Even as home delinquency rates hit record lows nationwide, some parts of Florida and Washington state saw a spike in the number of foreclosure starts in April.

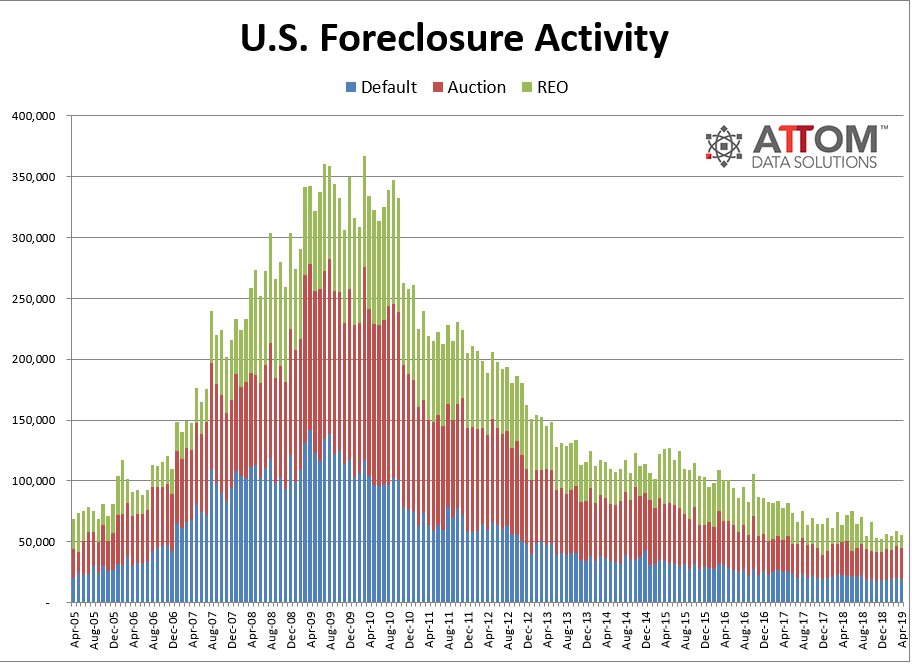

Across the country, the number of foreclosure filings fell to 55,646 properties from 58,550 properties last month, according the latest report from Attom Data Solutions, released on Thursday. This number, which includes default notices, scheduled auctions and bank repossessions, is down 5 percent from March and 13 percent from the same period last year.

Foreclosure starts, the first step toward the seizure of a home, have also reached 30,524 affected properties, down 5 percent from last month and 10 percent year over year.

“While overall foreclosure activity is down nationwide, there are still parts of the country that we need to keep a close eye on,” said Todd Teta, chief product officer at Attom Data Solutions, in a prepared statement. “For instance, Florida is seeing a steady annual increase in total foreclosure activity for the 8th consecutive month, which is being sustained by a constant annual double-digit increase in foreclosure starts.”

Courtesy of Attom Data Solutions.

That said, some parts of the country have seen a spike in the number of foreclosure starts. A total of 17 states, including Washington, Florida and Oregon, saw starts grow over the past year. Florida, in particular, saw some of the largest increases in foreclosure starts in individual cities, with 90 percent annual growth in Orlando and 45 percent annual growth in Miami. Overall, Washington saw a starts increase of 38 percent while Florida saw an increase of 34 percent.

Generational wealth: how to become your client’s long-term partner

Building client connections that span family networks READ MORE

Generational wealth: how to become your client’s long-term partner

Building client connections that span family networks READ MORE

When it comes to overall foreclosure rates, New Jersey, Maryland and Delaware experienced the highest growth — at one in every 980 housing units, one in every 1,218 and one in every 1,249, respectively. Nationwide, one in every 2,433 housing units had received a foreclosure filing in April.

But even so, high employment and a strong economy has contributed to a consistent lowering of foreclosure rates over the past six years. Over the past month, lenders completed the foreclosure process on only 11,078 U.S. properties, down 9 percent from last month and 22 percent year-over-year.

Source: click here