The number of homeowners sitting on negative equity has grown for the first time in four years, according to new data from CoreLogic released Thursday.

Nationwide, 35,000 more homeowners now owe more for their mortgages than their homes are worth — an unexpected figure given that the numbers have been falling since 2015. In total, the number of underwater properties grew by 1.6 percent to 2.2 million homes (or 4.2 percent of all mortgaged homes.)

Nonetheless, the negative equity rate is nowhere near the 26 percent that occurred at the height of the housing crisis in 2009. Compared to last year, the number of underwater properties has also decreased by 350,000, or 14 percent.

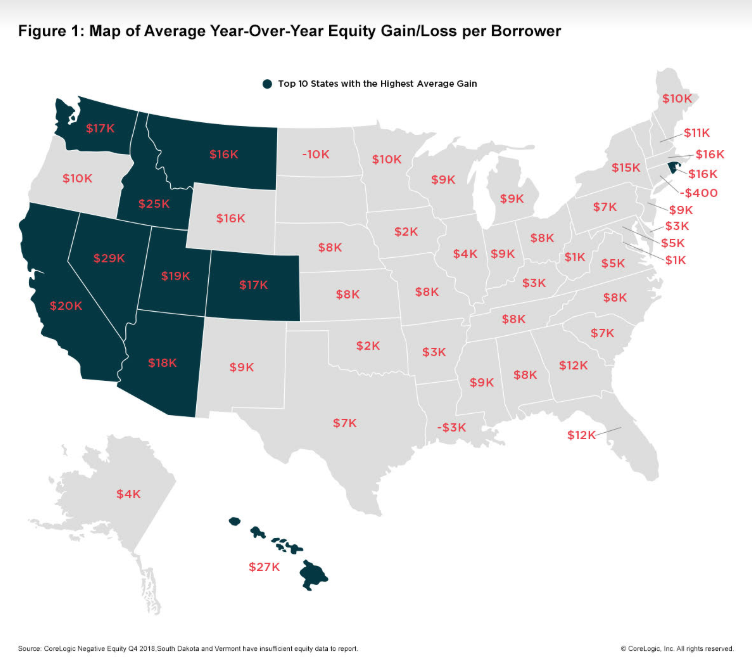

Courtesy of CoreLogic

“Our forecast for the CoreLogic Home Price Index predicts there will be a a 4.5 percent increase in our national index from December 2018 to the end of 2019,” said Dr. Frank Nothaft, chief economist for CoreLogic, in a prepared statement. “If all homes experience this gain, this would lift about 350,000 homeowners from being underwater and restore positive equity.”

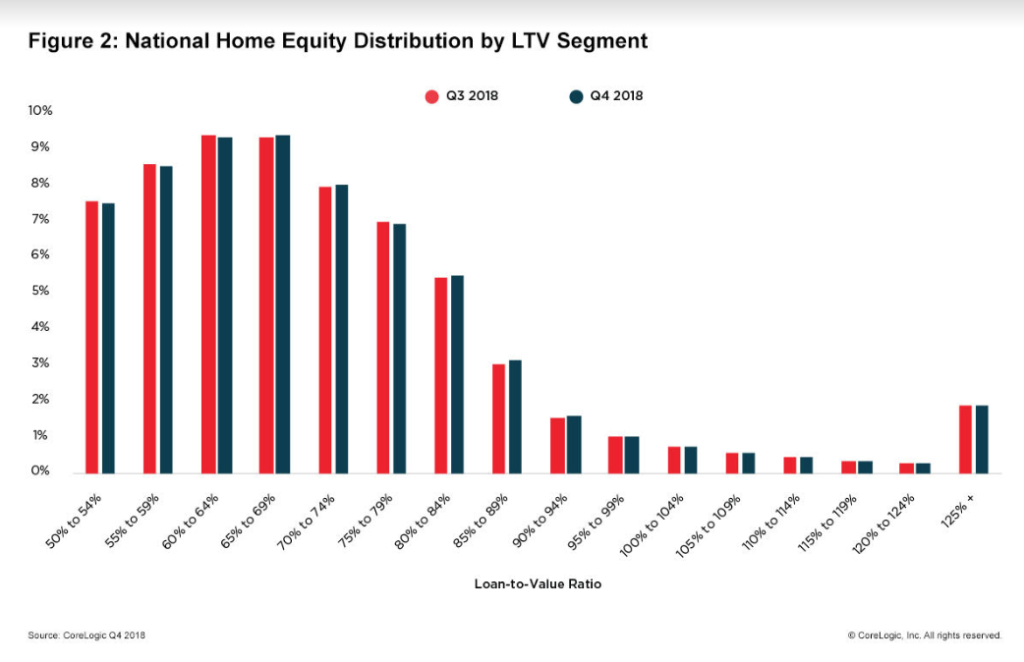

Courtesy of CoreLogic

What’s more, the average homeowner has gained $9,700 in equity over the past year. In Nevada and Hawaii, this number was as high as $29,400 and $26,900, respectively. CoreLogic predicts the number of homes with negative equity will even out by the end 0f 2019 given that home values across the country continue to grow, albeit at a slower pace than a year earlier.

Tried and true: email marketing is still king of the hill

Easily craft vital, targeted email campaigns with MoxiEngage CRM READ MORE

Tried and true: email marketing is still king of the hill

Easily craft vital, targeted email campaigns with MoxiEngage CRM READ MORE

“As home prices rise, significantly more people are choosing to remodel, repair or upgrade their existing homes,” said Frank Martell, president and CEO of CoreLogic, in a prepared statement. “With rates still ultra-low by historical standards, home-equity loans provide a low-cost method to finance home-improvement spending. These expenditures are expected to rise 5 percent in 2019.”

Source: click here