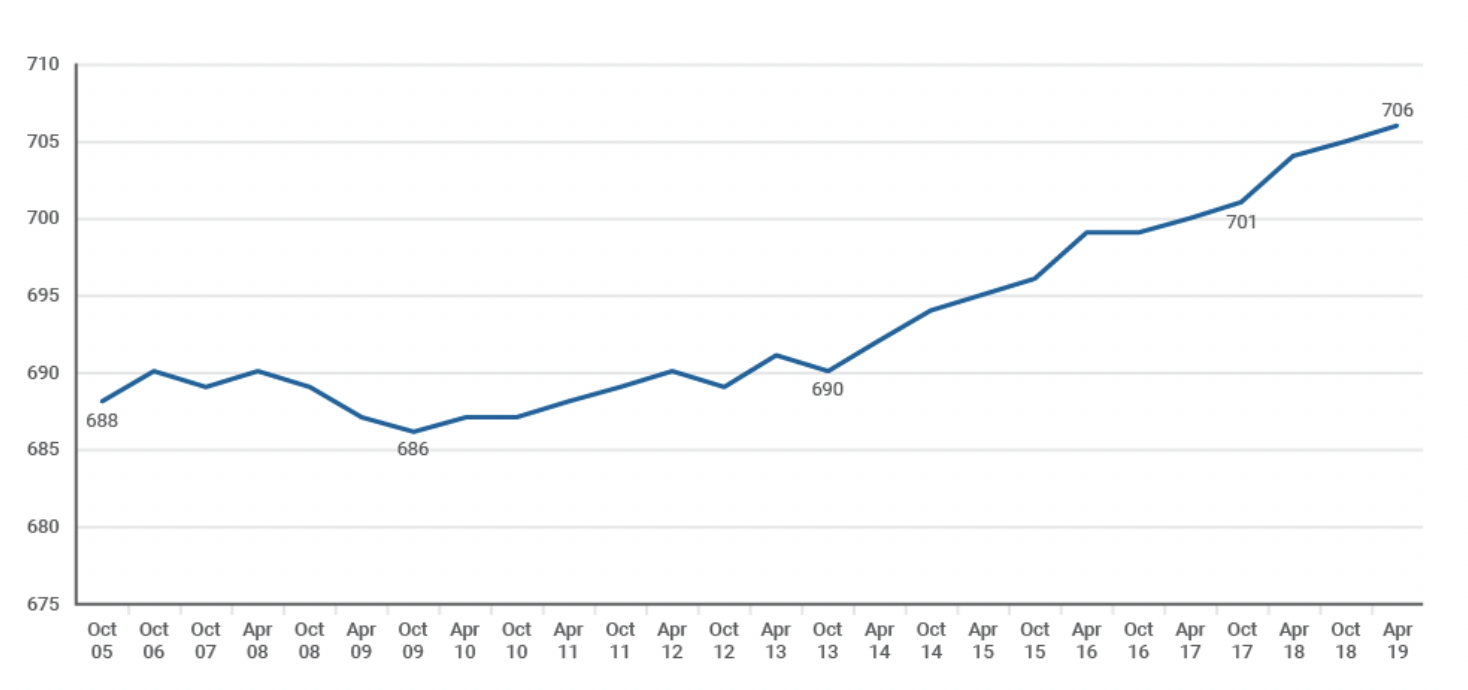

After years of steadily rising, the average FICO score in the U.S. has hit an all-time high of 706, the credit-reporting company announced this week.

In a blog post Tuesday, FICO vice president for scores and analytics Ethan Dornhelm wrote that “there have been nine consecutive years of increases in the national average FICO Score” to bring this year’s average to 706. Average scores had previously bottomed out a decade ago, in October 2009, during the housing and financial crisis. At that time, the average score fell all the way to 686.

But scores have rebounded since then and last year hit an average of 704 — a record at the time that has now been bested by this year’s figure.

Average FICO scores over the past decade and a half | Credit: FICO

FICO, originally an acronym that stood for Fair Issac Company, introduced its credit scores in 1989. The scores are a three-digit number meant to help lenders determine how much risk a potential borrower represents.

They are one of the main credit scores that regularly come up when someone wants to get, for example, a home loan. Better scores generally translate to more favorable lending conditions, such as lower interest rates.

Agent tool fatigue is real. And it’s our fault.

5 ways to turn digital transformation into a success—not a scourge READ MORE

Agent tool fatigue is real. And it’s our fault.

5 ways to turn digital transformation into a success—not a scourge READ MORE

According to FICO, lenders typically see any score above 670 “as indicating good creditworthiness.” Scores between 740 and 799 are considered “very good,” and a score above 800 is viewed as “exceptional.”

The lowest possible score is 300, and anything below 580 is considered “poor.”

Ethan Dornhelm

Dornhelm attributed the new high average scores to “increased consumer awareness around FICO Scores and credit education.” He also said that consumers have managed to purge from their files negative credit information that they accumulated during the recession, thus boosting their scores.

Dornhelm also pointed to a sustained period of economic growth that has helped improve consumers’ credit.

“The key driver of this trend,” he explained, “is the improved consumer financial health that has resulted from the steady economic growth that the U.S. has experienced since the Great Recession.”

Going forward, average scores will continue to change, and Dornhelm points in his blog post to trade talks with China, Brexit and interest rates as factors that “loom large as concerns of a recession persist.” And though he doesn’t explicitly say that the average will drop in the future, there certainly seem to be hints to that effect on the horizon.

“Recent origination vintages,” Dornhelm wrote, “have started to display modest increases in defaults.”

Source: click here