Tax season is upon us!

With less than two weeks to go before taxes are due, Americans everywhere are scrambling to get their finances in order and crossing their fingers for a refund. But dealing in real estate, of course, complicates that entire process, and that’s especially true for vacation rentals — which for owners can serve as both a home-away-from home and an income-producing side hustle.

Paul Garza, a tax accountant for vacation rental company Vacasa, told Inman in an email that taxpayers need to be especially vigilant when it comes to their rental properties. One of the most common mistakes people make, he added, is simply not “being familiar with all the reporting and due diligence involved.”

“It’s not always as easy as just filing your federal taxes at the end of the year,” Garza continued. “You need to make sure you are paying all applicable local taxes as well.”

Garza advised would-be vacation rental owners to do their research before buying because state and local regulations vary considerably. He also noted that for owners with limited time, “it would probably be a good idea to hire a property manager to track all transactions and hire a CPA at the end of the year to file your federal tax return.”

To make the process easier, Vacasa has also compiled a useful list of tips to make tax season more efficient for owners of vacation rentals. These tips won’t replace the guidance of a trusted tax advisor, but they can serve as a useful starting point, especially for agents looking to help clients navigate a tricky financial environment.

Mega 1000: The real estate industry’s most comprehensive, accurate brokerage company rankings

The second annual Mega 1000 from T3 Sixty ranks the nation’s largest real estate brokerages, franchisors and holding companies READ MORE

Mega 1000: The real estate industry’s most comprehensive, accurate brokerage company rankings

The second annual Mega 1000 from T3 Sixty ranks the nation’s largest real estate brokerages, franchisors and holding companies READ MORE

1. The number of days a property spends as a rental matters

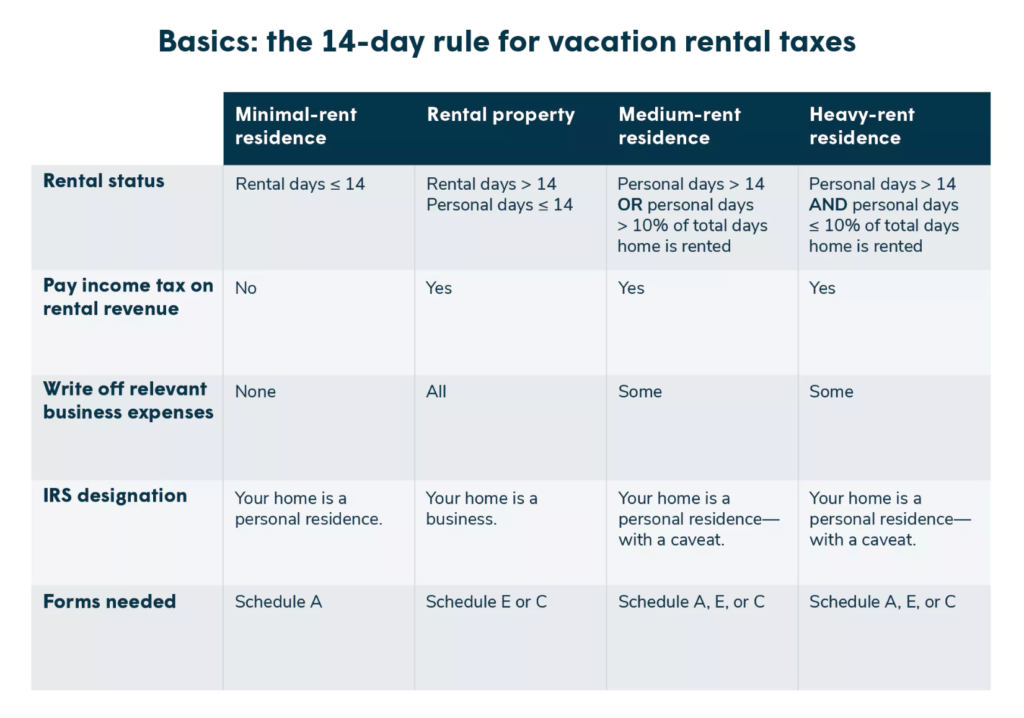

Probably the most important thing to remember here is that if you rent out a property for fewer than 14 days per year and use it yourself for at least that long, you don’t have to pay taxes on the rental income.

If both of those circumstances aren’t met, however, you’ll likely have to pay taxes on some of your income. The amount you pay will depend how the property is used, and for how long, so carefully consider the nature of the rental. Here’s a chart from Vacasa that breaks down the different distinctions:

Credit: Vacasa

2. Consider what you can deductWhile renting out a vacation property for more than two cumulative weeks per year can mean paying taxes on the resulting income — obviously a bummer — it also raises the possibility of writing off expenses associated with the property.

“Your taxes may be simpler if you start treating your property as a business, rather than a second home,” Vacasa notes in its guide.

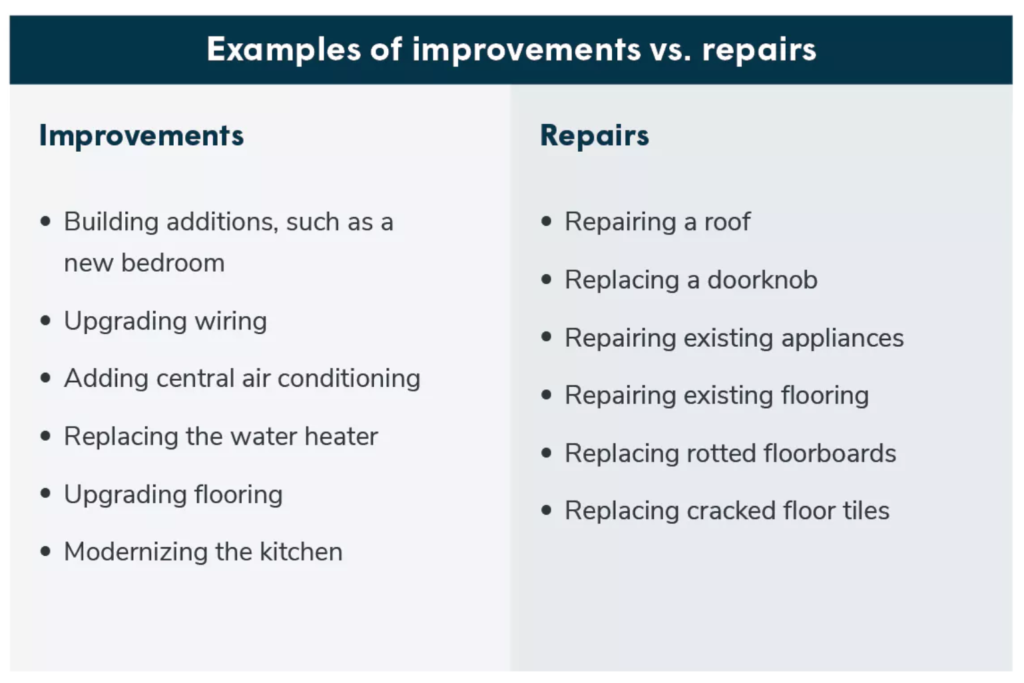

There are some fine distinctions in what can be written off, but owners should consider the difference between improvements, which are deducted over their useful lifetime, and repairs, which can be deducted all at once.

Credit: Vacasa

Vacasa also recommends keeping receipts and detailed records about both expenses and when a property is rented verses used by its owner.

For more information on repairs, improvements and other deductions, consult the IRS’s tip sheet on rental income.

3. Remember local rulesFederal taxes typically get a lot of the attention at this time of year, but local taxes can vary considerably from place to place and will have a significant impact on what vacation rental owners pay.

Property managers can help navigate the often-byzantine waters of local regulation. Vacasa also suggests turning to the local chamber of commerce with questions.

4. Use the correct tax formsPerhaps the least sexy but most important tip, vacation rental owners have to make sure they actually fill out the correct forms when it comes to their properties. In many cases, owners will need to use either an IRS Schedule E or Schedule C.

There are various criteria to determining which form to use, but the gist is that Schedule E is for passive income, while Schedule C is for money earned via self employment.

In other words, if you just collect rent and don’t put a lot of work into a vacation rental — meaning the IRS can’t consider it a business — Schedule E might be right for you. But if the rental is a business, Schedule C could be the way to go.

In either case, consult a tax professional or your property manager to make sure you choose the specific form that is right for your particular situation.

This post was updated after publication with comments from Vacasa accountant Paul Garza.

Source: click here