We’ll add more market news briefs throughout the day. Check back to read the latest.

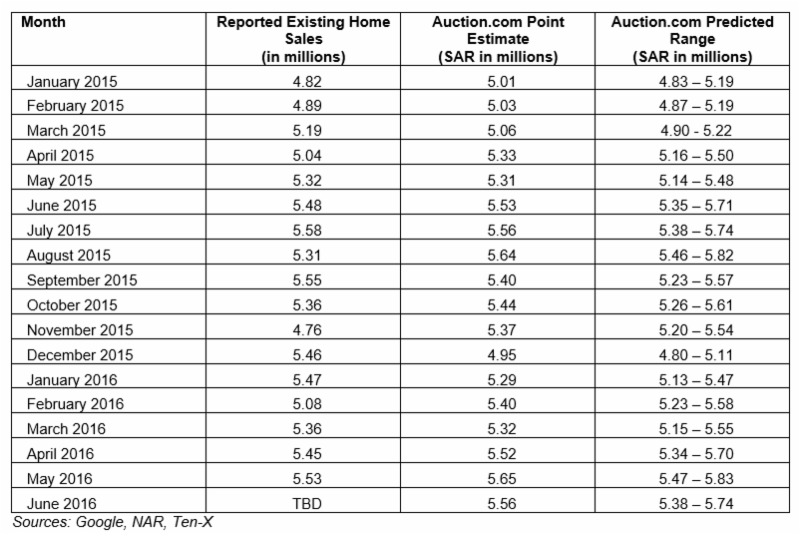

Ten-X Residential Real Estate Nowcast for June 2016:

Existing home sales will fall between seasonally adjusted annual rates of 5.38 and 5.74 million, with a targeted number of 5.56 million. This is a slight 0.5 percent increase from May. It also indicates a 1.4 percent year-over-year gain.

Home equity rates: Average Home Equity Loan Bank Rates by State | Credio Average Home Equity Loan Credit Union Rates by State | Credio Most recent market news:

HSH.com’s ‘Mortgage Rates Radar’:

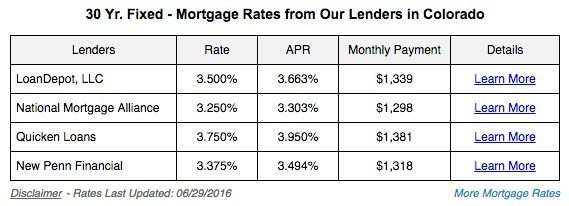

The average rate for conforming 30-year fixed-rate mortgages rose by one basis point (0.01 percent) week-over-week to 3.61 percent. The average rate for conforming 5/1-year adjustable-rate mortgage rose by one basis point (0.01 percent) week-over-week to 2.85 percent.

Freddie Mac’s Multi-Indicator Market Index (MiMi):

The national MiMi value stands at 84.1. This is up 0.27 percent from March to April. On a year-over-year basis, the national MiMi value has improved 7.37 percent. <a href=’http://www.freddiemac.com/mimi/’><img alt=’National ‘ src=’http://public.tableau.com/static/images/Mi/MiMiVisuals100Scale/National/1_rss.png’ style=’border: none’ /></a>Mortgage Bankers Association’s Weekly Applications Survey:

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 3 percent compared with the previous week. The refinance share of mortgage activity increased to 58.1 percent of total applications from 57.7 percent the previous week.Federal Housing Finance Agency’s mortgage interest rates for May 2016:

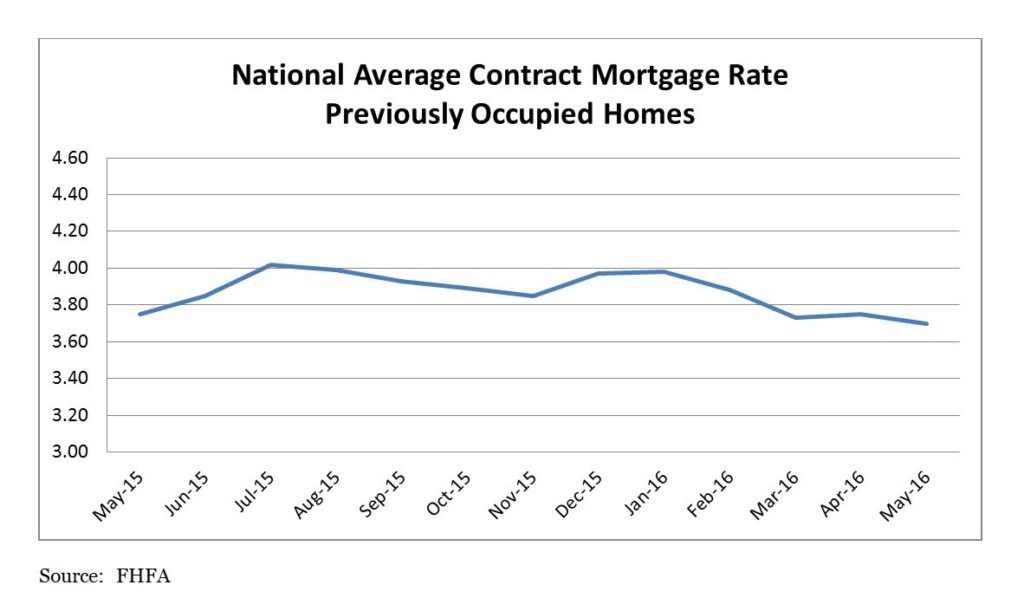

The index for the national average contract mortgage rate for previously occupied homes by combined lenders was 3.70 percent for loans closed in late May, down 5 basis points from 3.75 percent in April. The average interest rate on conventional, 30-year, fixed-rate mortgages of $417,000 or less was 3.89 percent, down 5 basis points from 3.94 in April. The average loan amount for all loans was $329,500 in May, up $7,100 from $322,400 in April.

National Average Contract Mortgage Rate for Previously Occupied Homes May 2015 – May 2016

Email market reports to press@inman.com.

Source: click here