New York City luxury residential sales have reached their lowest point in four years, according to an analysis by The Wall Street Journal published Monday. Overall sales in the luxury market fell 11.5 percent year-over-year while sales for properties priced $2 million and above fell by 31.5 percent.

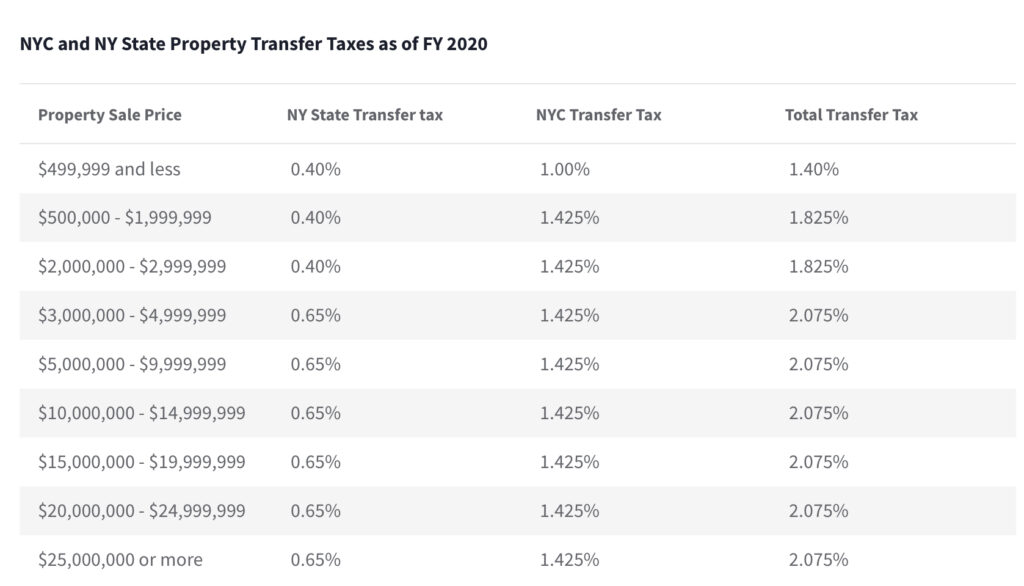

According to the analysis, the revised New York state transfer tax is partly to blame for the slump. As its name suggests, the tax is levied whenever real estate is transferred from a seller to a buyer. In New York City, state and city transfer taxes are applied and must be paid at closing.

Sellers are usually responsible for paying the tax, although buyers can take on the burden with one caveat — they cannot finance the tax cost, according to an explainer by StreetEasy.

Revised New York state transfer taxes | Photo credit: StreetEasy

For the 2020 state budget, New York state residential transfer taxes increased to 0.40 percent for properties priced under $3 million and 0.65 percent for properties priced over $3 million.

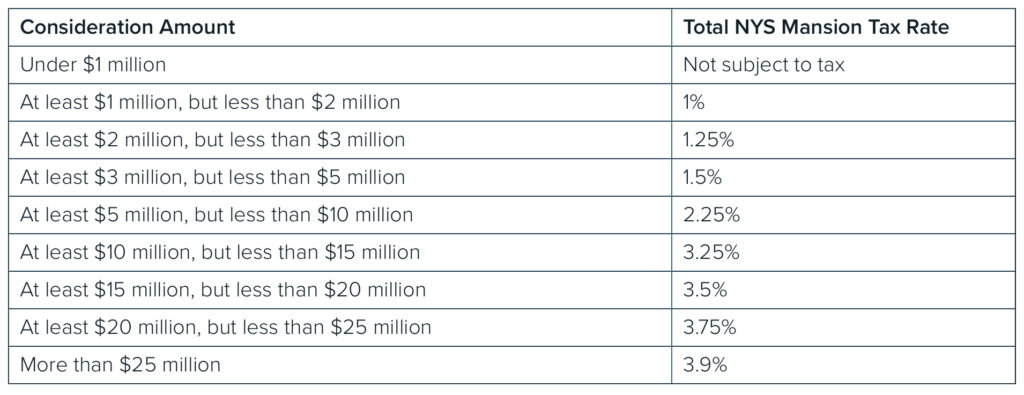

But the real gut punch for luxury sellers comes from the increased mansion tax, which only applies to properties priced at $1 million and above. The mansion tax ranges from 1 percent for properties priced between $1 million and $2 million to 3.9 percent for properties priced at $25 million or above.

How passion and pride can bring professional success

One agent became an LGBTQ+ ally and discovered a powerful community READ MORE

How passion and pride can bring professional success

One agent became an LGBTQ+ ally and discovered a powerful community READ MORE

The revised mansion tax scale | Photo credit: Kramer Levin Law

The revised transfer and mansion taxes went into July 1 and only apply to transfers after that date. The state also offered an exemption for properties that went under contract on or before April 1, but didn’t close until after the July 1 deadline.

New York Governor Andrew Cuomo said the increased taxes will improve MTA services and efficiency, which has come under intense scrutiny over the past couple years.

“This structure promotes tax administration efficiency, raising $365 million from high-end property transfers that will be deposited into the MTA’s Central Business District tolling capital lockbox and will be used to support up to $5 billion in financing for MTA projects,” Governor Cuomo said in a prepared statement.

Beyond causing luxury apartment sales to plummet, median prices have dropped 25 percent quarter-over-quarter to just over $1 million as sellers aim to attract buyers who want to avoid higher taxes.

Compass senior managing director Elizabeth Ann Stribling-Kivlan told the Journal “it’s a great time to trade up,” as prices have dropped.

However, buyers and sellers must prepare for another possible hit to the market in the form of Senate Bill 3060E and Assembly Bill A5375A. Both bills would add a 20-percent transfer tax on properties in New York City sold within one year and a 15 percent tax on properties sold after one year but less than two years after purchase.

Both bills are geared toward curbing real estate investments and flipping in order to help long-term residents pushed out by high prices.

New York State Association of Realtors Director of Government Affairs Mike Kelly told Inman in June the bills aren’t likely to help long-term residents find affordable housing, but they are likely to weaken sales in the in area as investors go elsewhere.

“I think it’s simply going to hurt New York City’s tax revenues that are in large part due to real estate transactions,” Kelly said.

Source: click here