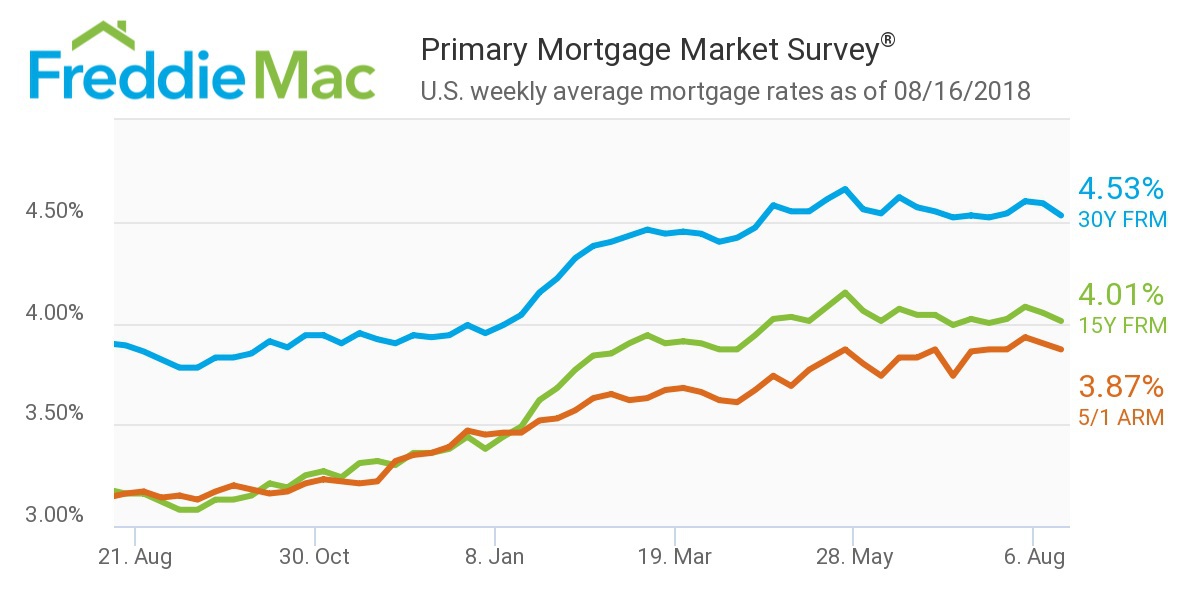

Mortgage rates rose incrementally for the second-straight week, according to Freddie Mac’s Primary Mortgage Market Survey, released Thursday. The rate for a 30-year fixed mortgage averaged 4.53 percent for the week ending August 17, down from last week’s 4.59 percent average but up significantly from a 3.89 percent average one year ago.

The rate for a 15-year fixed mortgage averaged 4.01 percent for the week, down from last week’s 4.06 percent and up from the 3.16 percent it was at during the same period last year. The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.87 percent – down from last week’s 3.90 percent average and up from the 3.16 percent average this week last year.

“This stability in borrowing costs comes despite the highest core inflation rates since 2008 and turbulence in the currency markets,” said Sam Khater, Freddie Mac’s chief economist. “Unfortunately, this pause in rates is not leading to increasing home sales.”

“This stability in borrowing costs comes despite the highest core inflation rates since 2008 and turbulence in the currency markets,” said Sam Khater, Freddie Mac’s chief economist. “Unfortunately, this pause in rates is not leading to increasing home sales.”

“Purchase mortgage applications trailed year-ago levels again last week, and it’s clear that in some markets the combination of ascending home prices, limited affordable inventory and this year’s higher rates are curtailing homebuyer demand,” Khater added.

Danielle Hale, chief economist for Realtor.com, said geopolitical and economic uncertainty have driven investors to ‘risk-free’ Treasury investments, which has led to lower rates and higher prices.

“As concerns about how emerging markets will fare as U.S. monetary policy tightens and the dollar strengthens, driving Treasuries lower, mortgage rates could slip from last week,” said Hale. “Despite any small moves lower, rates will still be roughly 60 to 70 basis points higher than one year ago.”

The keys to a better virtual tour

7 photography and videography tips for an eye-catching virtual tour READ MORE

The keys to a better virtual tour

7 photography and videography tips for an eye-catching virtual tour READ MORE

Source: click here