Housing affordability experienced improvement nationwide after months of struggling, according to the National Association of Realtors’ Housing Affordability Index released Thursday.

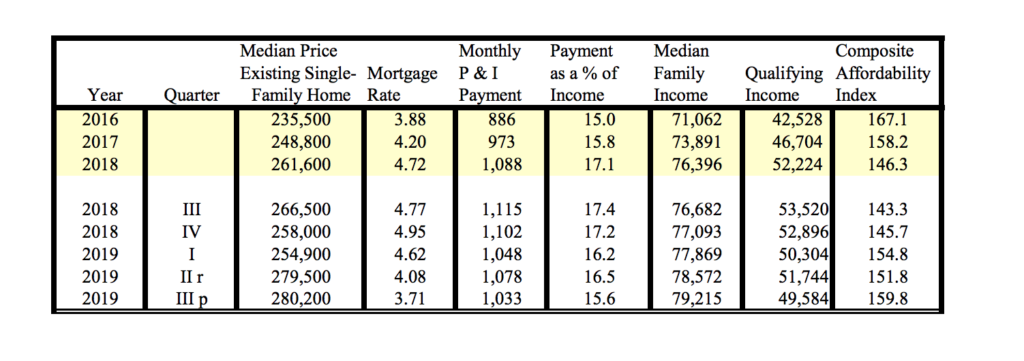

In the third quarter, the median price of a single-family home in the United States rose to $280,200 from $279,500. Nonetheless, mortgage rates fell from 4.08 percent to 3.71 percent while the percentage of a household income required for a mortgage fell from 16.5 percent to 15.6 percent. Median family income rose from $78,572 to $79,215.

The index, which first launched in 1970, utilizes a combination of median home prices, median family incomes and average mortgage interest rates to determine housing affordability. Based on NAR’s calculations, the affordability index clocked in at 159.8 points — 8 points higher than the previous quarter but lower than 167.1 points in 2016.

As a result, homebuyers can earn slightly less while still being able to afford a median-priced home. In the previous quarter, homebuyers needed to make at least $51,744 to afford a down payment and mortgage payments. In the third quarter, that number decreased to $49,584.

According to the NAR analysis, it remains unclear if the affordability uptick will last. While low mortgage rates and a strong economy are helping more people make the leap to homeownership, increased competition and limited inventory are also driving prices up.

Stick the landing: the right way to rebrand

The road to rebrand goes through Plainfield, Ill. READ MORE

Stick the landing: the right way to rebrand

The road to rebrand goes through Plainfield, Ill. READ MORE

Source: click here