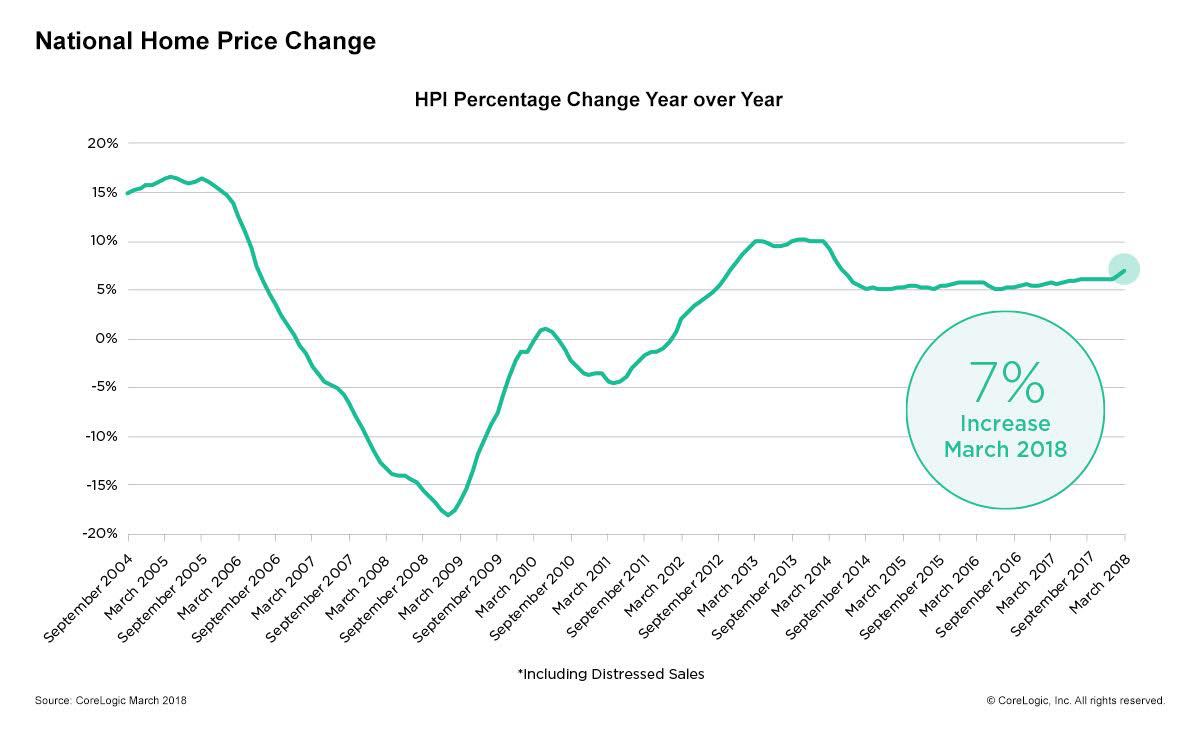

CoreLogic released its March Home Price Index and Forecast today, which showed a 7 percent year-over-year and 1.4 percent month-over-month increase in home prices.

“Home prices grew briskly in the first quarter of 2018,” said CoreLogic Chief Economist Dr. Frank Nothaft in a statement. “High demand and limited supply have pushed home prices above where they were in early 2006. New construction still lags historically normal levels, keeping upward pressure on prices.”

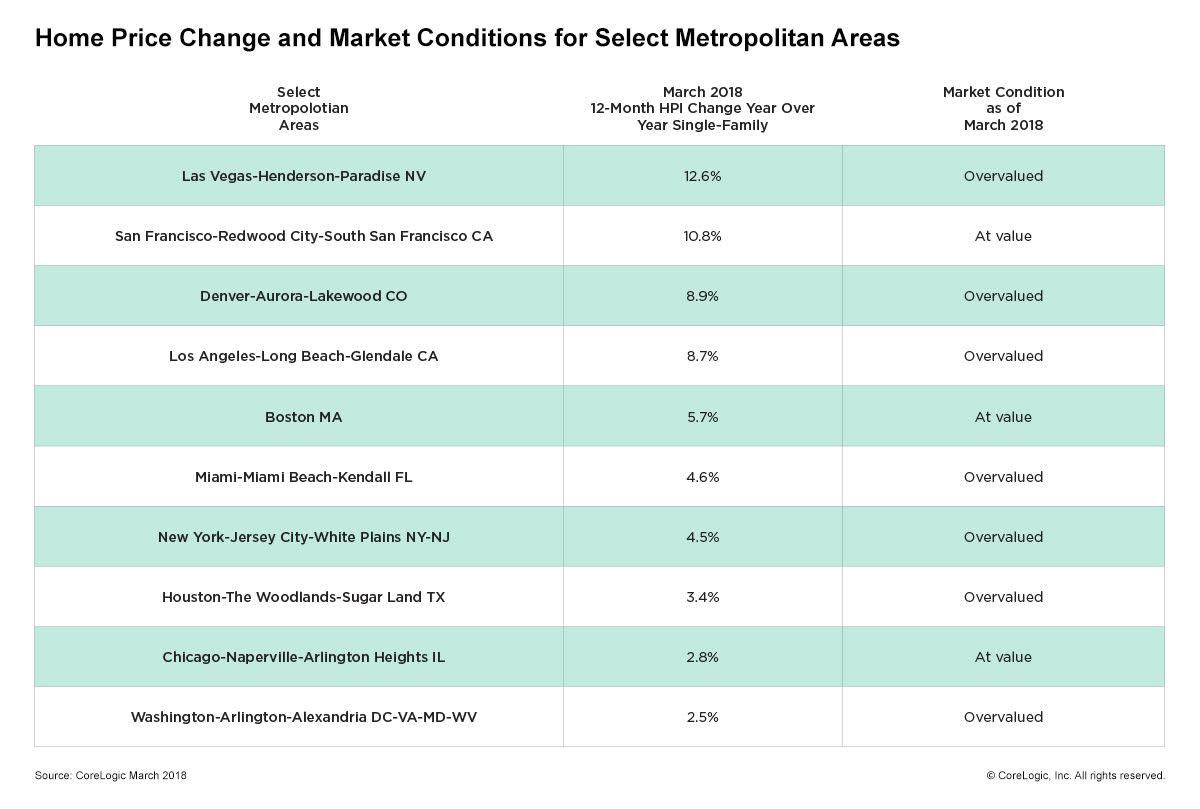

All 50 states experienced year-over-year price growth with Nevada (12.6 percent), Washington (12.6 percent), Idaho (12.3 percent) and Utah (11.6 percent) leading the way.

On the metro level, 37 percent of the nation’s 100 largest metropolitan markets are overvalued, 35 percent are at value and 28 percent are undervalued. When looking at the nation’s 50 largest metropolitan markets, half are overvalued, 36 percent are at value and only 14 percent are undervalued.

“The dream of homeownership continues to fade away for the average prospective buyer. Lower-priced homes are appreciating much faster than higher-priced properties, making the affordability crisis progressively worse,” said CoreLogic President and CEO Frank Martell of March’s report.

Turn your time into money

3 time management activities to book more appointments READ MORE

Turn your time into money

3 time management activities to book more appointments READ MORE

“CoreLogic’s Market Condition Indicators now indicate that half of the top 50 markets in the country are overvalued because home prices in those areas have risen so much faster than incomes,” he added. “This is clearly an unsustainable condition that can only be remedied by aggressive and coordinated public/private sector actions.”

Looking forward, CoreLogic expects home prices to ascend 5.2 percent by March 2019 and 0.1 percent by this April.

About the reportThe CoreLogic HPI is built on industry-leading public record, servicing and securities real-estate databases and incorporates more than 40 years of repeat-sales transactions for analyzing home price trends.

Generally released on the first Tuesday of each month with an average five-week lag, the CoreLogic HPI is designed to provide an early indication of home price trends by market segment and for the “Single-Family Combined” tier representing the most comprehensive set of properties, including all sales for single-family attached and single-family detached properties.

Source: click here