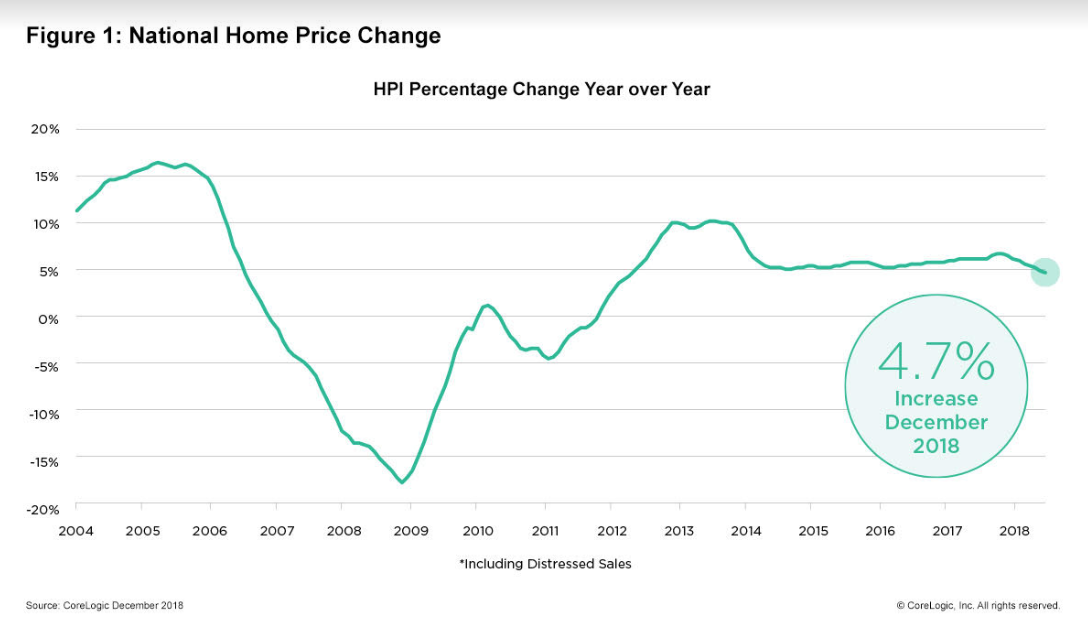

In December, home prices grew at their slowest pace since 2012, according to a CoreLogic Home Price Index and Forecast report released Tuesday.

Nationwide, home prices only increased by 4.7 percent year-over-year and 0.1 percent month-over-month in December, a stark drop from the yearly average of 5.8 percent and a signal that a buyer’s market may be approaching.

While home values have continued to rise upward unabated since 2012, a turnaround may be close at hand. CoreLogic predicts that home values will only grow by 3.4 percent in 2019. (In March, home prices peaked at 7 percent growth.)

CoreLogic

The gradual slowdown can be attributed to over-saturation. Indeed, 40 percent of the country’s largest cities have overvalued markets in which incomes are not rising as fast as home prices. According to Zillow’s estimates, the median single-family home in the US now goes for $275,000.

“Higher mortgage rates slowed home sales and price growth during the second half of 2018,” said Dr. Frank Nothaft, chief economist for CoreLogic, in a prepared statement. “Annual price growth peaked in March and averaged 6.4 percent during the first six months of the year.”

Design trends: how texture transforms a home

The latest surface design trends influencing buyer decisions READ MORE

Design trends: how texture transforms a home

The latest surface design trends influencing buyer decisions READ MORE

CoreLogic

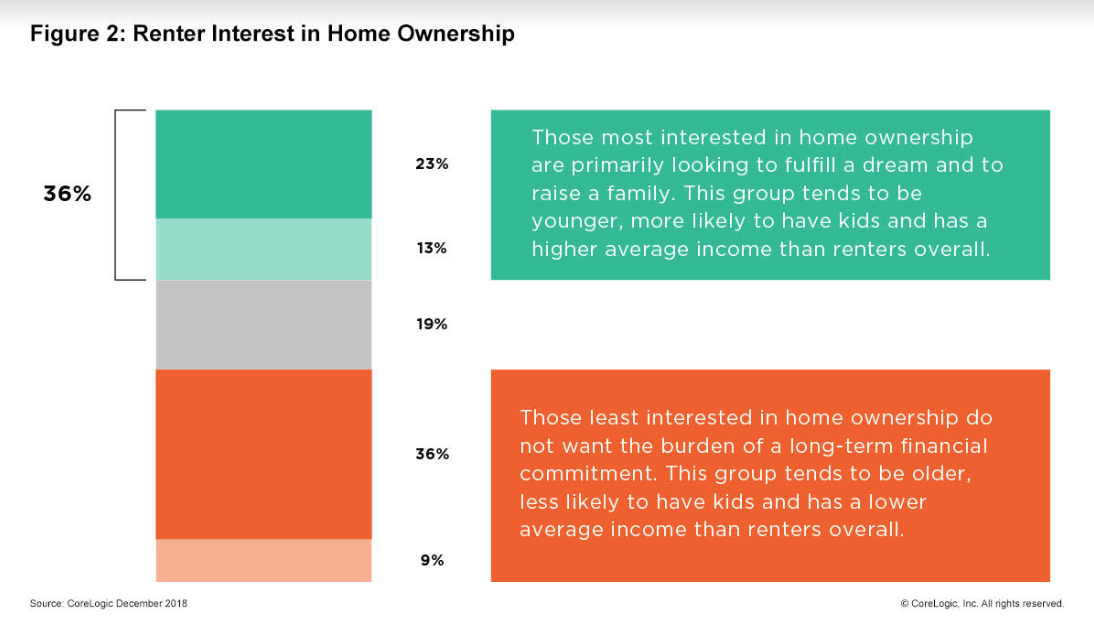

As a result, rising prices have put homeownership out of reach for many first-time buyers, prompting many to wait for the peak so prices come down and allow them to make a down payment. Still, many experts argue that change will be gradual and may not lead widespread affordability.

“The slowdown in the rate of home price appreciation reflects the impact of inventory shortages and growing affordability issues in many markets,” said CoreLogic CEO Frank Martell in a statement. “On the positive side, if home-price growth continues to moderate, interest rates remain stable and household incomes rise in 2019, it could help renters and first-time buyers take the plunge and realize the dream of owning a home.”

Source: click here