Being a real estate professional is an exercise in spinning many, many plates. Keeping track of the different components of a property deal is a key skill but having that ability may not save you — or your deal — in the end.

All sorts of wrinkles and unpredictable circumstances can mean that the process of helping someone buy or sell their home ends up more complicated than expected. “I tried to buy a lot once and could not get a clear title because two of the heirs were wanted by the state,” according to a respondent to a recent Inman survey.

While few transactions will need law enforcement involved, many will still potentially have unforeseen issues with title settlement and mortgage loans. But there are ways to account for those circumstances. For agents seeking more reliable partners, affiliated businesses could be the key to unlock more predictable sales transactions.

The idea of convenience and one-stop shopping resonates with consumers, and when agents have access to the expertise and services of varied entities that provide mortgage, relocation, insurance, title and property management services, they can offer a streamlined one-stop experience. A brokerage’s affiliated businesses have the potential to save transactions and provide better service, yet not all agents realize the value they provide them and their clients.

“Our affiliated title company works diligently to make all deals come to fruition. I have had closings at odd times of the day and different places to make the deals work,” says another respondent to Inman’s survey.

“I have had closings at odd times of the day and different places to make the deals work. Our affiliated title company works diligently to make all deals come to fruition.”

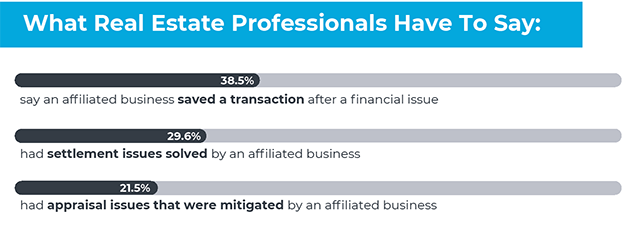

The survey also found that affiliates have improved the real estate broker experience in a number of different ways in terms of when transactions go wrong as well as providing better service.

Almost 60 percent of agents agree: their affiliated partners provide them with better service than non-affiliated companies. It’s also not uncommon that real estate professionals need to deal with these issues. Over half of the respondents told Inman that they’ve had trouble with securing a mortgage for clients. Similarly, 46.2 percent of respondents said they’ve had appraisal issues. Whereas only one in five told Inman they’ve had settlement issues in the past.

But these occurrences are where affiliated businesses shine. According to the results of the survey, 38.5 percent said they’ve had an affiliated business save a transaction after a financial issue. Settlement issues were solved by an affiliated business in 29.6 percent of the survey participants and 21.5 percent reported that an affiliated partner helped solve issues during the appraisal process.

That’s why brokerages like Long & Foster see the value in these affiliated partners and seek to bring that value to the real estate agent. As part of the number one real estate firm in the United States, Long & Foster has exemplified the need for customer focus in the real estate industry since 1968.

Operating 220 offices across the mid-Atlantic and Northeast, Long & Foster is home to more than 11,000 agents who have seen real benefits from the integration of affiliated businesses. Founders Wes Foster and Hank Long pioneered the concept of the one-stop-shop brokerage in the early 1970s. But the brokerage hasn’t stopped at providing just mortgage or settlement services. Long & Foster became part-owner of MoxiWorks a real estate tech company in 2015, acquiring Urban Pace a new home sales and marketing firm in 2016, as well as dozens of brokerages of all sizes.

In 2017, a year before Long & Foster’s 50th anniversary, HomeServices of America, an affiliate company of Warren Buffett’s Berkshire Hathaway, acquired the Long & Foster Companies. The company sought to maintain its ‘agents first’ philosophy to offer only the best in support for its partner brokers.

At the root of that philosophy is the idea of trust. Building relationships and trust between agents and clients, as well as agents and their brokerage, is the secret behind the success of Long & Foster. Having these resources available means that one of the most important sales transactions in an individual’s life is predictable and smooth. Leveraging that predictability, organizing all the external factors, and bringing them all under one roof can cut a lot of the stress out of the process.

An agent’s firsthand experience

“For us as agents, having the [affiliated businesses] go the extra mile, we meet the deadlines and the clients’ needs,” said Juan Umanzor, Jr., a real estate agent with Long & Foster based out of Bethesda, Maryland. “Should anything go wrong, we know that they’re gonna fix anything. Because it’s us. We want to protect our brand, and we want to protect the consumer as well.”

Juan Umanzor, Jr., Long & Foster Agent

Umanzor has seen the issues with closing sales in the past— like home buyers not qualifying for a loan due to high estimate ratios just a few days before closing. In these and similar cases, his affiliated insurance company has been able to find a solution for both agent and homebuyer. “We worked things out in a way that the customer was able to get cheaper insurance with necessary coverage, and that saved the deal,” he said.

According to Umanzor, his customers feel comfortable when they know that there’s only one point of contact they need to worry about. With the agent or broker taking on the coordination of all the various services, they keep things simple for the home buying experience. Like many real estate professionals today, Umanzor sees the fruits of these partnerships in the reviews of his service found online.

“The advantage is definitely having a circle of people that you trust that they’re going to do a great job for the client. It just makes everything easier,” says Umanzor.

“We worked things out in a way that the customer was able to get cheaper insurance with necessary coverage, and that saved the deal.”

Of course, all of his clients still have the option to look for outside partners. Umanzor said he would never dictate or limit what mortgage, insurance or title services his clients can use, but a close relationship with his affiliated partners has provided dividends in the past. He’s leveraged the competition between the affiliated partner and outside business to get a better deal for the client in the end. “Because what [affiliated businesses do] is, at the end of the day, it makes the consumer realize that they’re getting the best,” he says. “The ones who are going to win are the consumers.”

Someone’s most important purchase needs special attention

Branch Manager and legal counsel with RGS Title Gina Parello can say she has seen the difference that working with an all-in-one broker can make. “The Long & Foster agent can offer their clients more services to make the entire transaction very seamless,” she says.

Gina Parello, Branch Manager & Legal Counsel, RGS Title

An example of issues where a known affiliated company can help is jurisdictional problems. If an out-of-state company doesn’t understand local regulatory idiosyncrasies like specific deadlines, there can be real consequences for the home buyer. “If we’re working with an out of state lender and they don’t get the settlement documents to us, you can have a buyer who has all their stuff on a moving truck and nowhere to live,” says Parello.

The difference is that agents with the backing of an all-in-one brokerage, according to Parello, they’ve got the training and know how to solve these highly situational problems. “They’re trained to work with each other and know what each other’s processes are with the state laws so that we don’t have any hiccups,” she says.

As well, the longevity of Long & Foster and their presence on the market makes them predictable in potentially very fraught situations, says Parello. She reiterated that customers have all sorts of varied options for supporting firms to guide them during this very significant transaction. But customers can learn a hard lesson: they get what they pay for.

“The best way to present issues is working with a reputable company that knows what they’re doing.”

“I believe people work with individuals based on reputation or who they know. And sometimes they may say ‘I’m going to use my friend or my relative,’ or ‘I’m going to use some kind of discount brokerage firm,’” says Parello. “What they don’t realize is that in the end, they’re going to pay for it because you’re spending more time or something may not go as they had planned.”

Parello also points to the ethical standards and integrity of Long & Foster real estate agents, but also that they’re equipped to deal with the realities of today’s real estate business. The role that affiliated companies can play is important because of how unpredictable some of the purchasing process can be.

“Unfortunately, in the real estate business, you don’t know—until we get closer to the to the closing date—that things are falling apart,” she says. “The best way to present issues is working with a reputable company that knows what they’re doing.”

Mortgage companies see a clear benefit

To Tim Wilson, a key to his company’s success is the fundamental understanding that all situations are different and each deserve special attention. According to Wilson, who is the President and CEO of Prosperity Home Mortgage, a Berkshire Hathaway-affiliated mortgage banker, situational sales is something that’s trained in the company from the very first day. “Our goal is to meet the customer where they want to be met,” he says.

Tim Wilson, President & CEO, Prosperity Home Mortgage

He tells Inman that consumers get a clear advantage when agents serve as that single point of contact for mortgage, insurance, title or appraisal. “If [clients] have a question on title or insurance or mortgage, they know the agent can give us a call because we’re an employee of the company,” says Wilson.

The close partnership between Prosperity and Long & Foster means that keeps the process stakeholders accountable. “We’re in their office every day,” says Wilson. “If something goes wrong, we can’t not see them.”

But other benefits emerge as well. The system integration between the two companies means that Prosperity can offer innovative products like digital portals and a fast, affordable pre-approval process. The appraisal management group can help transactions move forward because of their unique property expertise.

“If [clients] have a question on title or insurance or mortgage, they know the agent can give us a call because we’re an employee of the company. We’re in their office every day. If something goes wrong, we can’t not see them.”

“We have programs where we guarantee that we’ll meet or beat their rate,” says Wilson. “So there’s a number of tools that we use to help the agent convince the customer to at least sit down with us, and it’s worth the customer’s time.”

Wilson understands that the stakes are higher for affiliated organizations as agents expect only top notch service.

“When they use us, we have to be better than everybody else as their expectations are higher when they’re using an affiliate company—as they should be,” says Wilson. “And so we deliver. We deliver consistently because [agents] know we have to.”

Rejecting the argument that agents may feel pressured to use in-house lenders, Wilson wants agents to use Prosperity because they are offering the best value. Prosperity can’t feel entitled to any business in the competitive industry.

“We consider that we have two customers on every transaction, the borrower and the agent. And it’s our jobs make an agent look great. And that’s what we do,” says Wilson.

The future is bright for the role of affiliated businesses in the real estate transaction

Beyond the traditional services each transaction needs, new and innovative products are emerging from unique startups as the real estate tech industry grows. It’s Long & Foster’s priority to provide its agents with technology that simplifies their lives – whether that’s making it easier to process a transaction or market themselves to grow their business.

To do this, they’ve introduced services like AgentIcon that creates branded social media content almost instantly or providing a marketing program like MoxiCampaigns from MoxiWorks, which makes it easy for agents to stay in touch with their sphere of clients.

These affiliated business provide built-in advantages and underscore the benefits of working with them. There’s no better option for more predictable sales transactions than the simplicity of these trusted relationships.

To find out more about the advantages of an all-in-one brokerage visit longandfoster.com.

Disclaimer: This is a paid research report, produced by Inman Group, LLC, for Long & Foster Real Estate. Information contained herein should not be read as an endorsement of Long & Foster Real Estate or any of its affiliates. Long & Foster Real Estate does not assume responsibility for the reliability or accuracy of any materials produced by third-party providers.

Source: click here