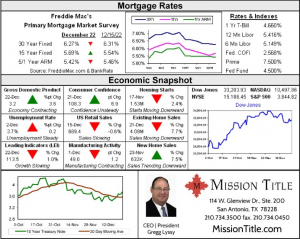

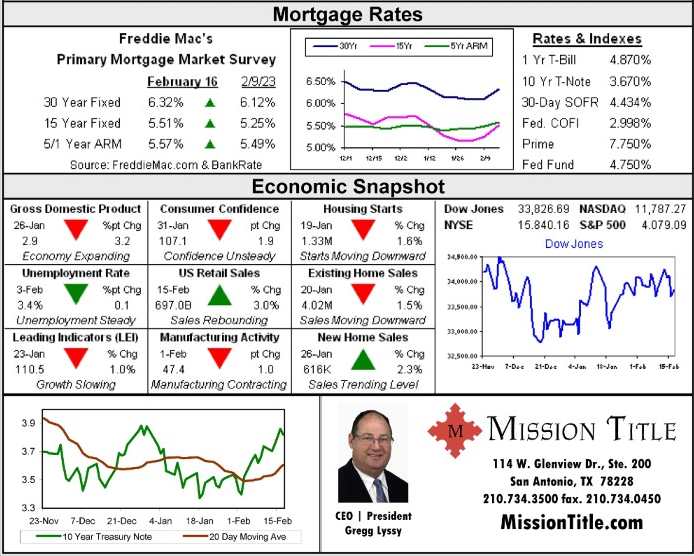

Despite the recent downward trend in mortgage rates and hopes that the Fed was nearing the end of itstightening cycle, rates blasted upward last week. While there are signs that inflation is cooling and theeconomy slowing, the likelihood of the Fed raising rates for longer than expected and keeping them athigher levels before reducing them continues to grow. The core reading of the CPI and PPI came in atexpectations, highlighting that inflation on an annualized basis is slowing. However, inflation is stillrunning at around three times higher than the Fed’s target. Moreover, service-related inflation isrefusing to budge. This amplifies concerns that we could shift into a wage-price spiral, which ishistorically hard to shake. Retail Sales also spiked upward by 3.0% last week, but many analysts willwait for February’s reading before placing significant meaning on January’s.

This week is likely to see rates level or moving upward. If the Fed’s meeting minutes reveal any hintsabout remaining aggressive or becoming more aggressive, rates are likely to move higher.

Mortgage Rates and Economic Snapshot

Mortgage Rates and Economic Snapshot