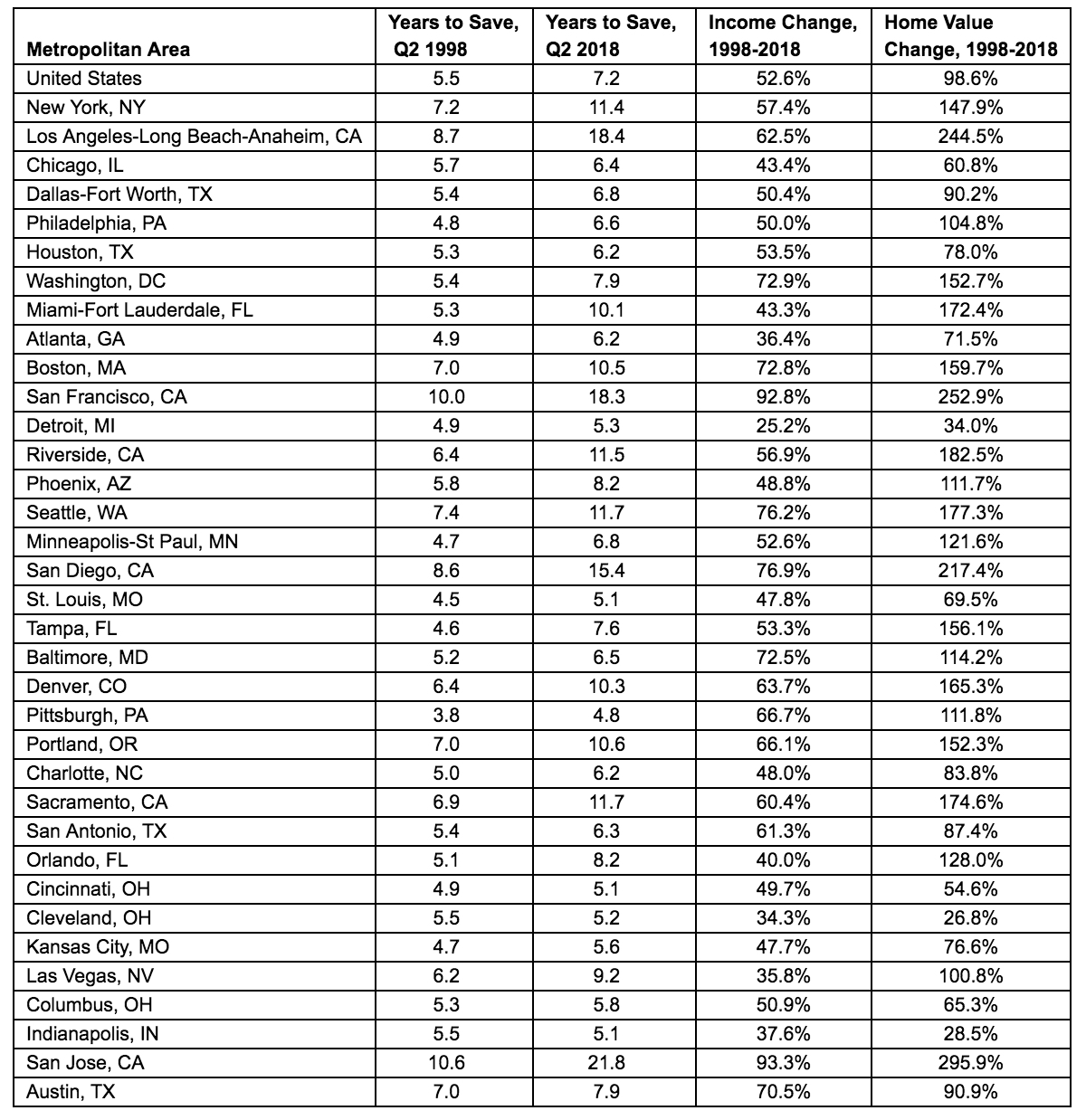

If your family earns the U.S. median income of $60,748 a year and dutifully puts 10 percent of it away every month, it’ll take you seven years to save enough for a down payment on a median-priced $217,300 home, according to a new Zillow analysis released on Monday.

Nationwide, those who earn a median salary and save a tenth of it every month will need 7.2 years to save 20 percent of a median valued home in their city. Traditionally, 20 percent has been considered a financially healthy down payment amount.

According to Zillow, it hasn’t taken this long for homebuyers to save for a down payment since the height of the housing crisis in 2008.

In 1998, it took homebuyers only 5.5 years to save up the same 20 percent for a median-priced home. Such growth is partially caused by the failure of income to keep up with housing prices — while home value grew by 98.6 percent in the last 20 years, incomes only rose by 52.6 percent.

“The simple fact that home values have far outpaced income growth, lengthening the time needed to save for a down payment, contributes to millennials’ struggles to enter homeownership,” Skylar Olsen, Zillow’s Director of Economic Research and Outreach. “Saving up for a down payment can be tough, especially when the cost of everyday life outpaces the money you put into the bank.”

Pittsburgh residents have it better than most: it only takes 4.8 years to save for a down payment, according to Zillow’s analysis.

Sphere of influence is still king

How to leverage your largest source of real estate business READ MORE

Sphere of influence is still king

How to leverage your largest source of real estate business READ MORE

Credit: Zillow

In some cities, it takes even longer to save for an average-sized down payment, even with a high median income.

It would take San Jose residents on the median local household income of $118,061 a jaw-dropping 22 years to save enough for a down payment on the $1,287,600 median-priced home in their city.

With its now notorious housing crisis, California does not fare well for first-time homebuyers, in general. In Los Angeles, saving for a down payment takes 18.4 years at the median income; in San Francisco, it takes 18.3 years.

“It requires good budgeting and long-term planning,” Olsen said. “It’s one reason why more and more first-time home buyers are looking to family and friends for financial help when coming up with their down payment.”

That said, some cities did see a decrease in the time needed to save for a down payment — in Austin, Texas, it takes nearly 2 years less to than it did in 1988. But even with these drops in parts of Texas and the Midwest, the current market is not at all kind to first-time and millennial homebuyers. With rising rents, a student loan crisis and high competition for affordable homes, fewer and fewer people are able to make a down payment on a house without help from family or friends.

“Slower rent growth in recent months should create some more breathing space in renters’ budgets, but rents remain high by historic standards,” Olsen said. “Even if you don’t have plans to buy a home in the next year or two, it’s not a bad idea to start setting aside savings for a future home purchase. It’s also important to remember that there are many options for mortgages requiring less than 20 percent down.”

Source: click here