Five states saw increases in the number of homeowners who fell behind on their mortgages, even as nationwide foreclosure rates remain at a 20-year low.

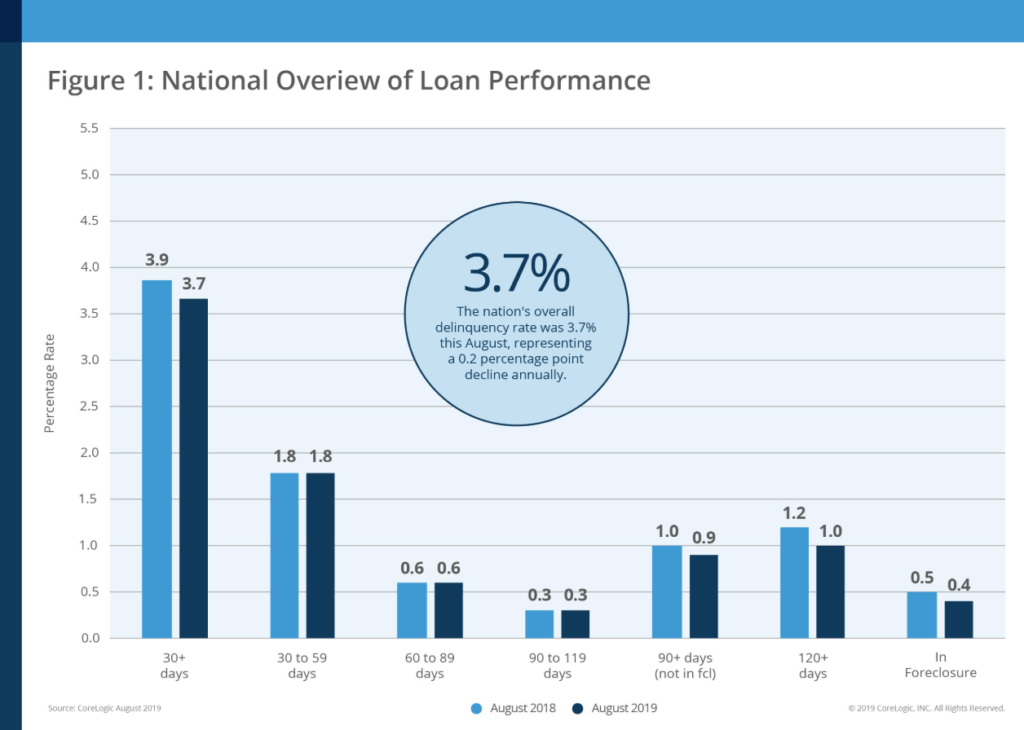

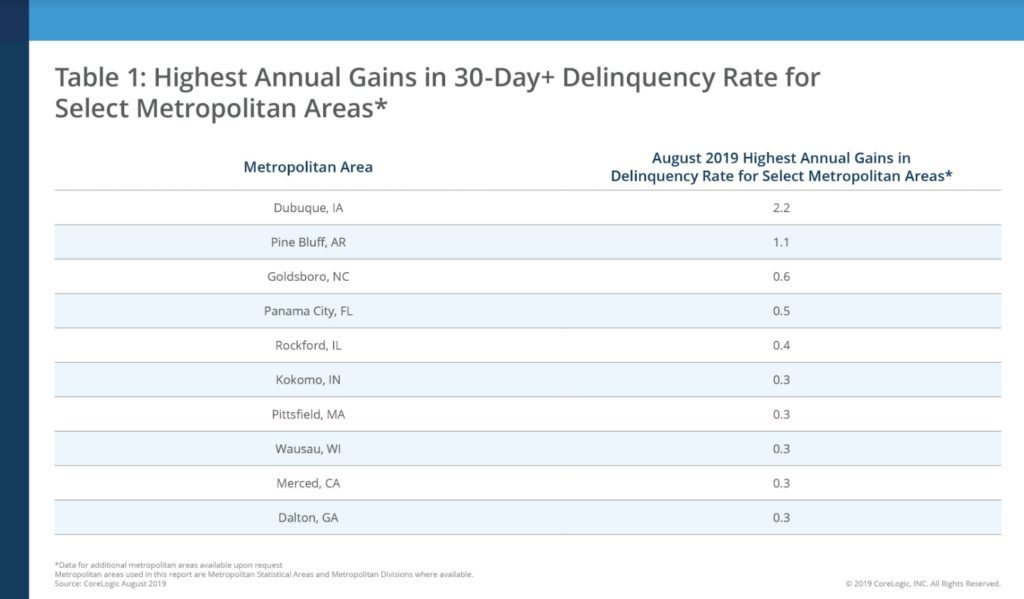

Across the country, the delinquency rate in August was 3.7 percent — the lowest in more than 14 years. That said, Iowa, Minnesota, Nebraska, Wisconsin and Rhode Island saw upticks in the number of delinquencies. The number of homeowners who did not make a mortgage payment for more than 30 days rose by 0.2 percentage points for Iowa and 0.1 percentage points for all the other states, respectively.

CoreLogic

Dubuque, Iowa; Pine Bluff, Arkansas; Goldsboro, North Carolina; and Panama City, Florida, were the cities with the highest number of delinquencies in the country.

The discrepancy between the rest of the country and these states is caused, at least in part, according to CoreLogic, to a struggling economy and lagging job market in those states.

“Job loss can trigger a loan delinquency, especially for families with limited savings,” said Dr. Frank Nothaft, chief economist at CoreLogic, in a prepared statement. “The rise in overall delinquency in Iowa, Minnesota, Nebraska and Wisconsin coincided with a rise in state unemployment rates between August 2018 and August 2019.”

2D, 3D, Panoramic, oh my! What’s the difference, really?

Understand the real meaning of each kind of real estate marketing media with this quick glossary READ MORE

2D, 3D, Panoramic, oh my! What’s the difference, really?

Understand the real meaning of each kind of real estate marketing media with this quick glossary READ MORE

CoreLogic

Nationally, the picture is still quite encouraging. The foreclosure inventory rate, which measures the number of mortgages in some stage of the foreclosure process, is at 0.4 percent — the lowest it’s been since January 1999. CoreLogic predicts that, while rates will continue to stay low, the string of natural disasters that have hit states like North Carolina and California may cause spikes of delinquencies in the affected areas in the months to come.

“Delinquency rates are at 14-year lows, reflecting a decade of tight underwriting standards, the benefits of prolonged low interest rates and the improved balance sheets of many households across the country,” said Frank Martell, president and CEO of CoreLogic, in a press statement.

Source: click here