We’ll add more market news briefs throughout the day. Check back to read the latest.

Most recent market newsThursday, April 5

Freddie Mac Primary Mortgage Market Survey (PMMS)

30-year fixed-rate mortgage (FRM) averaged 4.40 percent with an average 0.5 point for the week ending April 5, 2018, down from last week when it averaged 4.44 percent. A year ago at this time, the 30-year FRM averaged 4.10 percent. 15-year FRM this week averaged 3.87 percent with an average 0.4 point, down from last week when it averaged 3.90 percent. A year ago at this time, the 15-year FRM averaged 3.36 percent. 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.62 percent this week with an average 0.4 point, down from last week when it averaged 3.66. A year ago at this time, the 5-year ARM averaged 3.19 percent.

Attributed to Len Kiefer, deputy chief economist:

“After dropping earlier this week on trade-related anxiety in financial markets, the benchmark 10-year Treasury stabilized on Wednesday, but at a level slightly lower than from the start of last week. Mortgage rates followed and fell for the second consecutive week; the U.S. weekly average 30-year fixed mortgage was 4.4 percent in our survey this week.

5 secrets to building a successful brand in real estate

How design, your logo and you can elevate your brand READ MORE

5 secrets to building a successful brand in real estate

How design, your logo and you can elevate your brand READ MORE

“Though rates on the 30-year fixed mortgage are up 0.3 percentage points from the same week a year ago, a robust labor marking is helping home purchase demand weather modestly higher rates.

“The Mortgage Bankers Association reported in their latest Weekly Mortgage Applications Survey that the Purchase Index was up 5 percent from a year ago indicating that this spring is on track for a modest expansion in purchase mortgage activity.”

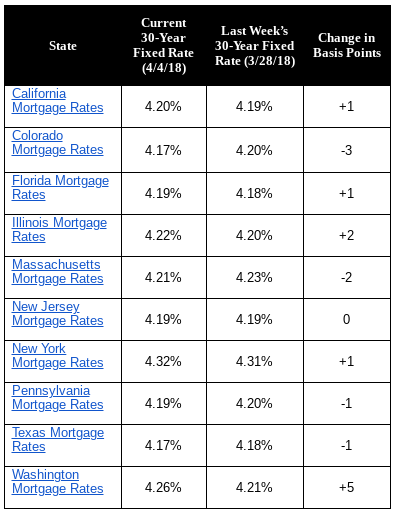

The 30-year fixed mortgage rate on Zillow Mortgages is currently 4.21 percent, unchanged from this time last week. The 30-year fixed mortgage rate stayed fairly flat over the past week, hovering between 4.17 and 4.26 percent. The rate for a 15-year fixed home loan is currently 3.61 percent, and the rate for a 5-1 adjustable-rate mortgage (ARM) is 3.61 percent. The rate for a jumbo 30-year fixed loan is 4.29 percent.

Current rates for 30-year fixed mortgages by state. Source: Zillow

“Mortgage rates were flat over the holiday-shortened week, holding near their lowest levels since mid-February but still well above where they stood a year ago,” said Aaron Terrazas, senior economist at Zillow. “Fears over trade policy and stock market movement have not yet meaningfully spilled over into bond markets.

“Friday’s monthly jobs report is the headline economic release this week, but markets know the economy is doing well and inflation – not employment – is the primary metric of concern. Wage growth will be closely scrutinized in Friday’s data, but even a disappointing number could be written off to wintry March weather.”

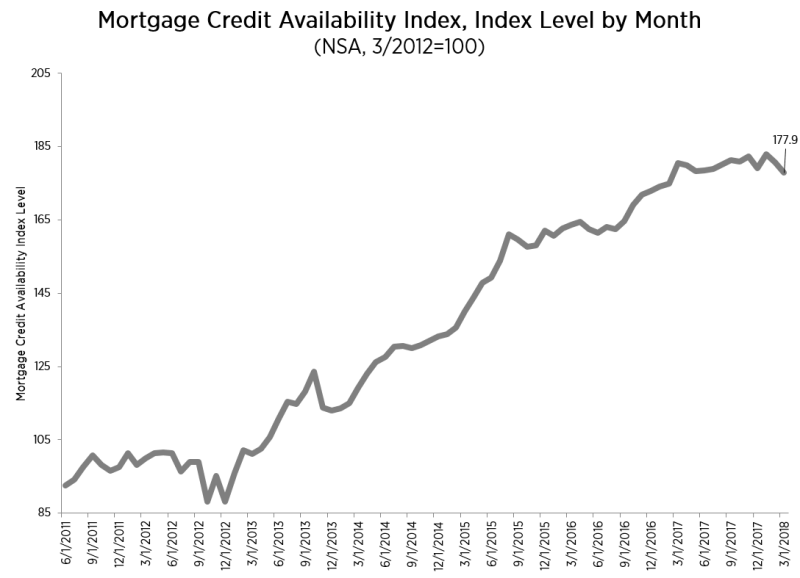

Mortgage Bankers Association’s (MBA) Mortgage Credit Availability Index (MCAI)

The MCAI decreased 1.5 percent to 177.9 in March. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Government MCAI fell by more (down 2.1 percent) than the Conventional MCAI (down 0.8 percent). The component indices of the Conventional MCAI both decreased from the month prior, with the Conforming MCAI falling by more (down 0.8 percent) than the Jumbo MCAI (down 0.7 percent).

Credit: Mortgage Bankers Association

“Mortgage credit availability decreased in March driven by both conventional and government loan programs. The government MCAI saw the largest decrease which was driven by investors making adjustments to their interest rate reduction offerings for FHA and VA loans,” said Joel Kan, MBA’s associate vice president of research and economics.

Wednesday, April 4

Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 3.3 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 3 percent compared with the previous week. The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 5 percent higher than the same week one year ago. The refinance share of mortgage activity decreased to its lowest level since September 2008, 38.5 percent of total applications, from 39.4 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 6.5 percent of total applications. The FHA share of total applications increased to 10.1 percent from 9.9 percent the week prior. The VA share of total applications remained unchanged at 10.3 percent. The USDA share of total applications remained unchanged at 0.8 percent. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) remained unchanged at 4.69 percent, with points remaining unchanged at 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate remained unchanged from last week. The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $453,100) decreased to 4.56 percent from 4.60 percent, with points decreasing to 0.27 from 0.36 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week. The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 4.74 percent from 4.75 percent, with points decreasing to 0.54 from 0.56 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week. The average contract interest rate for 15-year fixed-rate mortgages remained unchanged at 4.09 percent, with points decreasing to 0.42 from 0.46 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week. The average contract interest rate for 5/1 ARMs decreased to 3.87 percent from 3.92 percent, with points decreasing to 0.28 from 0.46 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.Tuesday, April 3

CoreLogic Home Price Index (HPI) and HPI Forecast, February 2018

In February, home prices in all 50 states increased in value year-over-year Washington state experienced the strongest gains at 12.5 percent Home prices projected to increase by 4.7 percent by February 2019“Family income is rising more slowly than home prices and mortgage rates, meaning that the mortgage payment takes a bigger bite out of income for new homebuyers,” CoreLogic President and Chief Executive Frank Martell said in a release.

“CoreLogic’s Market Conditions Indicator has identified nearly one-half of the 50 largest metropolitan areas as overvalued. Often buyers are lulled into thinking these high-priced markets will continue, but we find that overvalued markets will tend to have a slowdown in price growth.”

Read more here.

Monday, April 2

The average 30-year fixed-mortgage rate is 4.27 percent, down 6 basis points from a week ago. A month ago, the average rate on a 30-year fixed mortgage was higher, at 4.30 percent. The average 15-year fixed-mortgage rate is 3.69 percent, down 6 basis points over the last week.

Source: Bankrate

Source: click here