The Consumer Federation of America has released another scathing report about the real estate industry, this time focusing on an alleged lack of transparency regarding agent commissions and commission splits.

Released on Monday, the report is based on a survey of 2,000 Americans, as well as conversations with 200 agents located in 20 metros and an analysis of 263 agent and broker websites across four markets.

According to the study, only 32 percent of Americans know an agent’s typical commission, which is anywhere from 5 to 6 percent of the sales price. Of the 453 respondents who’ve bought or sold a home within the past five years, only 44 percent knew the typical commission.

Stephen Brobeck

CFA senior fellow and report author Stephen Brobeck said consumers’ lack of awareness stems from brokers and agents lack of transparency about commissions and commission splits.

“The reluctance of traditional real estate agents and firms to provide information about commission levels helps explain why there is so little price competition in the industry,” Brobeck said in a prepared statement. “It also helps explain why most consumers, even recent home buyers and sellers, do not know that nearly all commissions range between five and six percent.”

Build client relationships one unexpected detail at a time

Making the small things count to make your clients feel valued READ MORE

Build client relationships one unexpected detail at a time

Making the small things count to make your clients feel valued READ MORE

In their evaluation of 263 broker and agent websites in Harrisburg, Pennsylvania; Baton Rouge, Louisiana; Des Moines, Iowa; and San Francisco, California, CFA said only 11 websites shared specific commission fees.

The first three markets were chosen because their median home price was in line with the national average, and San Francisco was included to test whether agents were more or less likely to mention commissions if the commission was high, CFA explained.

Of those 11 sites, only one was for a traditional real estate brokerage, and the other 10 were discount brokerages that wanted to highlight their affordability. Only one website, Redfin, mentioned a commission split, which is the commission offered to a buyer’s agent.

Another seven websites didn’t offer specific commission fees but mentioned they do have a commission or “cost of selling,” and suggested sellers call potential brokerages in order to compare fees.

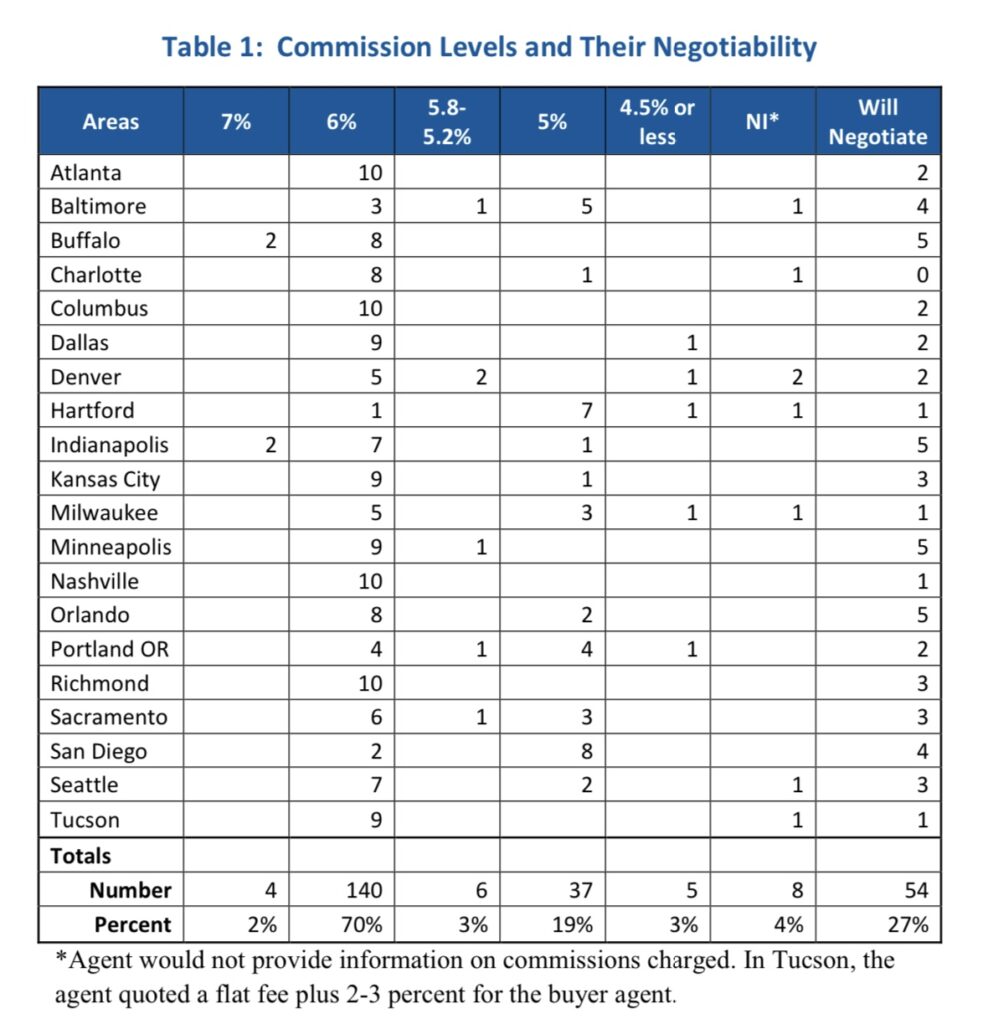

The commission information provided by 200 agents during CFA’s phone inquiries.

However, the CFA claims these phone inquiries rarely yield the commission information sellers are looking for.

“But in our research, we learned that it often was not easy to learn the level of commissions through general phone inquiries,” the report read. “In completed calls to 30 real estate firms in five cities, we learned full commission levels from only seven offices.”

After failing to get commission information through general inquiries, a CFA researcher posed as a homeowner and called 200 individual agents.

They told each agent they were looking to sell their home, which was worth anywhere from $300,000 to $400,000, according to a recent Zestimate. They also noted they were looking for a ‘full service’ agent and wanted to know specific homeselling costs, from commissions to closing.

Ninety-six percent of agents shared their specific commission fees, which was typically six percent. The CFA said a handful of agents immediately answered questions about commission fees, splits and negotiation, but it took ‘multiple prompts’ for most agents to explain costs.

“A majority of those called were clearly more interested in discussing their services and reputation than the fees they charged,” the report read. “Many of them had to be prompted to respond to our question about costs.”

CFA says their experience analyzing brokerage websites and making general inquiries offers context to two surveys the group published with the Engine Group and the American Association of Retired Persons (AARP).

The survey with the Engine Group revealed less than half of Americans (43 percent) understood agents’ roles and how those roles impacted their transaction experience. Meanwhile, the joint survey with AARP revealed that only 26 percent of Americans knew real estate commissions could be negotiated.

This lack of awareness costs sellers and buyers alike, said the report. Sellers end up spending more on commission fees and aren’t aware that a low commission split may be the reason why their listing is languishing on the market. Furthermore, buyers may be missing out on a great listing because the commission split is low, the report said.

“Home buyers who are not aware of their agent’s commission split are vulnerable to being ‘steered’ away from properties that carry a low split—homes for which the agent is receiving less commission,” the CFA noted while pointing to a Cornell Real Estate review and comments from agents who admitted low commission splits hurt buyers and sellers.

“Below 2.8 percent [typical split in Denver area] agents may not want to show your home,” said one agent during an inquiry. “If the [split] is below 3 percent, then nobody will show your home,” said another.

Lastly, the CFA said the lack of transparency about commissions also hurts real estate professionals, as consumers trust in agents and brokers wane.

The study says consumers, journalists and government entities will likely have to pressure brokers, agents and multiple listing services (MLS) into sharing specific commission fees and splits, since the industry isn’t likely to make a wide-scale change on its own.

So far, Northwest MLS and Redfin are the only examples of industry insiders making the change on their own, CFA said.

“Exposing uniform or near-uniform commission levels could put pressure on the industry to allow individual agents to compete on the size of these fees,” said the report regarding journalists’ role. “Reporting on variation in commission levels, especially if splits remain uniform, could encourage some agents to lower their fees.”

When it comes to the government, the CFA says “the U.S. Department of Justice can increase cost transparency by investigating the buy-side commissions to which home buyers do not have access, and it appears to be doing so.”

Over the past year, agent commissions have been under the Department of Justice’s magnifying glass with two class-action suits “alleging the sharing of a commission between the listing and buyer broker violates the Sherman Antitrust Act by inflating seller costs,” noted a previous Inman report.

In an op-ed published in September, Brad Inman argued the NAR lawsuit regarding commissions was good for consumers: “After untold attempts by advocates, regulators and others to bring ease and transparency to the buying, selling and financing of homes, the process remains a black box — opaque and confusing to most of us.”

“It creates a bad consumer experience, and it’s formative in the industry’s sometimes stained reputation,” Inman added. Which turns me to the lawsuits against the National Association of Realtors (NAR) and other big real estate firms. Against a backdrop of inaction, it could be one of the best things to happen to the industry.”

Source: click here