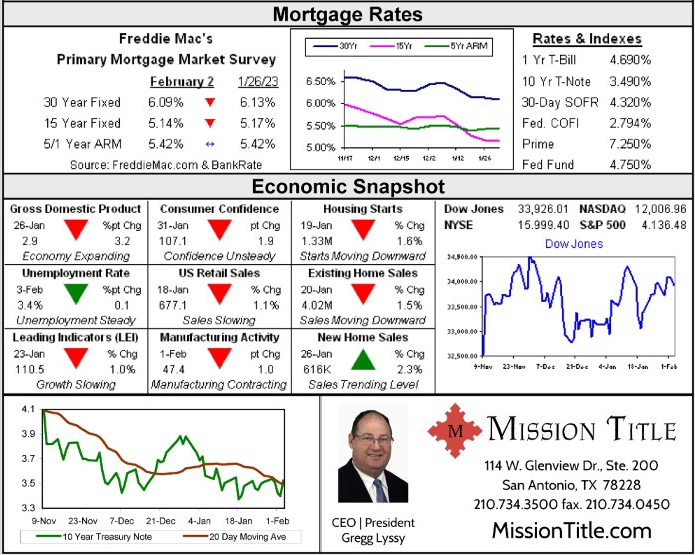

The Federal Reserve meeting ended as market participants expected, with a quarter-point increase anda slightly more dovish-sounding policy statement. Mortgage rates were already positioned for theincrease, so the rate bump did not impact mortgage rates. However, with Consumer Confidence andthe ISM Manufacturing Index posting below-expectations reading and a more dovish-sounding policystatement from the Fed, mortgage rates were posed to continue their recent gentle downward trend.Then Friday’s employment report stunned the market. Unemployment dropped to 3.4%, which waslast seen in 1969. More importantly, the market predicted a gain of about 200K jobs, and the reportrevealed an astounding 517K new jobs along with a 71K upward revision for previous months.Unsurprisingly, mortgage rates reversed course and began moving back upward.

This week could see rates mostly flat as little critical economic data is due. Even after last week,traders appear likely to remain cautious, waiting for more signals regarding the economy’s direction.

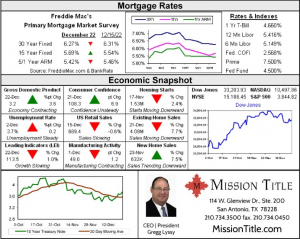

Mortgage Rates and Economic Snapshot

Mortgage Rates and Economic Snapshot