As home prices have risen for 91 consecutive months, Americans are growing weary as the dream of homeownership moves further out of reach.

According to a Redfin survey of 3,000 Americans who bought or sold a home in the last year, 46 percent of respondents say rising home prices have made their lives worse. Meanwhile, only 16 percent say rising home prices have benefitted them, likely because they purchased a home during the last housing bubble when home prices were at historic lows.

In response to dwindling affordability, Americans are more open to government intervention in the form of policies that fund affordable housing communities, limit investors’ ability to buy and flip homes and provide down payment assistance for lower-income families.

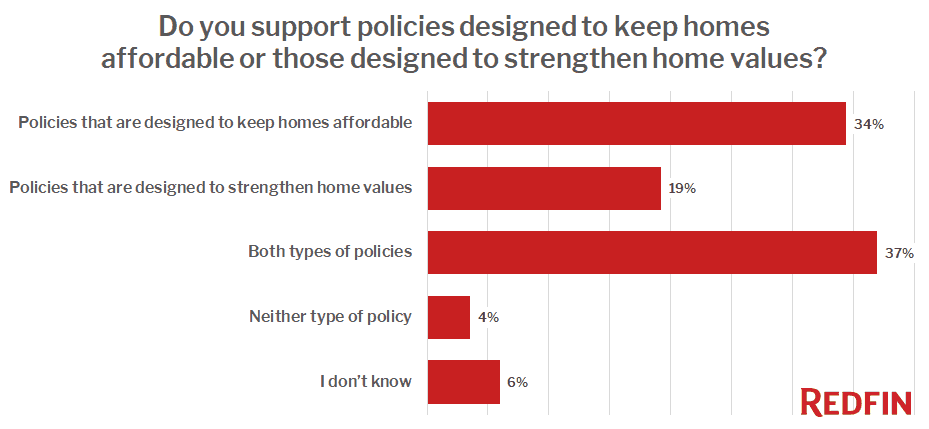

Thirty-four percent of respondents support policies that keep homes affordable, while 19 percent support policies that strengthen home values. More than a third of respondents (37 percent) support policies that achieve both, while less than 10 percent didn’t support or weren’t sure about government intervention.

“Many homeowners feel financially motivated to see what is often their biggest financial asset grow but also care about the continued affordability and livability of the community in which they have invested,” Redfin chief economist Daryl Fairweather wrote.

The home inspection is not just for homebuyers

Use pre-inspections as a home seller differentiator READ MORE

The home inspection is not just for homebuyers

Use pre-inspections as a home seller differentiator READ MORE

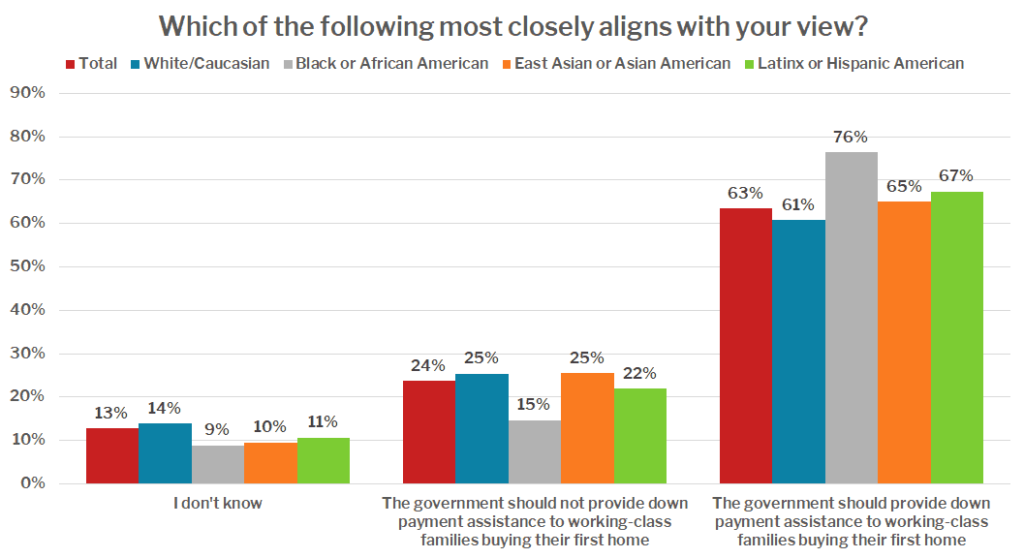

While respondents were split about policies creating better affordability or home values, there was a solid consensus about government-offered down payment assistance.

A whopping 63 percent of Americans said the government should provide down payment assistance for working-class families. African-Americans were most likely to support this idea (76 percent), followed by Latinx Americans (67 percent), Asian Americans (65 percent) and white Americans (61 percent).

Redfin notes that African Americans’ overwhelming support of down payment assistance programs likely comes from a history of redlining, where the government kept black people from purchasing in specific neighborhoods by limiting buyers to subprime mortgage loans.

“Presidential candidates Elizabeth Warren and Kamala Harris have policies that increase government aid going to down payment assistance for first-time homebuyers in historically red-lined neighborhoods to boost African American homeownership,” the report noted.

Lastly, 33 percent of Americans support legal limits on how many properties an investor can buy and flip. Homeowners across the country have complained about investors claiming large shares of available housing, only to rent them or list them on short-term vacation housing sites, like Airbnb.

Only 25 percent of Americans support policies that would make investing easier. Another 9 percent support both policies, while 22 percent weren’t sure either way.

Source: click here