We’ll add more market news briefs throughout the day. Check back to read the latest.

Most recent market newsThursday, November 16

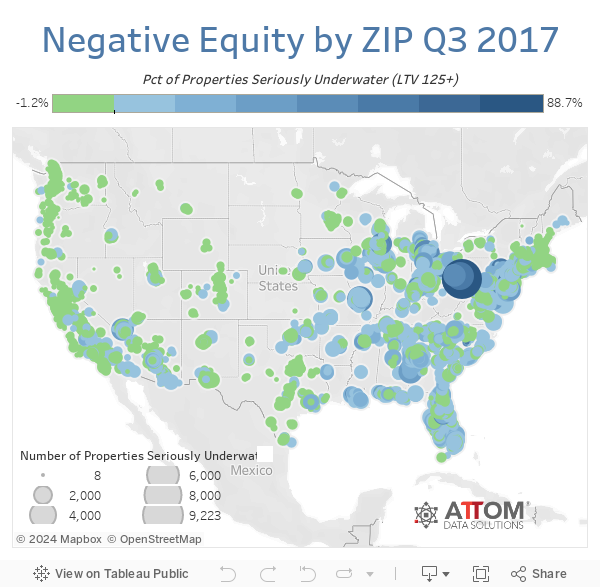

There were 4.6 million (4,628,408) U.S. properties that were seriously underwater at the end of Q3 2017, down by more than 800,000 properties from the previous quarter and down by more than 1.4 million properties from Q3 2016 — the biggest year-over-year drop since Q2 2015. The 4.6 million seriously underwater properties at the end of Q3 2017 represented 8.7 percent of all U.S. properties with a mortgage, down from 9.5 percent in the previous quarter and down from 10.8 percent in Q3 2016. 14 million equity rich U.S. properties represented 26.4 percent of all U.S. properties with a mortgage, up from 24.6 percent in the previous quarter and up from 23.4 percent in Q3 2016. Among 93 metropolitan statistical areas with a population of 500,000 or more, the highest share of equity rich properties were in Hawaii, California, New York, Oregon and Washington. States with the highest share of seriously underwater properties were Louisiana (19.2 percent); Iowa (14.2 percent); Pennsylvania (14.0 percent); Mississippi (13.8 percent); and Alabama (13.7 percent).

var divElement = document.getElementById(‘viz1510870299713’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’600px’;vizElement.style.height=’587px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

“Accelerating home price appreciation this year is increasing the velocity at which seriously underwater homeowners are recovering home equity lost during the Great Recession,” said Daren Blomquist, senior vice president at Attom Data Solutions.

4 tips to raise your real estate business’s online profile

As a real estate professional, you know how important it is to get your name in front of prospective clients. With the modern digital world increasingly mobile, the opportunity to create real impact and grow your business is yours for the taking … READ MORE

4 tips to raise your real estate business’s online profile

As a real estate professional, you know how important it is to get your name in front of prospective clients. With the modern digital world increasingly mobile, the opportunity to create real impact and grow your business is yours for the taking … READ MORE

“Median home prices nationwide are up 9.4 percent so far in 2017, the fastest pace of appreciation through the first three quarters of a year since 2013. Continued home price appreciation is also helping to grow the number of equity rich homeowners across the country compared to a year ago,” he added.

News from earlier this weekTuesday, November 14

Ten-X reports homes sales drop in Phoenix

Single-family home sales in the Phoenix housing market fell 4.3 percent in the second quarter from the same time period one year ago. The Second Quarter 2017 Economic and Single-Family Housing Market Outlook Report for Phoenix found a strong and resilient market diminish slightly as the homeownership rate fell over the past year to 62 percent, below the national average of about 64 percent.

Phoenix Homeownership Rate Falling (PRNewsfoto/Ten-X)

“The Phoenix housing market remains on a path toward recovery, even though both sales and homeownership rates dipped slightly in the second quarter,” said Ten-X Executive Vice President Rick Sharga. “Affordability may start to become an issue, since home prices continue to increase at a rate much higher than the U.S. average, and in many cases, it’s now less expensive for Phoenix residents to rent than to own a home.”

“At the moment, the Phoenix market remains affordable for most buyers thanks to the strong local economy,” Sharga said. “Moving forward, expected increases in new home construction should add to the inventory of homes for sale and help maintain housing affordability in the region.”

Corelogic Loan Performance Insights Report August 2017

The 30 days or more delinquency rate for August 2016 was 5.2 percent. In August 2017, 4.6 percent of mortgages were delinquent by at least 30 days or more including those in foreclosure. This represents a 0.6 percentage point decline in the overall delinquency rate compared with August 2016. As of August 2017, the foreclosure inventory rate was 0.6 percent down from 0.9 percent in August 2016.

Monday, November 13

Home prices boom 10 years after housing crisis: realtor.com

U.S. median home sales price in 2016 was $236,000, 2 percent higher than in 2006. 31 of the 50 largest U.S. metros are back to pre-recession price levels. Austin, TX, has seen the largest price growth in the past decade: 63 percent. It’s followed by Denver, at 54 percent, and Dallas, at 52 percent. Nationwide, realtor.com data show that listing prices have been up by double digits for the majority of 2017.

realtor.com

The biggest change on the housing scene over the past decade is that lending standards are the tightest they’ve been in almost 20 years. The median 2017 home loan FICO score was 734, significantly up from 700 in 2006. The bottom 10 percent of borrowers have an average FICO of 649 in 2017, up from 602 in 2006.“Lending standards are critical to the health of the market,” said realtor.com Chief Economist Danielle Hale. “Unlike today, the boom’s under-regulated lending environment allowed borrowing beyond repayable amounts and atypical mortgage products, which pushed up home prices without the backing of income and equity.”

realtor.com

In October, unemployment hit a 17-year low, at a rate of 4.1 percent. In 30 of the 50 largest U.S. metros, unemployment is less than half of 2010 levels. In September, employment reached 79 percent in the 25-34 age group, back up to 2006 levels and 5 percent higher than 2010. There are 600,000 fewer total housing starts and nearly 700,000 fewer single-family housing starts.“The healthy economy is creating more jobs and households, but not giving these people enough places to live,” Hale said. “Rapid price increases will not last forever. We expect a gradual tapering as buyers are priced out of the market — not a market correction, but an easing of demand and price growth as renting or adding roommates becomes a more affordable alternative.”

realtor.com

Las Vegas; Tucson, AZ; and Riverside, CA — remained more than 20 percent below 2006 price levels at the end of 2016, at 25 percent, 22 percent, and 22 percent, respectively.

realtor.com

Email market reports to press@inman.com.

Source: click here