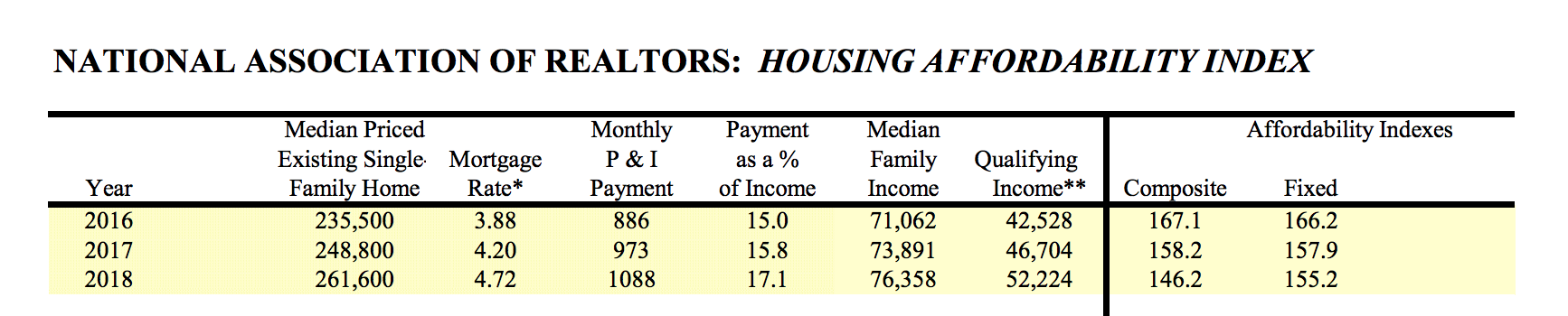

Housing affordability continues to fall, according to the National Association of Realtors’ Housing Affordability Index, released on Tuesday.

Nationwide, the average price of a single-family home fell modestly to $256,400 in December, from $259,900 in November, while rising to $261,600 in 2018, up from $248,800. The adjustment brought the Affordability Index to 147.6 points in December and 155.2 year-over-year, compared to 157.9 in 2017.

The index, which began in 1970, examines housing affordability based not only on median home prices, but also median family incomes and average mortgage interest rates. Median family incomes were the only metric to see modest improvements, according to NAR.

“Housing affordability will be the key to sustained healthy growth in the housing market in the upcoming years,” NAR Chief Economist Lawrence Yun said. “That requires more homebuilding of moderately priced homes.”

The monthly mortgage rate hovered at 4.99 percent (unchanged since November) while the median family income was $77,940 (up from $77,216 in November), according to NAR.

The average family also paid 17.1 percent of its income towards rent or a mortgage in 2018, compared to 15.8 percent in 2017 and 15 percent in 2016.

Why brokerages must own their data

Your website or CRM with an API is not your platform READ MORE

Why brokerages must own their data

Your website or CRM with an API is not your platform READ MORE

NAR.

In 2018, the average U.S. home cost a record-high $261,600. Although incomes rose as well, higher home prices and mortgage rates quelled affordability overall.

To purchase a single-family home at the national median price, a family needs an overall income of $62,954 to make a 5 percent down payment. A 10 percent down payment requires an income of $59,640 while an income of $53,013 is necessary for a 20 percent down payment.

Experts predict that, even as the current streak of fast home value growth reaches its peak, affordability will continue to be a problem for first-time and lower-income homebuyers.

“Housing starts fell far short of historically normal levels, with only 9.6 million new housing units added in the past decade; compared to 15 to 16 million that would have been needed to meet our growing population and 20 million new job additions,” Yun said.

Source: click here