What does the growth of crowdsourced commercial real estate investment mean for real estate professionals?

In April 2019, Wisconsin-based property developer and investment firm J. Jeffers and Co. needed to find equity investors for a new office building in Milwaukee. The goal was clear: raise about $10 million in equity investment to get the project off the ground. They expected it would take at least a couple of weeks to find new, interested investors and finally get working on the 11-story 160,000 sq-ft multi-use structure.

Turns out they didn’t even need a day. Thanks to online investing platforms, first introduced in 2012 and now a mainstream way to raise capital for commercial real estate, J. Jeffers and Co was able to find 400 new investors and ended up accepting over $14 million in funding — well above their initial $10 million target. They sold out the investment opportunity after a single day being published on the online platform.

Classically, commercial real estate has been solely the realm of large institutional investors. But crowdfunded commercial real estate ventures, made possible by the Jumpstart Our Business Startups Act (or JOBS Act) have started to democratize the previously inaccessible commercial real estate investing space for individual accredited investors in the United States.This could be a new investing avenue for real estate professionals who are looking for ways to grow their wealth and potentially protect themselves from more unpredictable public markets.

Economic and employment growth is fueling a rise in the commercial real estate markets around the world. According to Deloitte, the United States saw an 11 percent year over year growth in transaction volume to end at $122 billion the first half in 2018. While growth has slowed in the early months of 2019, the National Association of Realtors expects multi-family and industrial buildings will remain attractive asset classes. In more specific examples, urban areas continue to foster retail spaces and tech jobs are supporting the need for more office space.

What real estate professionals are saying

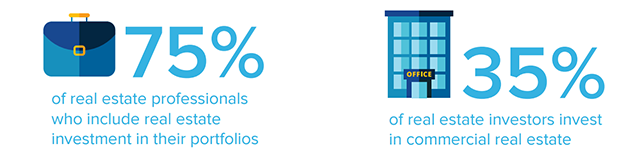

In a survey of Inman.com readers, it was found that over three quarters of real estate industry respondents include real estate investments in their portfolio. But of that number, only 34 percent said that included commercial properties. The two main barriers reported by the respondents included not having enough knowledge about commercial real estate markets and that commercial real estate investment costs are too high.

Some of the main features of the online commercial real estate investment marketplace from Portland-based CrowdStreet are helping to address those concerns. Their online syndication model means that initial investments as low as $25,000 could get accredited investors access to long-term property deals anywhere in the country. Additionally, the company provides a variety of educational resources into livestreams, blogs, market research and more to help investors learn more about commercial real estate and make more informed investing decisions. Their investor community itself can also be a source of information for new investors.

Founded in 2014, CrowdStreet powers one of the largest and most diverse online commercial real estate marketplaces in the U.S. The platform offers investors three different ways to grow their wealth: through direct investing in individual properties, portfolio vehicles managed by CrowdStreet affiliates, as well as a private managed account service (through a CrowdStreet affiliate).

As of August 31, 2019, CrowdStreet’s Marketplace has included 361 offerings, 173 different sponsors with 12 property categories, spread out over 39 states.

Why investors are attracted to private equities market

There are a number of compelling reasons to look into the commercial real estate market, says New York City-based investor Townsend Baldwin. Perhaps the most fundamental is the idea that syndicated investment options have opened doors previously inaccessible to the average individual investor. The properties found on crowdfunding platforms are listed by a selection of real estate sponsors and are found in a diverse number of geographical locations.

Townsend Baldwin, Investor

Before the regulatory changes allowing the crowdfunding of offerings related to private equity assets like commercial buildings, knowing the right people or being a large institution were key to finding these deals. Now that’s no longer required, says Baldwin.

According to Baldwin, the knowledge of the crowd has allowed him to make more informed investment decisions. While most online platforms have a quality control process that determines which investments it allows on their marketplaces, each individual investor is responsible for conducting their own due diligence. Baldwin has found many other participants on his investments were willing to share their own insights into the deal.

Furthermore, Baldwin says, “It is an opportunity to participate in a massive review process with hundreds of other limited partners around specific properties. And the real deep down satisfaction comes when you can help other LPs discover something they did not know about the investment and help them hone their analytical skills. After all, happiness really hits you when you have an opportunity to help others.”

A compelling part of commercial real estate investment for Baldwin was the long-term nature of the deals. “I think that these days in society there’s too much of a premium placed on over-trading, for instance, in the stock market, on get-rich types of schemes, and on making money overnight,” says Baldwin. Instead, for these types of investment opportunities, the value creation plan plays out over the course of five to ten years.

“I think that these days in society there’s too much of a premium placed on over-trading, for instance, in the stock market, on get-rich types of schemes, and on making money overnight.”

Baldwin points out that making the right decisions in commercial real estate investment could also come down to a couple of instincts already familiar to real estate professionals, namely a deep understanding of local real estate markets and understanding what makes a property a great investment—things that real estate agents and brokers do every day.

With the diversity found in investment types, geographic location, and sponsors, the individual investor has a large number of choices when seeking deals. To Baldwin, that’s critical to enable deal flow. Traditionally, deal flow is the amount of offers that are presented to an investor, with the more the merrier. That dynamic is supercharged when investors get to pick from a group of deals.

“It’s all about deal flow, because the key is to find the gems. The more deal flow you have, the higher probability you have of finding a deal that you understand and that you like,” he says.

What are some strategies real estate professionals can use to enter the market?

Not only do investors need to keep tabs on the details of the specific sector they’ve invested in, but needing to compensate for an unpredictable larger picture is becoming increasingly important. Stocks, funds and bonds are tied to major market movements, the actions and decisions of the federal reserve, and even a certain high profile Twitter account. Commercial real estate, on the other hand, is not as directly tied to as many external market forces.

Ted Parker, Senior VP and Western Regional Director, Millennium Trust Company

Classically, the main participants in the commercial real estate market have been large institutional investors. Pension plans, hedge funds, and insurance companies are the entities which usually have the ability to put up the large amounts of capital to operate long-term investment plans in these types of alternative investment markets. But that changed in 2012 with the passage of the JOBS Act, according to the Securities and Exchange Committee.

The new post-JOBS Act world also allowed financial custodians to help people invest their retirement savings into alternative investments, through approaches that make these new investment options even more accessible: self-directed IRAs, or SD-IRAs.

The reasons for compatibility here are fairly straightforward, according to Ted Parker, Senior VP and Western Regional Director at California-based financial custodian Millennium Trust Company.

“Most investors probably have much larger retirement accounts than they do taxable accounts,” he says. Since the custodians at Millennium Trust are not managing investments like financial advisors, they only charge an annual fee of around $100. Beyond just facilitating any bank transfers, representatives at Millennium Trust provide a level of review on the details of the proposed investment.

“Most investors probably have much larger retirement accounts than they do taxable accounts.”

What other benefits are there to commercial real estate investment?

According to Jill Homan, President of Javelin 19 investments, leveraging syndicated real estate offerings means an opportunity for investors find investments which help underserved communities, as well as potentially increase the engagement of women in the investment industry.

Jill Homan, President, Javelin 19 Investments

The first area is an emerging experiment in the way investments are made in economically challenged areas and it was passed into law with 2017’s Tax Cuts and Jobs Act. It means investors could see some pretty significant tax incentives to invest in specific properties found in what are called “Opportunity Zones.”

Opportunity Zones are found across the country. These areas often have a 20 percent poverty rate or a median household income of no more than 80 percent of the statewide number, according to an analysis by Bloomberg In June 2018, the US Department of Treasury officially certified more than 8,700 census tracts as Opportunity Zones.

As well as injecting support into areas which would stand to benefit the most from outside investment, the benefits to investors don’t stop there. When someone invests qualified gains into Opportunity Zones and holds the investment for seven years before Dec. 31 2026, they will see a 15 percent reduction on their capital gains tax liability, and investments held for five years before the same date will see a ten percent reduction. On top of all that, if the investment is held for ten years, any future appreciation on the investment won’t have any capital gains taxes applied to it. (Investors should note that the tax rules are very complex and require appropriate planning by the sponsor and the investor in order to tax advantage of these tax benefits.)

“The reason investors are so excited about this is twofold,” says Homan. “Number one, you have an ability to make an impact. So you have the impact investing component. But just as exciting, an investor may be able to invest in an Opportunity Zone investment and receive a higher after-tax return than a non-Opportunity Zone investment.”

Already, CrowdStreet has had several property choices found on their online Marketplace which would qualify as Opportunity Zone investments, says Homan. It’s important to realize that the funding model isn’t philanthropy, as a solid and profitable property investment is still required to see eventual capital gains.

“The reason investors are so excited about this is twofold. You have the impact investing component — but just as exciting, an investor may be able to invest in Opportunity Zone investment and receive a higher after-tax return…”

Additionally, Homan says that CrowdStreet has enabled her to foster interest in emerging investment communities. Early on when raising money for a future investment, Homan realized there was only one other woman found in her network.

“That’s kind of strange, because I’ve been on the board of CREW (Commercial Real Estate Women Network) and like my friends are a lot of women in real estate. For some reason, I just hadn’t been kind of connecting the dots,” says Homan. “So I reached out to my network and asked them if they were interested in investing in real estate, and if they were being asked by developers. Overwhelmingly, the response was, they are interested in investing and they’re not [being approached].”

So Homan began organizing informal clubs for women in the investment and real estate sectors to help network potential investment deals. Something only made easier with online platforms like CrowdStreet.

“[The group] has grown organically, as we haven’t sought out to grow it. People hear about and say, ‘Hey, can I can I join? Or will you add my friend?’ These are all accredited investors,” says Homan. “This is just one tip of an iceberg of what I think is a bigger point. I think there’s an opportunity to really engage women in a much, much bigger way.”

That’s why the interest in these alternative investments are growing and the technology is evolving as well. The online syndication of private equities provide an alternative to the stock market and can be a new way to generate wealth, while also opening up new capital flow to underserved communities. Platforms like CrowdStreet only make it easier for the average accredited investor to participate in these new and exciting developments.

More information about online investing in commercial real estate can be found at CrowdStreet.com.

Disclaimer: This is a paid research report, produced by Inman Group, LLC, for CrowdStreet, Inc. Information contained herein should not be used as a basis for making an investment in the CrowdStreet Marketplace or in any of CrowdStreet’s or its affiliates’ investment products or read as an endorsement of CrowdStreet or any of its affiliates. CrowdStreet does not assume responsibility for the reliability or accuracy of any materials produced by third-party providers.

Source: click here