We’ll add more market news briefs throughout the day. Check back to read the latest.

S&P/Case-Shiller Home Price Index for March 2016:

The national index was at 176.91. This is up 0.72 percent month-over-month. In March 2015, the index was 168.24.Black Knight Home Price Index for March 2016:

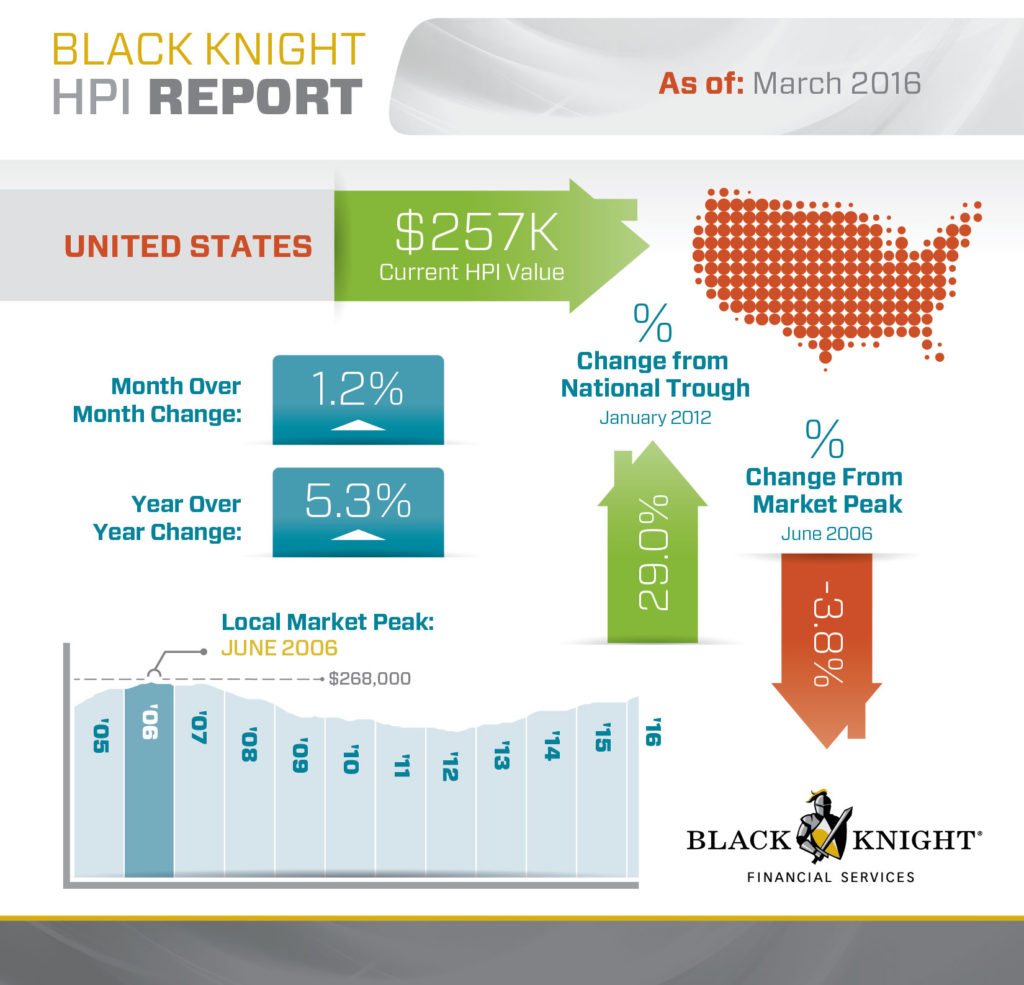

The home price index in the United States was $257,000. This is up 1.2 percent from February 2016. It’s also up 5.3 percent from March 2015.

Home equity rates: Average Home Equity Loan Bank Rates by State | Credio Average Home Equity Loan Credit Union Rates by State | Credio Last week’s most recent market news:

National Association of Realtors’ Pending Home Sales Index for March 2016:

The Pending Home Sales Index was up 1.4 percent to 110.5 in March from 109.0 in February. The index is now 1.4 percent above March 2015 (109.0). After last month’s slight gain, the index has increased year-over-year for 19 consecutive months and is at its highest reading since May 2015 (111.0).Freddie Mac’s Primary Mortgage Market Survey:

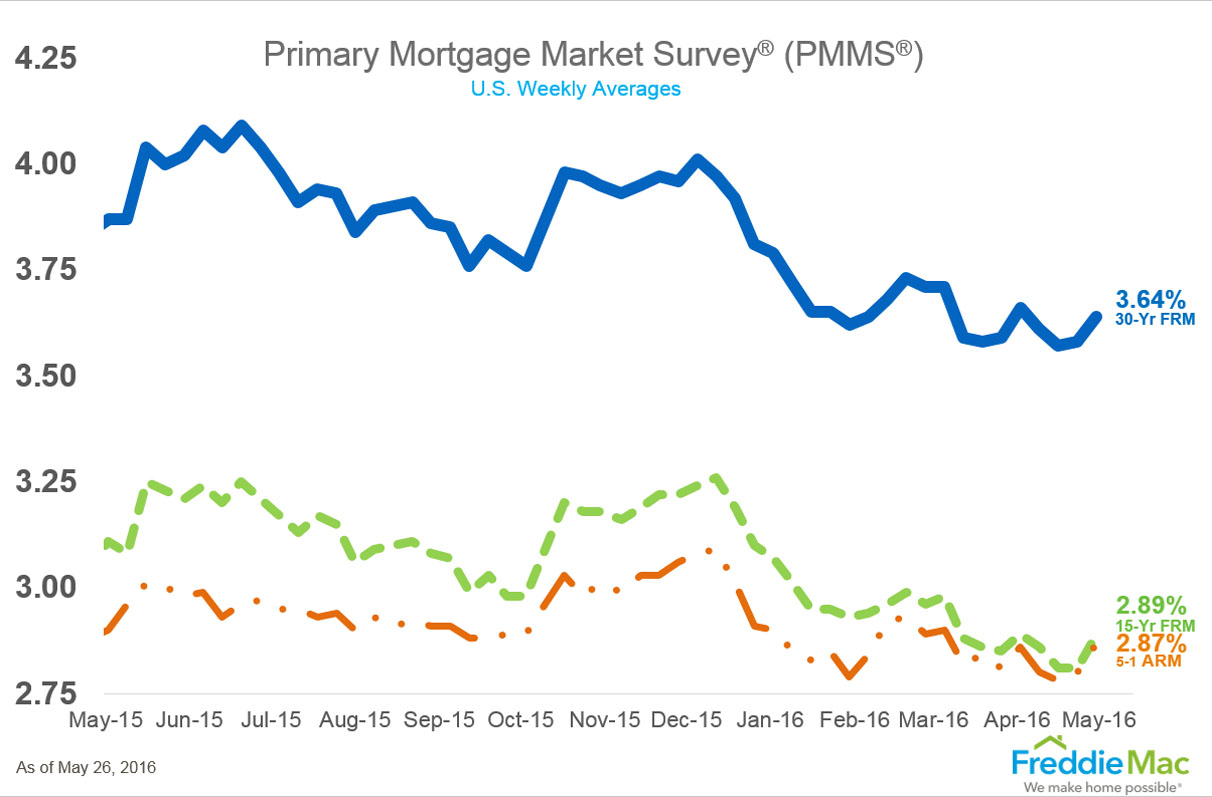

The average rate for a 30-year fixed-rate mortgage was 3.64 percent with an average 0.5 point for the week ending May 26, 2016. This is up from last week when it averaged 3.58 percent. A year ago at this time, the 30-year FRM averaged 3.87 percent.

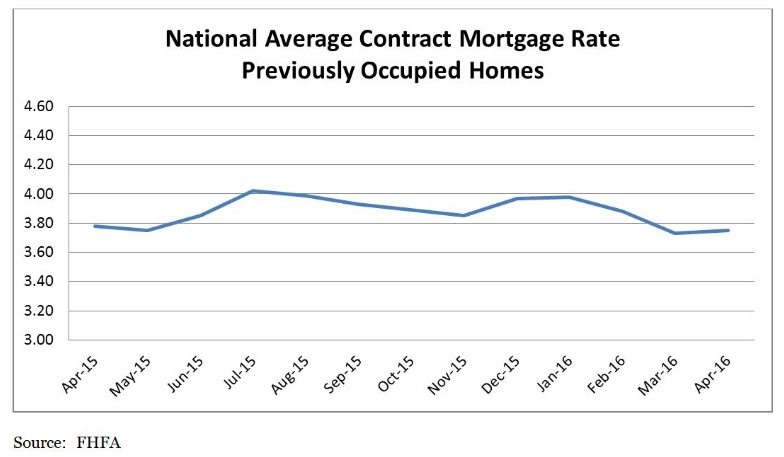

Federal Housing Finance Agency’s April 2016 mortgage rate index:

The average interest rate on all mortgage loans was 3.75 percent, down 1 basis point from 3.76 in March. The average interest rate on conventional, 30-year, fixed-rate mortgages of $417,000 or less was 3.94 percent, down 1 basis point from 3.95 in March. The average loan amount for all loans was $322,400 in April, down $2,600 from $325,000 in March.

Email market reports to press@inman.com.

Source: click here