Reposted with permission from Mike DelPrete.

In the past year, two of the U.S.’s leading portals, Zillow and Redfin, have launched iBuyer businesses.

Zillow’s entry was in part a response to an existential threat to its business model, and much of the value it might derive is not from buying and selling houses at all, but rather by generating valuable seller leads (watch my video presentation from Inman Connect Las Vegas). Which begs the question: How serious is Zillow about being an iBuyer?

Opendoor’s 3x advantageThe best way to compare seriousness is actual market traction and purchase volumes — putting your money where your mouth is.

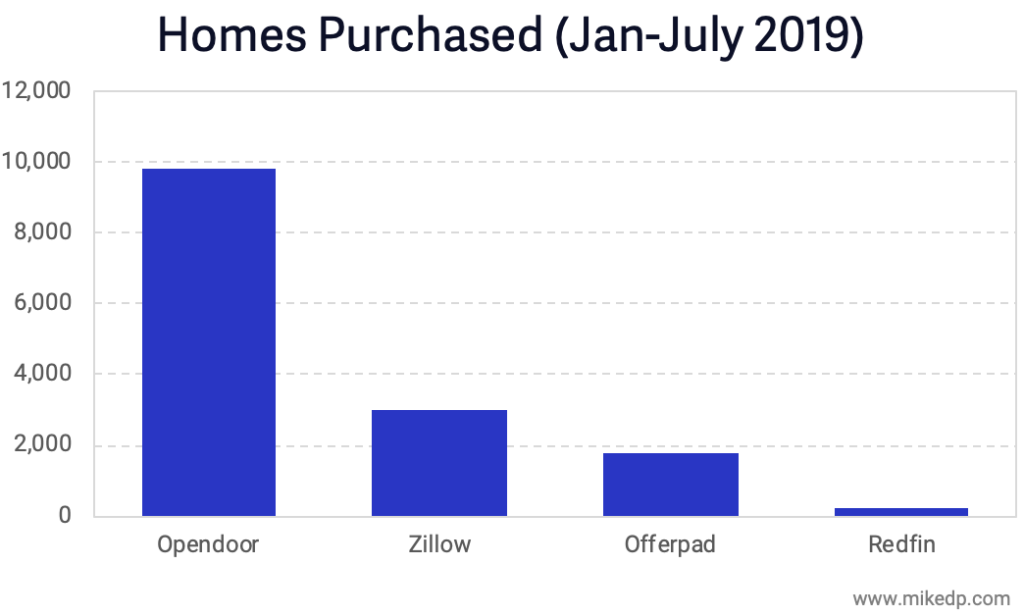

In the first seven months of 2019, Opendoor continues to be the clear leader in the iBuyer space as measured by home purchase volume. Opendoor has purchased nearly 10,000 homes, around three times the volume of Zillow.

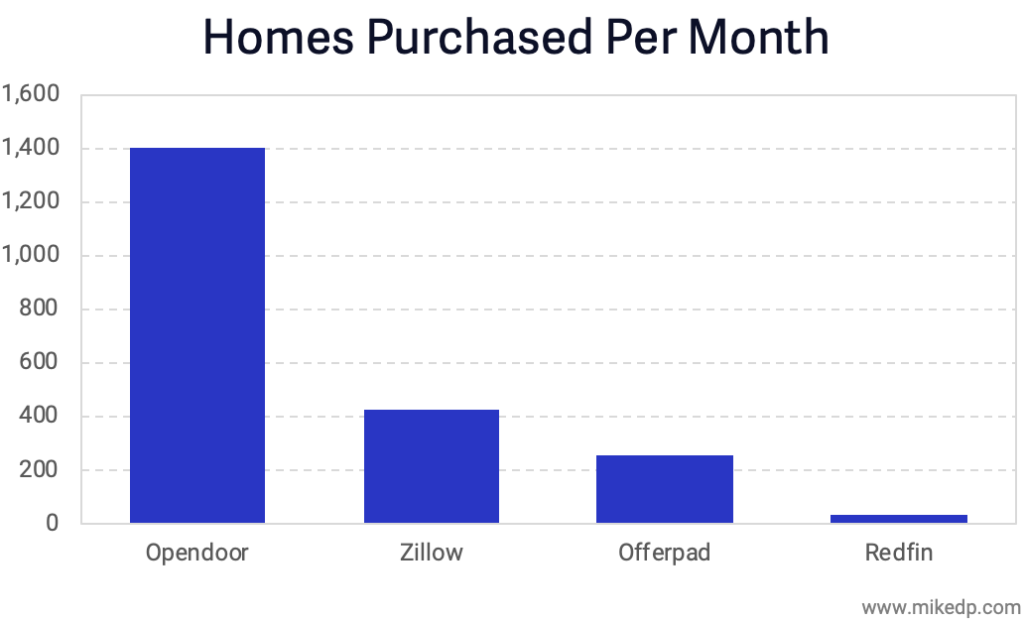

On average, Opendoor is purchasing around 1,400 homes per month (as an aside, a recent Opendoor commercial stated the company buys a home every 34 minutes — or around 1,300 per month).

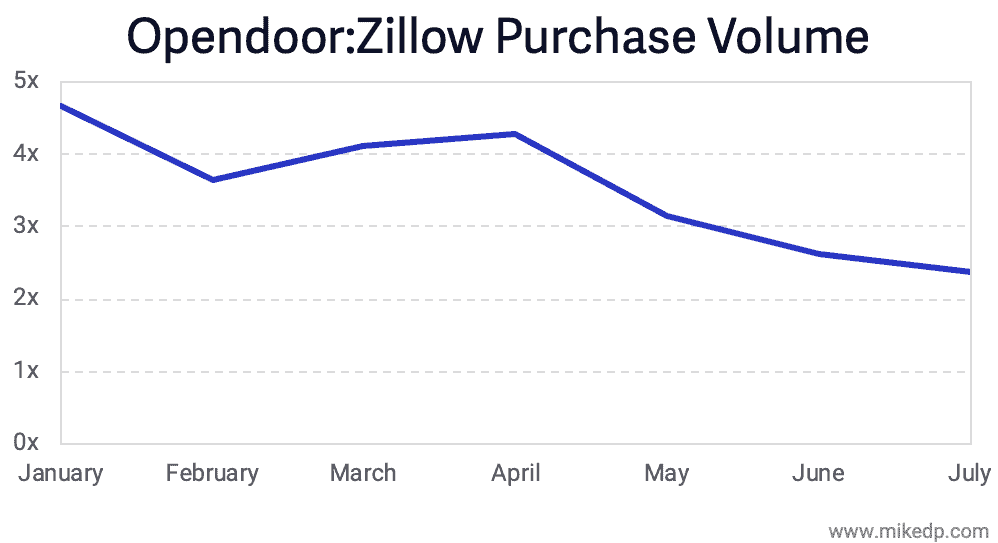

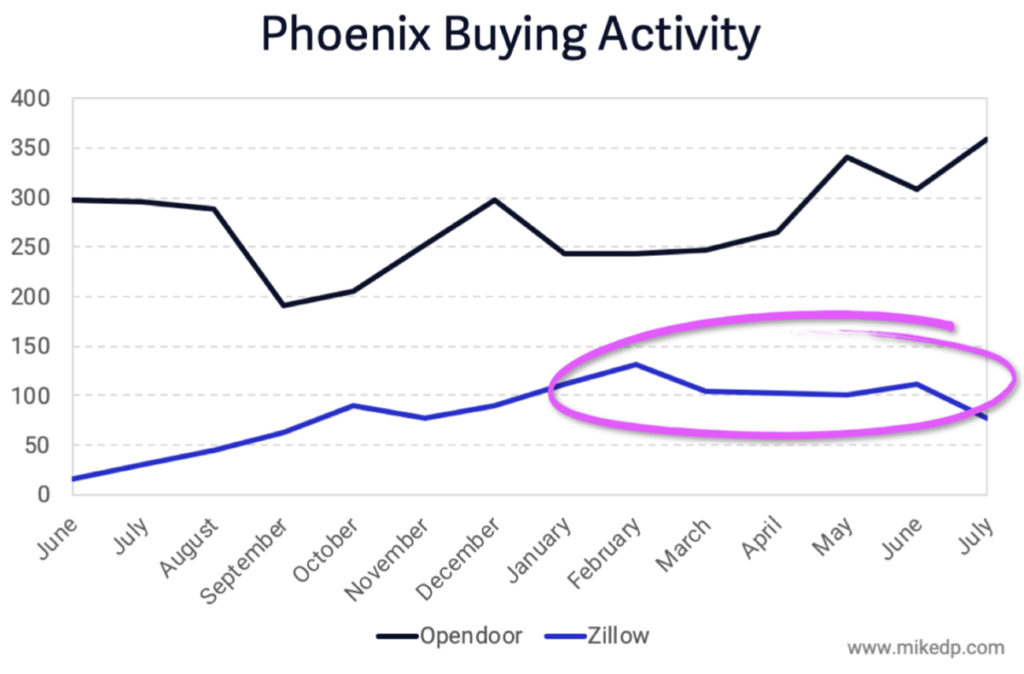

However, Opendoor’s volume advantage is eroding over time as Zillow’s activity accelerates. In January, Opendoor purchased 4.7 times the volume of Zillow, but that is down to 2.4 in July.

The magic number in all of this appears to be 3x: year-to-date in 2019, Opendoor is about 3x ahead of Zillow in terms of home purchases. But Zillow is catching up.

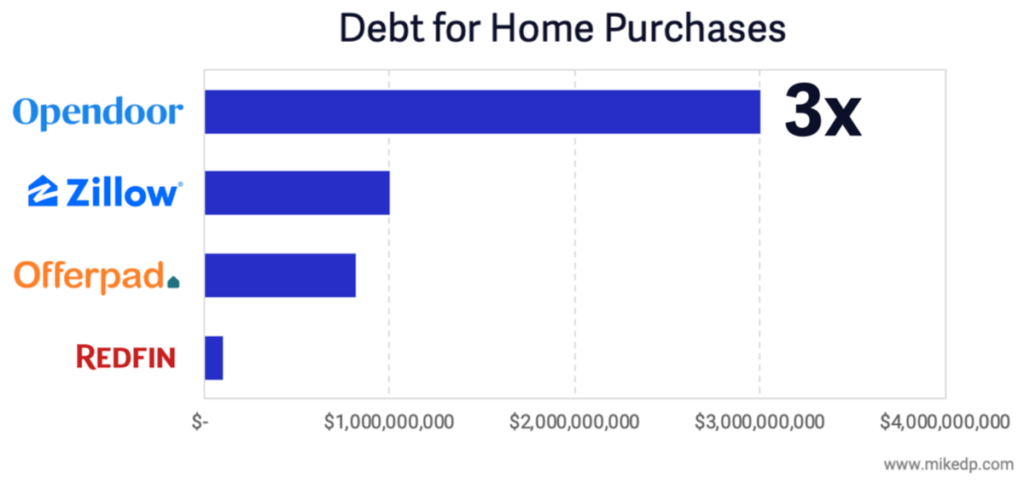

Available firepower to purchase homesAnother way to judge a company’s level of seriousness about iBuying is how much debt it has available to purchase homes. Each of the major iBuyers has secured massive amounts of debt, but some have secured more than others.

Once again, the magic 3x number appears: Opendoor has three times the debt available to purchase homes compared to Zillow. So it is no surprise that it is purchasing three times the volume of homes.

What about Redfin?Readers might notice Redfin in distant fourth place in many of the charts, which, again, is an indicator of seriousness about iBuying.

Opendoor has 30 times the debt available and has purchased nearly 40 times the homes compared to Redfin in 2019. On average, Opendoor is purchasing around 1,400 homes per month, compared to Redfin’s 36 homes per month.

Redfin is an iBuyer in the same way I’m a basketball player. Both statements are technically true, but neither of us are anywhere close to the big leagues.

Differing strategies and motivationsOpendoor’s entire business model revolves around buying and selling as many homes as possible. At scale, it becomes a powerful business. Zillow, on the other hand, might want to moderate its home purchases to achieve a scale where it maximizes seller leads.

As I’ve said before, Zillow has the potential to make more money with less risk by monetizing seller leads.

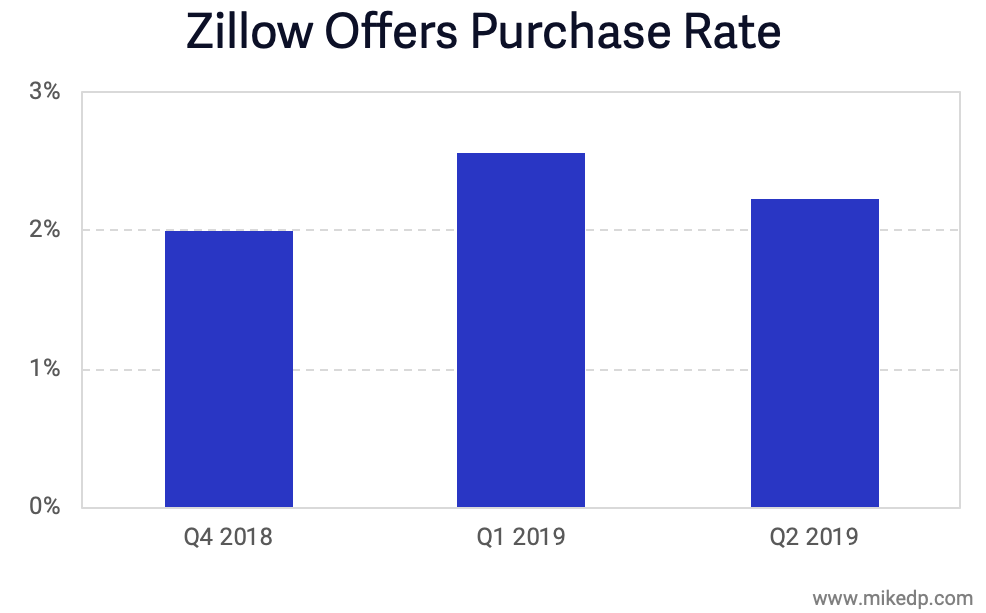

Zillow’s purchase rate (the amount of homes it buys compared to the total number of offer requests it receives) has consistently hovered around 2 percent.

Zillow is expanding fast to catch up to Opendoor, but it might have different motivations in doing so. Zillow’s buying activity in Phoenix, for example, has plateaued since January of 2019. Is it taking a well-earned breather, or is 100 homes a month all it wants (or needs) to buy?

The evidence suggests that Zillow is serious about being an iBuyer and a major player in the space. But its motivations, and the question of why it wants to be an iBuyer, might differ significantly from other iBuyers.

Check out my full talk from Inman Connect Las Vegas below:

Mike DelPrete is a strategic adviser and global expert in real estate tech. Connect with him on LinkedIn.

Source: click here