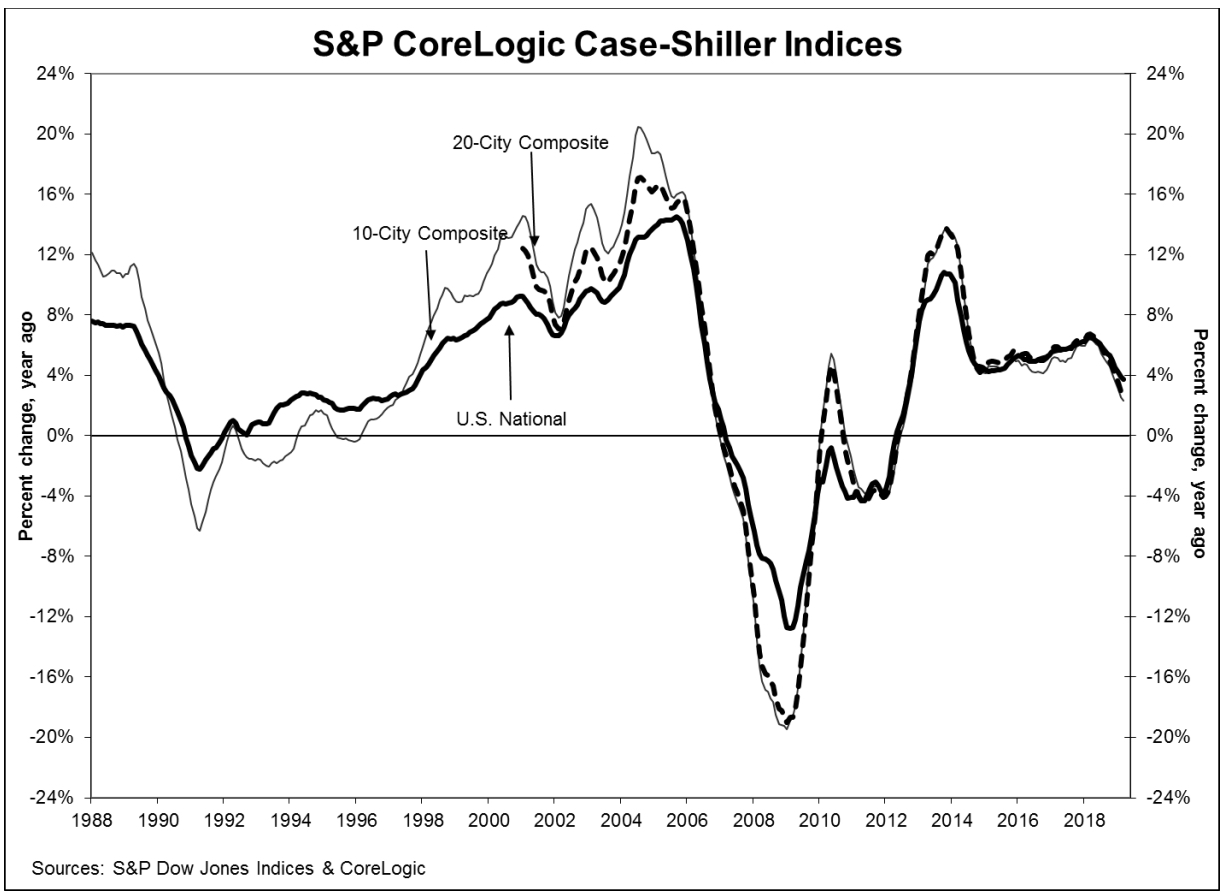

Home prices in the U.S. grew at a 3.7 percent annual rate in March, down from the previous month’s 3.9 percent and the slowest in seven years, according to the latest S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index released Tuesday.

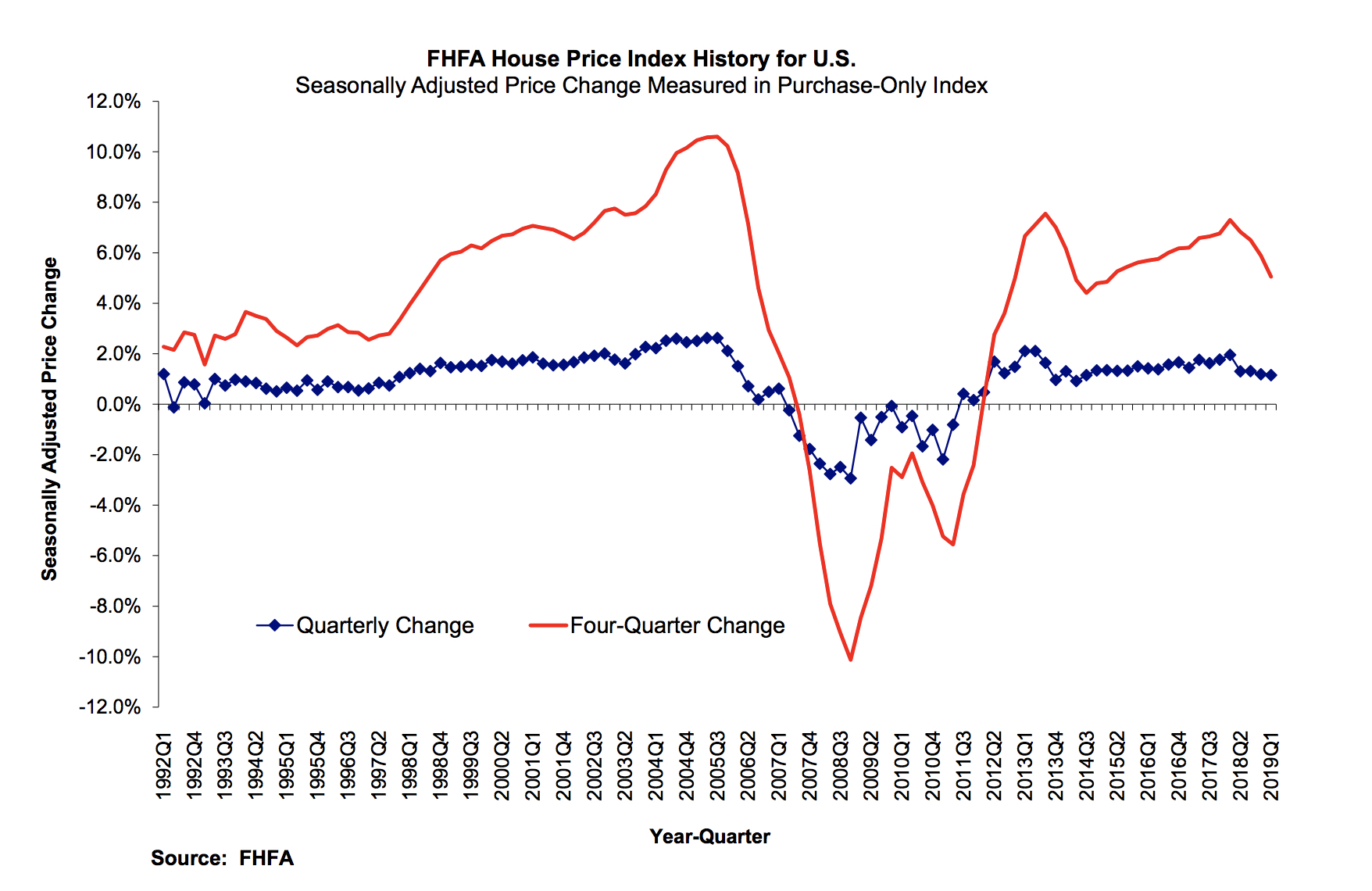

Meanwhile, in a separate report released Tuesday, home prices rose 5.1 percent from the first quarter of 2018 to the first quarter of 2019, according to the Federal Housing Finance Agency’s (FHFA) house price index.

“Home price gains continue to slow,” David M. Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, said in a statement. “The patterns seen in the last year or more continue: year-over-year price gains in most cities are consistently shrinking. Double-digit annual gains have vanished.”

Case Shiller’s home price index

In a market like Seattle, for example, annual home price gains were at 13 percent one year ago. In March, home prices in Seattle only grew 1.6 percent.

“The shift to smaller price increases is broad-based and not limited to one or two cities where large price increases collapsed,” Blitzer added.

Above and beyond: how 3 real estate leaders earned a referral

Above and beyond: how 3 real estate leaders earned a referral

As a customer, there’s nothing better than when someone goes above and beyond for you. It might be at the grocery store, the doctor’s office, or the bank. The location doesn’t matter. What matters is that when people genuinely care about what’s best for you and strive to make you happy, it’s a great feeling — so great, you’ll probably tell people you know about it.

READ MORE

With the slowing price growth and low mortgage rates, the housing market should be stronger, according to Blitzer. The rate of price increases still outweighs the rate of inflation, however, which may be causing the issues.

“Given the broader economic picture, housing should be doing better,” Blitzer said. “Mortgage rates are at 4 percent for a 30-year fixed rate loan, unemployment is close to a 50-year low, low inflation and moderate increases in real incomes would be expected to support a strong housing market.”

“Measures of household debt service do not reveal any problems and consumer sentiment surveys are upbeat,” Blitzer added. “The difficulty facing housing may be too-high price increases.”

Prices rose year-over-year in all 50 states in the first quarter of 2019, according to FHFA’s data, but like the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, that price appreciation is slowing down.

FHFA home price index

“House prices have risen consistently over the last 31 quarters,” Dr. William Doerner, supervisory economist at FHFA said in a statement. “Although price growth is still positive, the upward pace is softening across the country, especially among states with the largest supplies of housing.”

The S&P/Case-Shiller U.S. National Home Price Index is a composite of single-family home price indices that is calculated every month; the indices for the nine U.S. Census divisions are calculated using estimates of the aggregate value of single-family housing stock for the time period in question.

The FHFA home price index tracks changes in home values for properties owned or guaranteed by Fannie Mae and Freddie Mac.

Developing …

How do you stay ahead in a changing market? Inman Connect Las Vegas — featuring 250+ experts from across the industry sharing insight and tactics to navigate threat and seize opportunity in tomorrow’s real estate market. Join more than 4,000 top producers, brokers and industry leaders to network and discover what’s next, July 23-26 at the Aria Resort. Hurry! Tickets are going fast, register today!

Thinking of bringing your team? There are special onsite perks and discounts when you buy tickets together. Contact us to find out more.

Source: click here