Economic data last week convinced the market that the Fed will trim rates at its meeting this week. With the previous week’s less-than-stellar employment report, the annual re-benchmarking of the data trimmed over 900K jobs from the April 2024-March 2025 period. While the economy appears to be humming along healthily, further softening in the labor market is not what the Fed wants to see. On the flip side, inflation is not cooling. The PPI and CPI core readings stepped higher, with the annualized core CPI reading moving upward to 3.1%, well out of the Fed’s target range.

This week, Retail Sales and Industrial Production are due, along with a Fed meeting with the Summary of Economic Projections released. The economic data may move rates slightly, but all eyes are on the Fed. The market would be confounded if the Fed does not move rates and focuses on inflation. This would lead to higher mortgage rates quickly. However, if the Fed cuts rates, focus will shift to the Fed SEP. The more rate cuts predicted, the further mortgage rates are likely to fall.

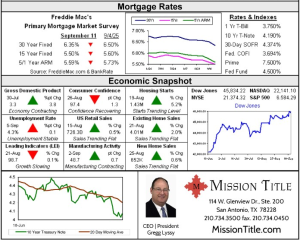

Mortgage Rates and Economic Snapshot

Mortgage Rates and Economic Snapshot