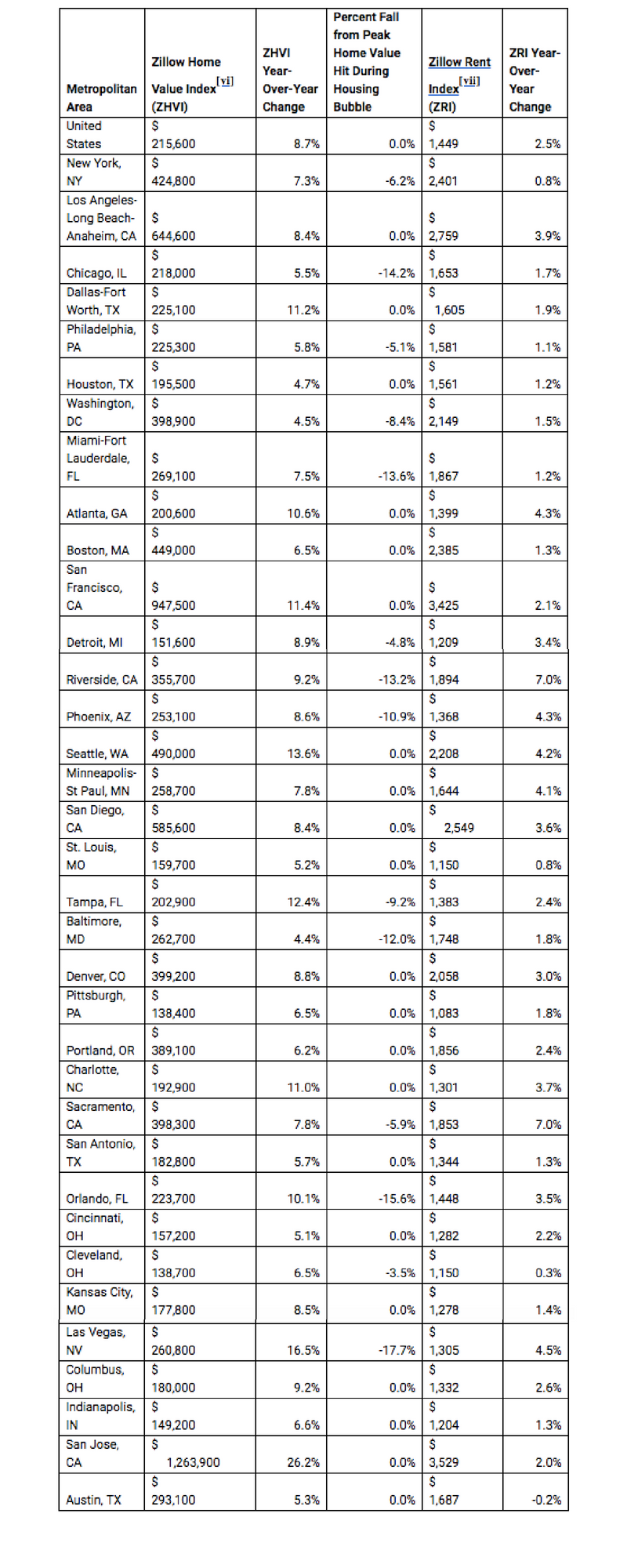

Home values have risen 8.7 percent year-over-year to a median of $215,600 in April — only 0.3 percentage points from June 2006 ahead of the housing market collapse, according to the latest Real Estate Market Report from home search giant Zillow. released Thursday. Furthermore, home values have superseded their housing boom peaks in 21 out of the 35 largest markets with San Jose, California, leading the way.

“Home values are rising faster than we’ve seen in a very long time: The spring homeshopping season has been a perfect storm of strong demand and tight supply,” said Zillow senior economist Aaron Terrazas in a statement. “Sluggish new construction has exacerbated the supply situation, and homes that are hitting the market, are moving very quickly once they do.”

“Americans are also in a spending mood, boosted by recent tax cuts and rising wages,” he added. “Millennials who long delayed becoming homeowners, are out in force — a shift we’re also seeing in softer rent appreciation.”

In San Jose, home values jumped 26 percent to a median of $1,263,900. Las Vegas and Seattle rounded out the top three with home value increases of 16.5 percent and 13.6 percent, respectively.

Although the current home price growth is nearing the previous peak before the housing bubble burst, Terrazas said there’s no need to worry about an impending crash.

“While the 8.7 percent annual pace of home value growth that we saw in April 2018 was the highest since summer 2006, it is still well below the peak appreciation rates we saw during the housing bubble years — around 11 percent year-over-year reported in late 2004,” he told Inman in an emailed statement.

How to stand out from the competition

Tom Ferry explains why it’s crucial to have a USP READ MORE

How to stand out from the competition

Tom Ferry explains why it’s crucial to have a USP READ MORE

“More importantly, while the homeownership rate at the peak of the mid-2000s housing bubble was approaching 70 percent, today it remains around 64 percent — in line with or slightly below its historic average.”

“There is no doubt that the United States today is facing a housing crisis, but it is a very different kind of crisis from what happened a decade ago,” Terrazas added.

“It is a crisis of affordability and a crisis of supply. And while there are certainly regional pockets where the pace of home value appreciation does not seem sustainable — most notably the California Bay Area — overall nationwide I expect home value appreciation to slow in the months ahead, but not crash.”

Other highlights from the report:

Mortgage rates settled at 4.35 percent at the end of April after hitting a low of 4.19 percent on April 4, 6, and 11, and reaching a high of 4.42 percent on April 25. The national median rent also experienced increased 2.5 percent to a median payment of $1,449 per month. Sacramento, Calif., Riverside, Calif., and Las Vegas experienced rent appreciations of 7 percent and 4.5 percent, respectively.

The Zillow Real Estate Market Reports are a monthly overview of the national and local real estate markets. The reports are compiled by Zillow Real Estate Research. The data in Zillow’s Real Estate Market Reports are aggregated from public sources by a number of data providers for 928 metropolitan and micropolitan areas dating back to 1996. Mortgage and home loan data are typically recorded in each county and publicly available through a county recorder’s office. All current monthly data at the national, state, metro, city, ZIP code and neighborhood level can be accessed at www.zillow.com/local-info/ and www.zillow.com/research/data.

Source: click here