Check Inman every day for the daily version of this market roundup.

Mortgage rates: 30-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio 15-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio Home equity rates: Average Home Equity Loan Bank Rates by State | Credio Average Home Equity Loan Credit Union Rates by State | CredioThursday, May 26:

National Association of Realtors’ Pending Home Sales Index for March 2016:

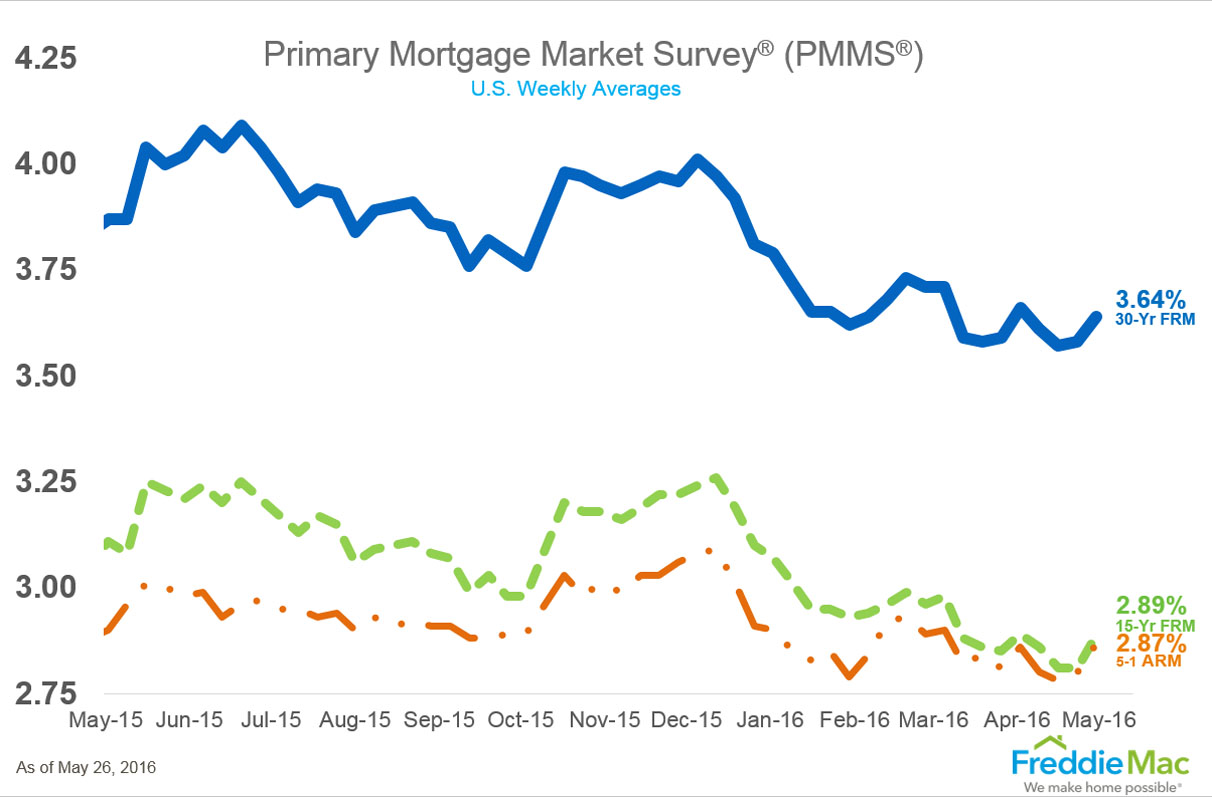

The Pending Home Sales Index was up 1.4 percent to 110.5 in March from 109.0 in February. The index is now 1.4 percent above March 2015 (109.0). After last month’s slight gain, the index has increased year-over-year for 19 consecutive months and is at its highest reading since May 2015 (111.0).Freddie Mac’s Primary Mortgage Market Survey:

The average rate for a 30-year fixed-rate mortgage was 3.64 percent with an average 0.5 point for the week ending May 26, 2016. This is up from last week when it averaged 3.58 percent. A year ago at this time, the 30-year FRM averaged 3.87 percent.

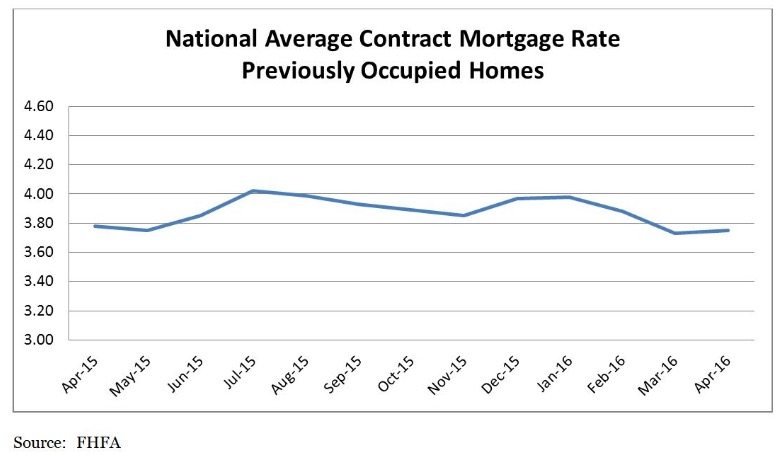

Federal Housing Finance Agency’s April 2016 mortgage rate index:

The average interest rate on all mortgage loans was 3.75 percent, down 1 basis point from 3.76 in March. The average interest rate on conventional, 30-year, fixed-rate mortgages of $417,000 or less was 3.94 percent, down 1 basis point from 3.95 in March. The average loan amount for all loans was $322,400 in April, down $2,600 from $325,000 in March.

Wednesday, May 25:

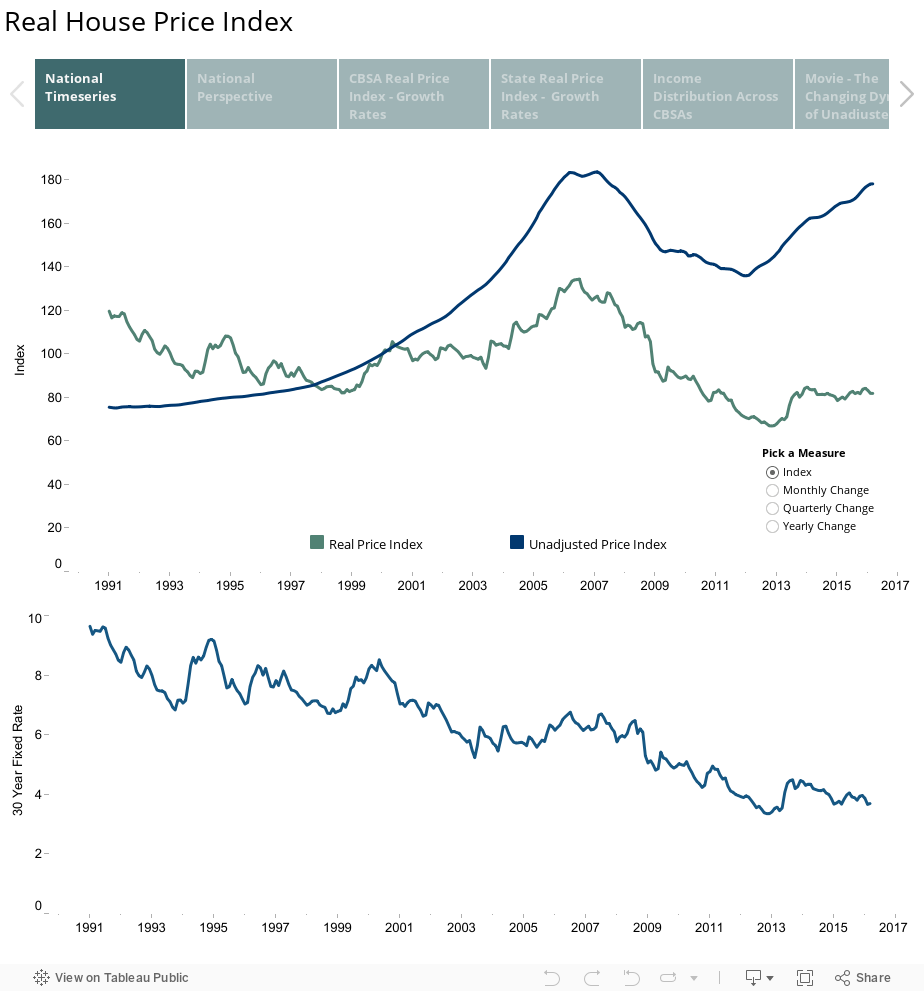

First American Real House Price Index (RHPI) for March 2016:

The RHPI was unchanged in March 2016 from February 2016. The RHPI decreased 2.1 percent year-over-year. The five states with the highest year-over-year increase in the RHPI are North Dakota (16.0 percent), Wyoming (14.7 percent), Rhode Island (12.2 percent), Delaware (6.0 percent) and Missouri (5.6 percent).

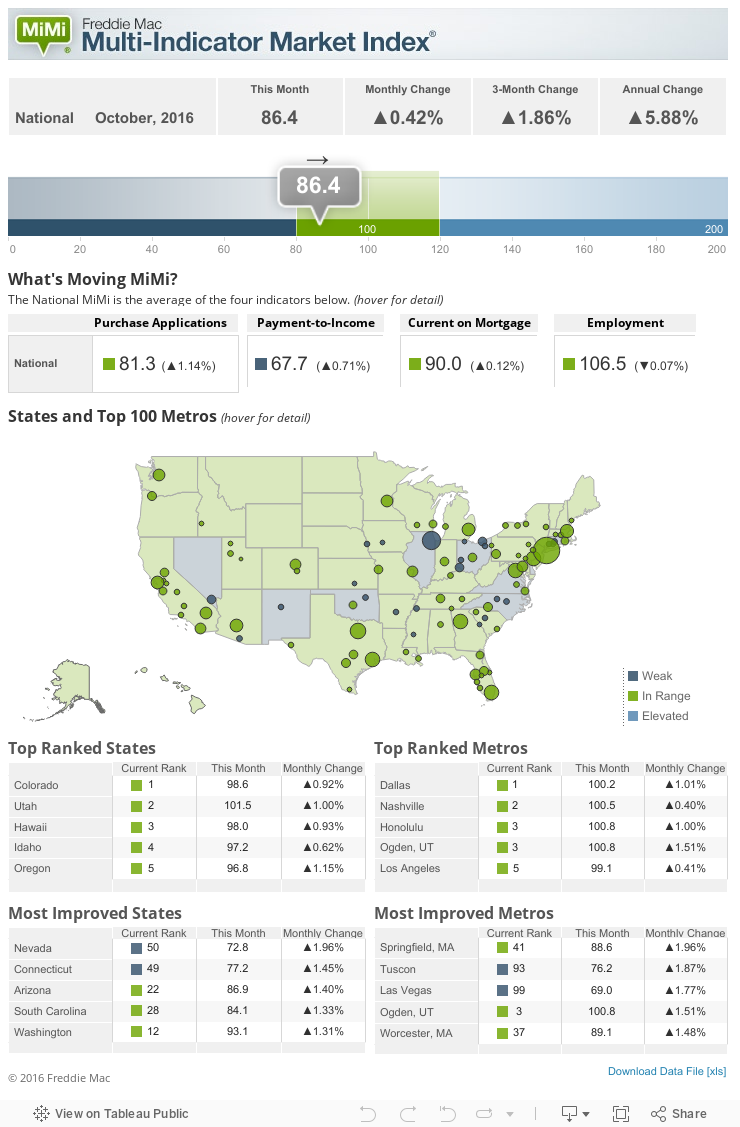

Freddie Mac’s Multi-Indicator Market Index (MiMi) for March 2016:

The MiMi is at 83.8, up 1.00 percent month-over-month. The quarterly MiMi is up 1.56 percent. Year-over-year, the MiMi is up 7.23 percent.

Mortgage Bankers Association’s weekly applications survey:

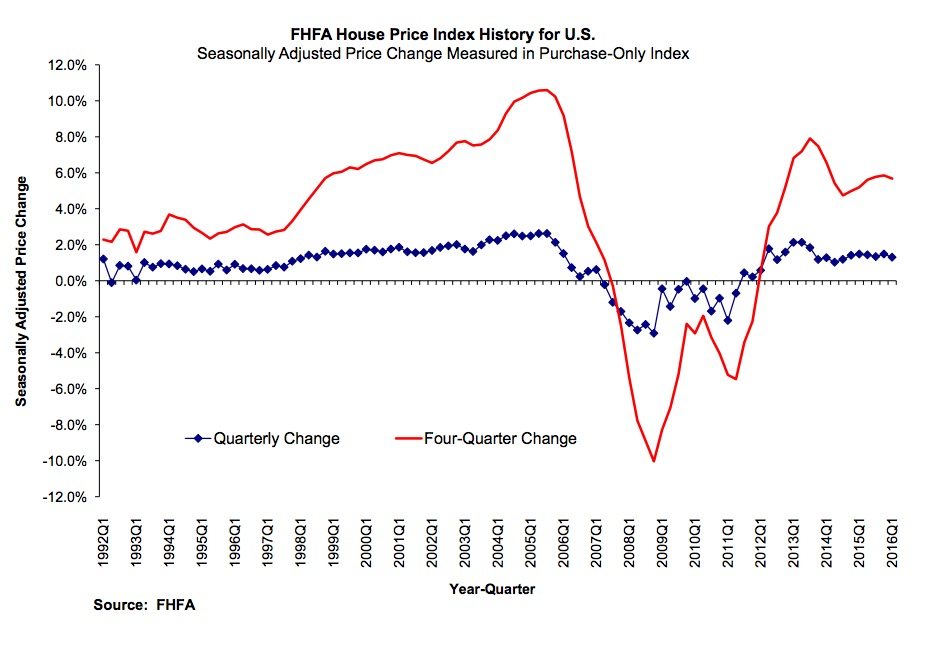

Mortgage applications increased 2.3 percent from one week earlier (adjusted). The refinance share of mortgage activity decreased to 53.7 percent of applications from 54.6 percent the previous week. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.85 percent from 3.82 percent.Federal Housing Finance Agency’s Home Price Report for March 2016/Q1 2016:

Home prices rose in every state between the first quarter of 2015 and the first quarter of 2016. The top five states in annual appreciation were Oregon (11.8 percent), Florida (11.2 percent), Washington (10.9 percent), Nevada (9.4 percent) and Colorado (9.0 percent.) Annual price increases were greatest in the metro area of West Palm Beach-Boca Raton-Delray Beach, Florida, where prices increased by 16.7 percent. Prices were weakest in El Paso, Texas, where they fell 2.8 percent.

Tuesday, May 24:

Sales of new single-family houses in April 2016 were at a seasonally adjusted annual rate of 619,000. This is up 16.6 percent month-over-month and up 23.8 percent year-over-year. The median sales price of new houses sold in April 2016 was $321,100; the average sales price was $379,800.CoreLogic’s MarketPulse Report for May 2016:

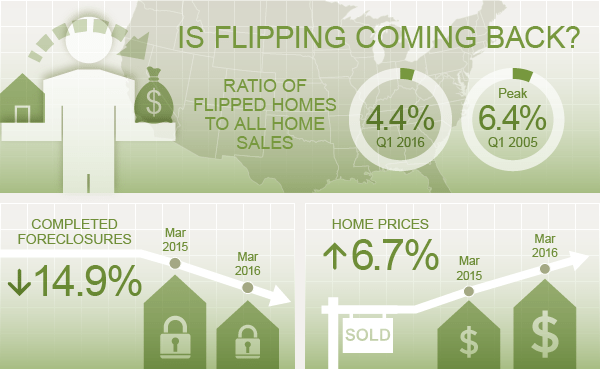

In March 2016, the ratio of flipped homes to all home sales was 4.4 percent. Completed foreclosures were down 14.9 percent year-over-year. Home prices were up 6.7 percent year-over-year.

Black Knight Financial Services’ “First Look” at April mortgage data:

The total foreclosure pre-sale inventory rate is 1.17 percent, 5.87 percent lower than March 2016 and 27.76 percent lower than April 2015. The total foreclosure starts in April were 58,700, down 19.37 percent month-over-month and 16.62 percent year-over-year. The number of properties 30 or more days past due but not in foreclosure totaled 2,146,000, up 84,000 month-over-month but down 179,000 year-over-year.Monday, May 23:

Campbell/Inside Mortgage Finance HousingPulse Tracking Survey for April 2016:

First-time homebuyers accounted for 38.9 percent of home purchases in April 2016, up from 38.1 percent in March 2016 and 37.2 percent in April 2015. Current homeowners accounted for 45.7 percent of home purchases in April, and investors had a 15.4 percent share. Move-in ready real estate owned properties received an average of 2.4 offers in April, and non-distressed properties received an average of 2.2 offers during the month.Email market news to press@inman.com.

Source: click here