Even as you worry about the myth of millennials not buying homes, a new demographic is already moving in on this territory. Generation Z, or children born from 1995 onward, is already starting to buy houses.

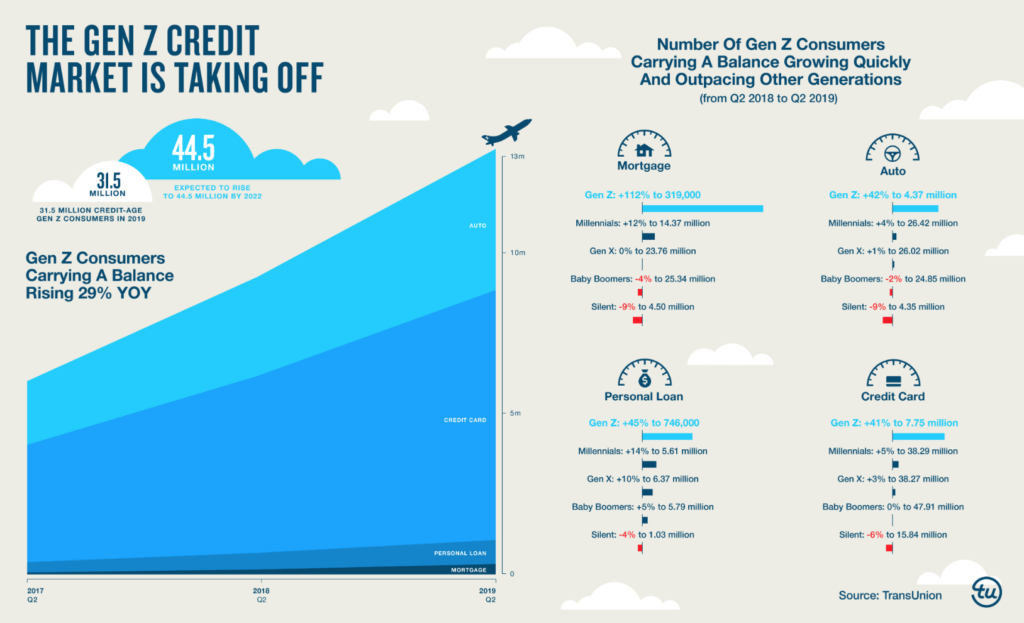

According to a new TransUnion report, 14 million Generation Z consumers have some sort of credit balance in 2019.

The number of Generation Z consumers who took out a mortgage grew by 112 percent to 319,000 between 2018 and 2019. While much more millennials, or those born between 1981 and 1995 have mortgages (14.37 million), that number of those taking new ones out grew by only 12 percent.

Generation Zers are currently much more likely to have other forms of debt — student loans, auto loans and credit card debt are the most common form of debt for them. (In general, much larger numbers of people have credit card debt and auto loans than mortgages).

But they are still young and will be a major force for the market in the coming years. According to the study, 13 million new Generation Z consumers will become credit eligible and start taking out loans that include mortgages by 2022.

TransUnion

“Both the newest and oldest members of the credit-eligible Gen Z generation are beginning to enter the credit market for the very first time,” said Matt Komos, vice president of research and consulting at TransUnion, in a media statement.

‘The smartest tech choice I made this year.’

12 real estate leaders share the decisions that helped shape their businesses READ MORE

‘The smartest tech choice I made this year.’

12 real estate leaders share the decisions that helped shape their businesses READ MORE

And if you still do not feel millennials and Generation Z are not a serious market force. Consider this: Not one of the older generations — Generation X, baby boomers and the silent generation — saw an increase in the number of people taking out mortgages.

Generation X stayed stable at 23.76 million while baby boomers fell 4 percent to 25.34 million. The number of mortgages taken out by the silent generation, or those born between 1925 and 1945, fell 9 percent to 4.5 million.

“From a generational perspective, Gen Z consumers accounted for two percent of total originations,” reads the report. “Gen Z may soon account for a larger share of mortgage loan growth, however, as the median age of home buyers is 28, and the oldest individuals in this generation are currently 24.”

Source: click here