We didn’t just assume there were issues. In fact, over the last two years, we interviewed and concept-tested with hundreds of real estate agents, buyers, sellers, lenders, and title/escrow officers. And the frictions they described are real:

There is a serious lack of transparency and secure communication, leaving agents and their buyers and sellers anxious over where they are in the closing process. The consumers find a complete overload of paperwork, written in hard to understand legalese and no easy support to answer questions, leaving them wondering what they have just signed and why they signed it. A predominantly non-automated and non-standardized process leads to issues with quality, accuracy, and repeatability — plus a lot of duplicate data entry Between wire fraud and e-mail phishing, fraud is a scary reality and consumers are particularly vulnerable during this process. With the initial earnest money deposit, the buyer and sellers’ funds to close, and then payoffs and disbursements, a vast amount of money has to move in many directions — but it does so slowly.These frictions are felt by all stakeholders, but to buyers and sellers who are unfamiliar with the process, they amount to a stressful, imperfect experience. To a real estate agent, silence at the mid-point of escrow likely means everything is progressing as planned, but for an in-experienced consumer, it leaves them feeling uncertain and uneasy.

No news is no longer good news. Today’s buyers and sellers are empowered participants of their real estate transaction who are mobile, hands-on and smart. They expect a seamless real estate journey from start to finish.

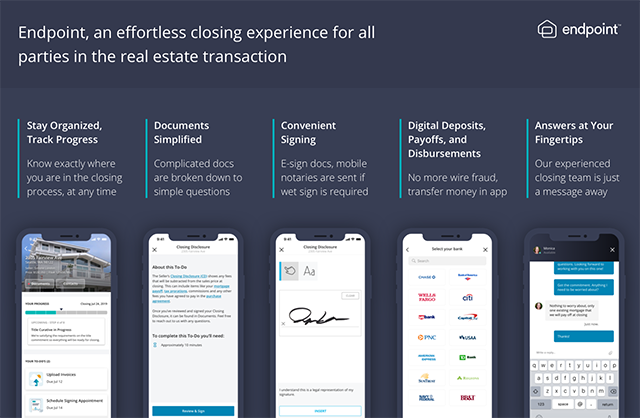

To solve for this, Endpoint provides agents an on-time, hassle-free closing that keeps them effortlessly in the know throughout the transaction. Push notifications ensure they are alerted when their buyers and sellers complete actions and tasks in real time, and they can access all of their title and escrow needs in one place.

But, more importantly, their consumers are provided a step-by-step, guided interaction from the very beginning, ensuring a worry-free experience with no unwanted surprises:

Buyers and sellers have visibility into the steps of the closing process with real-time updates and notifications. Documents are completed in application, with clear guidance on what information is needed and how long it is likely to take. Earnest money is transferred directly in the application and agents are instantly notified once the money is received. E-signatures can happen in the app, while wet signatures can be captured with a notary at the convenience of the buyer and sellersAs our business has grown, this improved buyer and seller experience has proven to be a true differentiator for the agents who use Endpoint. One that helps them look good in front of their clients and win more repeat and referral business in the process.

According to a Zillow® survey, more than a third of Americans cry while selling their home. We believe the closing process should never be the cause of that emotion. We live in an on-demand, mobile-first world, and yet closings take everyone 20 years back in time.

That’s what drives our mission to create an effortless closing experience. Endpoint will be the expert guide through the process. Not because we jerry-rigged technology on top of existing people and processes. Rather, because Endpoint is focused on building technology, people and processes from the ground up to work better, together.

Source: click here