The Consumer Financial Protection Bureau (CFPB) has ended its investigation into whether the Zillow Group violated the Real Estate Settlement Procedures Act (RESPA) and Section 1036 of the Consumer Financial Protection Act with its co-marketing program for agents and lenders, according to a form Zillow filed with the Securities and Exchange Commission (SEC).

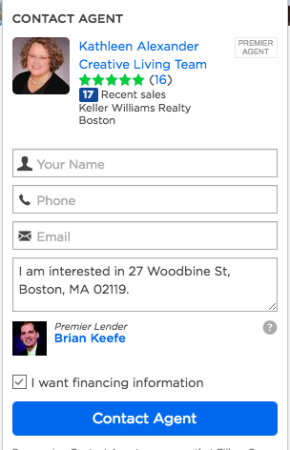

The co-marketing program allows Zillow Premier Agents to invite lenders to share advertising costs and appear alongside them as “Premier Lenders.” That arrangement could have exposed agents to legal liability if regulators found that agents were not paying their fair share of the advertising spend. CFPB was considering whether this setup violated the anti-kickback provision of RESPA and the section of the Consumer Financial Protection Act that prohibits anyone from helping financial service providers deceive customers.

A Zillow co-marketing ad. Credit: Screenshot/Zillow

An office within CFPB notified Zillow it was considering whether to recommend legal action in February 2017. The bureau and Zillow spent the past several months going back and forth to reach a settlement. The CFPB told Zillow on Friday that the investigation was complete and that the bureau did not intend to take enforcement action.

“We are pleased the CFPB has concluded their inquiry into our co-marketing program,” Zillow said in a statement. “As we have said before, it is long-standing practice for agents and lenders to advertise together, and we are glad they can continue to do so through Zillow Group’s advertising platform. Our mission has always been to arm consumers with information that helps them make smarter financial decisions, which this program does by providing consumers with an easy way to connect with agents and lenders.”

Zillow likely benefited from the switch from the Obama to the Trump administration in this case, according to litigation analyst Thomas Claps of Susquehanna Financial Group. Obama-appointed CFPB director Richard Cordray, who oversaw the CFPB’s first interest in Zillow’s co-marketing program, resigned in November 2017 and was replaced by Trump appointee Mick Mulvaney, who has criticized Cordray’s decisions as director and pushed for legal action only to be taken “reluctantly,” Claps said.

How to rope in more seller leads with Mega Agent Pro

Outsource seller prospecting and focus on what you do best READ MORE

How to rope in more seller leads with Mega Agent Pro

Outsource seller prospecting and focus on what you do best READ MORE

“Today’s news will lift the overhang stemming from the CFPB investigation, which had been pending for the past three years,” Claps said. “If the CFPB had filed its lawsuit, it would have sought monetary fines and significant changes to Zillow’s Co-Marketing program.”

The CFPB didn’t immediately respond to a request for comment from Inman.

Zillow also faces an ongoing shareholder lawsuit over this situation. A shareholder filed a lawsuit in August 2017 alleging that Zillow defrauded investors by misrepresenting its co-marketing program’s compliance with regulations, artificially inflating its stock price. A month later, another investor filed a similar lawsuit. A federal court consolidated the cases in January.

Inman Deputy Editor Andrea V. Brambila contributed reporting.

Source: click here