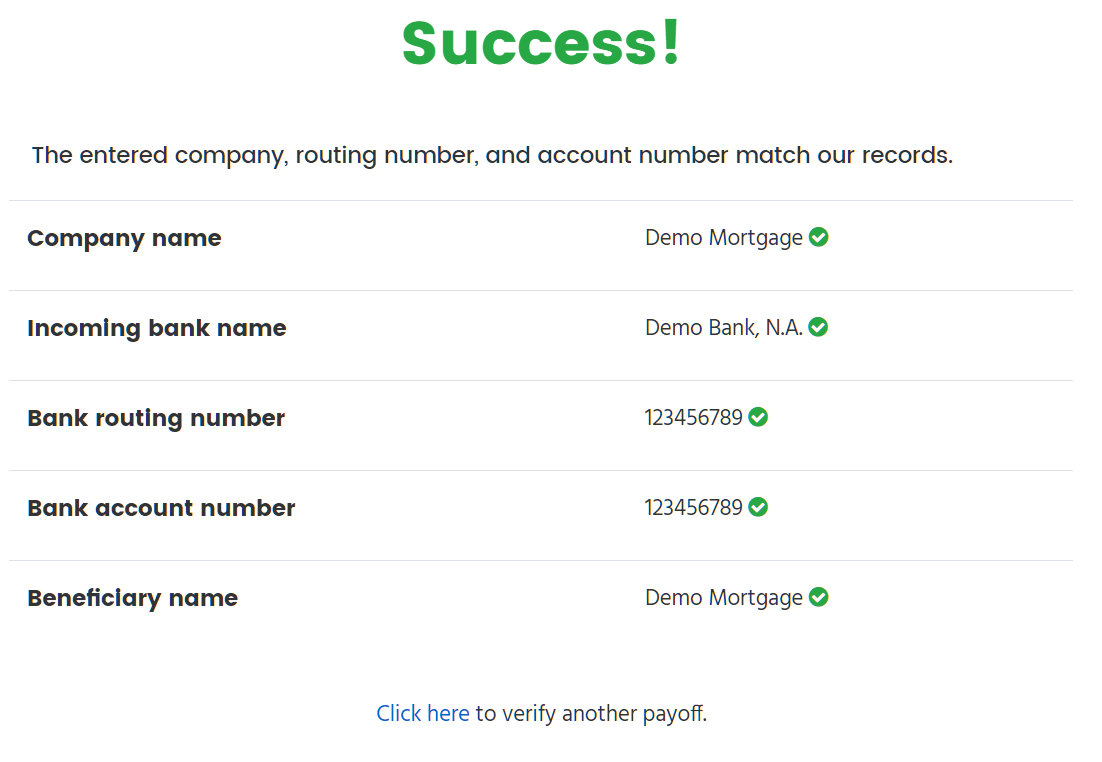

The seller’s bank information is confirmed within the portal, leveraging in part a connection to Plaid, a Visa-owned company with a PayPal-like interface that quickly ensures bank data. However, that too is delivered via a tokenized URL and a texted password. The user selects his or her bank and logs in using standard online account credentials.

It includes instant payoff verification, too, and an account and activity oversight dashboard for title agents.

Throughout the process, the buyer is informed with a series of rather stern notices about not trusting any other emails about wire transfers, to such an extent, in fact, that I think it could actually increase a person’s concern.

Still, the title company should do its part, using ClosingLock’s notices and waivers.

The software also includes an e-signature tool, and a strong focus on making it about the buyer and seller. It’s clear that ClosingLock wants to make the user experience quick and easy, but most of all, secure.

ClosingLock has customers industry-wide, and if your local title office worries you a little, let them know about ClosingLock. After all, the deal is not going to get less digital.

The more we all grow comfortable trading properties through online means, the less bold scammers have to be.

Have a technology product you would like to discuss? Email Craig Rowe

Craig C. Rowe started in commercial real estate at the dawn of the dot-com boom, helping an array of commercial real estate companies fortify their online presence and analyze internal software decisions. He now helps agents with technology decisions and marketing through reviewing software and tech for Inman.

Source: click here