Mortgages and housing continue to dodge Fed bullets. The 10-year T-note is steady near 2.95%, which holds 30-fixed mortgages near 4.75%.

First the data, then the Fed.

The first Friday of each month brings the data-gorilla: job market results from the immediately prior month. April payrolls grew by 164,000 jobs, about as forecast but double the Fed’s estimate of a sustainable, non-inflationary pace. However, everything else about the report was weak. Average hourly earnings rose by four whole cents, an annualized increase of 1.8%. Long-term unemployed, involuntary part-time, participation rate, average hourly work week, discouraged workers… all unchanged. 3.9% unemployment is s statistical quirk.

Two other early-month indicators for April, the ISM surveys of manufacturing and service-sector purchasing managers: expected at 58.7 and 58.4, respectively, arrived at 57.3 and 56.8 — still pretty good numbers but now in serial decline.

In new data from an older period, March personal income gained 0.3%, a little below forecast, and the Fed’s favorite measure of inflation (core personal consumption expenditure deflator, “PCE”) slid slightly upward to 1.9% year-over-year, essentially on Fed target.

This overall picture is a modest down-wobble, not a truly weak trend.

Delivering a luxury experience in a tech-driven world

4 key concepts real estate professionals should adopt READ MORE

Delivering a luxury experience in a tech-driven world

4 key concepts real estate professionals should adopt READ MORE

However, every month in which 2018 continues this way questions the effect of the new tax cuts and fountain of deficit spending. Businesses were supposed to hire, raise wages, and invest, and they are doing none of these things. Public corporations are reporting first quarter earnings, and some analysts find roughly half of earning gains attributable to tax cuts.

The Fed met this week. Stronger economic data in prior months had created a bit of a debate: the Fed had given every indication of three 0.25% hikes in Fed funds this year, one already done to 1.75%, and a few people inside the Fed and many outside argued that the Fed would go four times. The case for four has been poor, is poorer now, and markets say that four ain’t happenin’. And that the second and third may take a while. Nevertheless, chirpers say another hike at the June 13th meeting.

To watch the Fed, watch the 2-year T-note. These are so short-term, and so often financed that changes in the cost of money make or break traders. During a period of Fed hikes, 2s must trade at a yield premium to the current Fed rate because it’s going up again and again before the 2-year matures, and longer-term securities must pay more than short-term because risks expand with time.

The Fed is 1.75% now, and 2s have been trading at 2.50% for three weeks — did not even flicker upward after this week’s meeting. At 2.50%, 2s traders have built-in the Fed’s next hike, but not the one after that, or any prospect of a fourth this year. (BTW: please ignore the Fed funds futures market, an anti-predictor.)

The second reason to watch 2s: the spread to 10s. 10s have not moved since the end of February while 2s have moved up. the 2s-10s spread is now the narrowest since the last recession, only 0.45% (45 “basis points,” each one-hundredth of one percent, expressed as “bps,” spoken on trading desks as “beeps”).

Two reasons to watch 2s-10s: first, a narrow spread wrecks the adjustable rate-mortgage market. There is little discount now from 30-fixed for 5- and 7year ARMs. Second, historically when 2s have crossed above 10s, recession is guaranteed.

The Fed after each meeting issues a one-page statement, most of it repetitive and content-free. Chair Greenspan grudgingly began to issue these statements for the first time in 1994, usually one or two sentences. Today we scour each of the new, Aunt Blappy versions for subtle shifts, and this week’s had one: “Inflation on a 12-month basis is expected to run near the Committee’s symmetric 2 percent objective over the medium term.” Bold face “symmetric” is mine. That one new word added resolves a debate inside the Fed and a question outside. Is the 2% target “hard?” Like an electric-wire fence, to touch it will bring immediate and painful response?

“Symmetric” says, no. The Fed tolerated the last five years below 2% without re-entering QE and easing hysterics, and will tolerate two-plus for a while. Recent increases in oil prices are highly likely to take even core inflation above 2% for a while. However, although the Fed will not accelerate its pace of tightening now, that withheld action is predicated on the expectation that the current pace of tightening will by next year slow the economy to a sustainable pace, GDP growing sub-two, monthly payroll gains below 100,000.

That’s the dry, technical case. Reality? An old friend used to say that the Fed’s job was to carry an immensely valuable crystal orb balanced on a flat silver tray without edges, while refereeing a hockey game.

Tax cuts and fiscal splurge about to over-stimulate the economy? Odds are falling. The prospect of trade war? U.S. trade policy is in the hands of Peter Navarro, certified fruitcake who upon the departure of our negotiators for China said, “The discussions will take place in Beijing, but the decisions will take place in Washington.” Right. I can imagine Fed officials after reading this line covering their eyes. At the Fed you’re not allowed to roll them.

Since 1944 the world has made great progress in trade negotiations, always in multi-national concert. The world is more economically entangled than ever before, hence the futility of attempting one-on-one negotiations. That strategy could result in all against one. Any business manager plugged into global trade, NAFTA maybe as important as all of the rest combined… any manager is reluctant to wager new risk and is instead laying contingency plans for defense.

Put all of that together and it’s not surprising that market interest rates are not moving up, even though the Fed will.

US 10-year T-note in the last year, stuck since February:

U.S. 10-year T-note chart.

US 2-year T-note in the last year, stuck for three weeks:

U.S. 2-year T-note chart.

Perhaps the most concerning chart, source WSJ and Fed, reveals the continuous, eight-year overestimation of future inflation. We have at last reached 2%, but what confidence can we or the Fed have in future projections, higher or lower?

Credit: The Wall Street Journal

The Atlanta Fed at the outset of Q1 projected 5% annualized GDP growth in Q1. Turned out to be 2.3%. Its newest for Q2 begins with 4% growth:

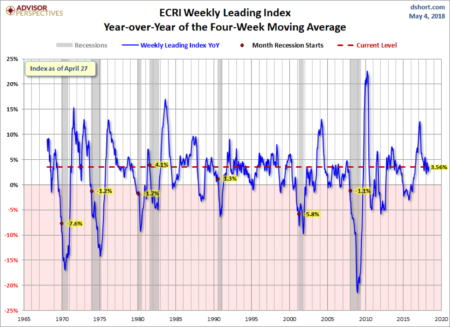

The ECRI has stalled, GDP indicated about 2.5%:

Credit: Dshort.com

Source: click here