The saying goes that you have to see something to believe it — well, homeowners all over the country are seeing home prices skyrocket and believe that their home, too, should be worth more than they paid for it.

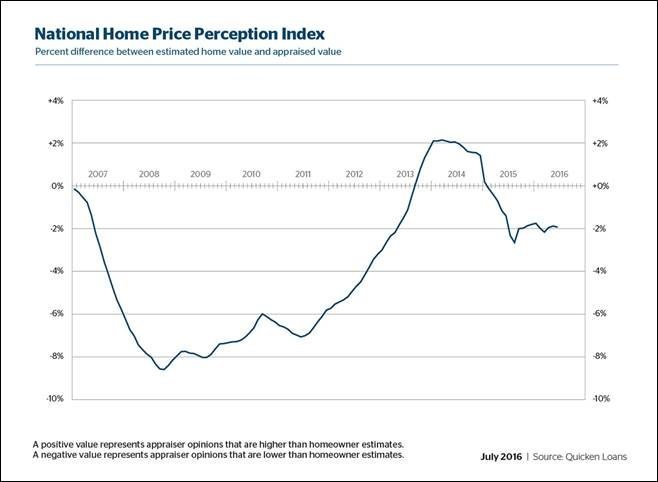

According to the latest Quicken Loans Home Price Perception Index (HPPI), those perceptions are off by about 2 percent.

In June, appraisers valued homes at 1.93 percent lower than what homeowners expected. This is a wider gap between appraiser and homeowner opinion than in May, when the difference was 1.89 percent.

“Perception is everything. It can make or break a home sale or mortgage refinance,” said Quicken Loans Chief Economist Bob Walters in a press release. “That’s why it’s so important for homeowners to realize how they perceive their home’s value could vary widely from how an appraiser views it.

“If the estimate is lower by just a few percentage points, the buyer could need to bring as much as another several thousand dollars to the table to avoid having to restructure the loan.”

Despite the difference in homeowner expectations versus appraisal reality, home valuations overall grew 0.84 percent from May. That may seem marginal, but incremental increases make a difference — with valuations experiencing a 4.47 percent increase year-over-year.

This trend was also reflected regionally; all four quadrants of the nation showed small monthly gains with more significant growth compared to June 2015 — with the West holding the lead at 5.84 percent year-over-year growth in appraised value. The Northeast, in comparison, recorded modest annual growth of 2.07 percent.

In June, appraisers valued homes at 1.93 percent lower than what homeowners expected.Still, home value perceptions fluctuate greatly among the nation’s cities. For example, homeowners in Denver actually underestimate the value of their property by as much as 3 percent, whereas those in Baltimore, Detroit and Philadelphia tend to overvalue their homes by more than 3 percent on average.

“Nationally, home value increases are well within the healthy range,” Walters added. “Although, the variances across the country can influence owners’ perception. Owners in the West, where appraised values are rising more quickly, tend to underestimate their home’s value. The opposite is true for those in the Northeast, with appraised values showing slower growth.

The Quicken Loans Home Price Index and Home Price Perception Index measures the difference between appraisers’ values and homeowners’ opinions of home values. It compares estimates on homeowner-supplied refinance mortgage applications to the appraisal later performed. The national composite is determined analyzing appraisal and homeowner estimates throughout the country. Quicken’s Home Value Index is based solely on appraisal data from home purchases and mortgage refinances.

Like me on Facebook! | Follow me on Twitter!

Source: click here