It’s become harder for a typical African American family to afford a home in the years since The Great Recession, with many families able to afford just 25 percent of homes for sale last year, down from 39 percent in 2012, according to a new study from Redfin released Wednesday.

“As prices rise, minorities can get squeezed out of a neighborhood,” Jason Allen, the market manager for Maryland at Redfin, said in a statement.

“For a lot of people, homeownership is their main vehicle for building long-term wealth,” Allen added. “Many African American families who can only afford to buy homes in communities with fewer amenities, lower-rated schools, and long commutes, end up sacrificing not only long-term appreciation, but also access to better job opportunities for themselves and better educational opportunities for their children.”

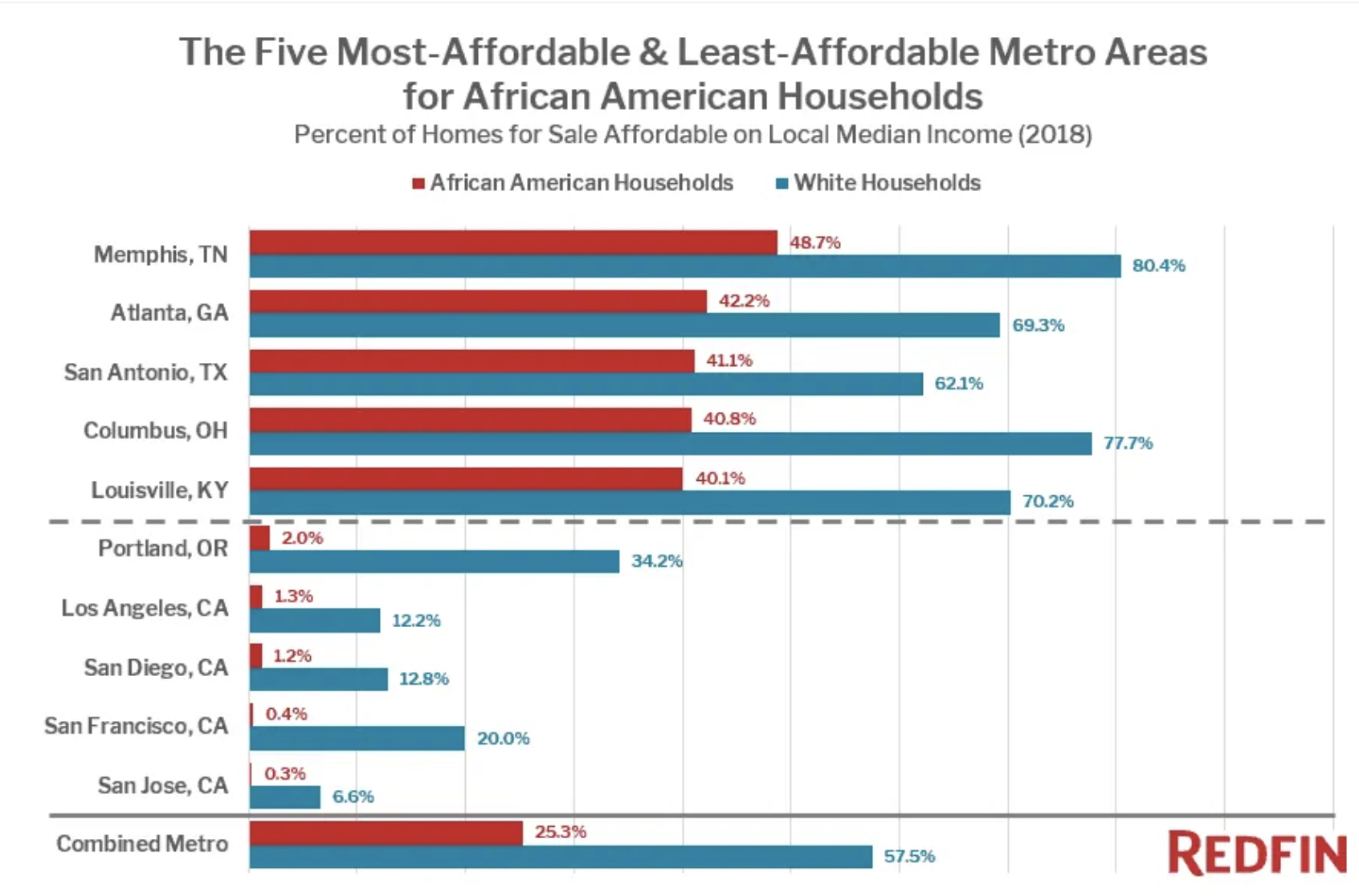

It’s exponentially more difficult in different metros across the country. Fewer than 10 percent of homes for sale in San Francisco, Los Angeles, Seattle, Denver and Boston, were affordable to the typical African American family. In San Francisco, that number is less than 1 percent.

Graph courtesy Redfin

The most affordable metro areas for African American families were Memphis, Atlanta and San Antonio, all cities where the typical African American family could afford more than 40 percent of the homes for sale. For comparison, the typical white family in Memphis could afford more than 80 percent of the homes, while the typical African American family could afford just 48.7 percent.

Use virtual real estate to connect with buyers just about anywhere

See how one agent helps his remote clients in a second home market READ MORE

Use virtual real estate to connect with buyers just about anywhere

See how one agent helps his remote clients in a second home market READ MORE

“Home prices have risen 70 percent since the beginning of the housing crash recovery in 2012,” Redfin Chief Economist Daryl Fairweather said in a statement. “African Americans, who were disproportionately affected by the housing crash in 2008, have found it much harder to get back into homeownership, especially as prices skyrocketed out of budget.”

“With shortages of affordable homes, the future doesn’t bode well for African Americans who aspire to be homeowners,” Fairweather added. “However, affordable housing and housing inequality is being taken seriously by 2020 presidential candidates. While some candidates’ proposals are more specific than others, the fact that it’s being discussed at the highest level of government is a step in the right direction.”

Redfin used income data broken down by race and mortgage data from Freddie Mac to calculate a maximum affordable mortgage payment for each metro. It then analyzed home listings that were active on the market at any time during 2018 and 2012, using list price, HOA dues, taxes and insurance, assuming a 20 percent downpayment, to determine whether the mortgage payment would fall under a 30 percent affordability threshold.

Source: click here