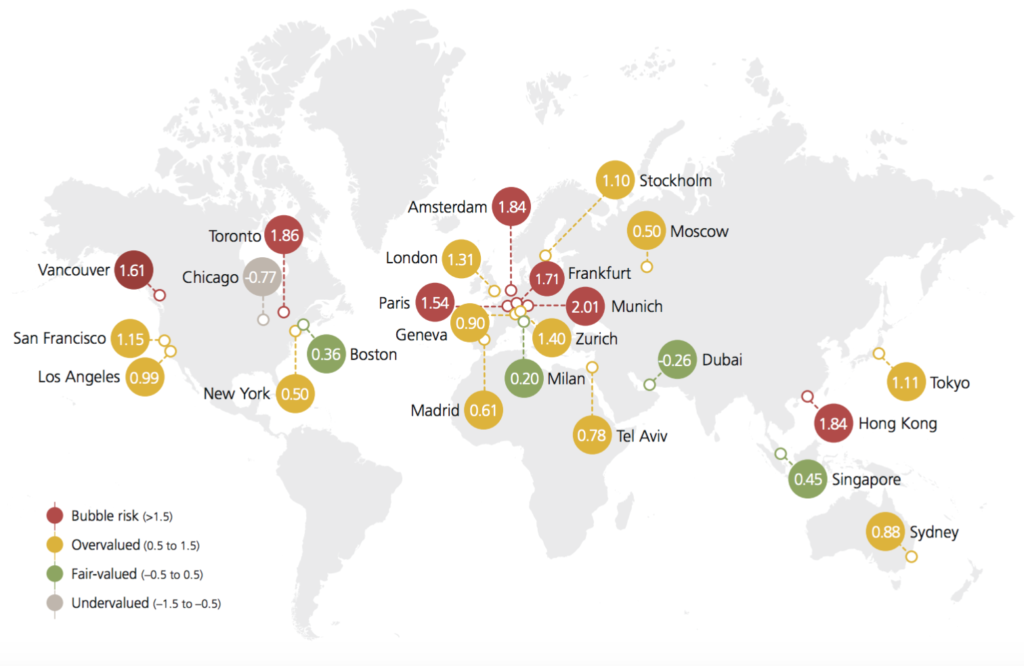

San Francisco is the American city most at risk of seeing a housing crash in the coming months while Toronto tops the list of at-risk cities in all of North America.

According to a new UBS Global Real Estate Bubble Index study, seven cities in North America are at a high risk of seeing a real estate bubble in the coming months and years.

By looking at rent prices in relation to incomes, mortgage changes and construction levels, the Swiss bank found that while some cities have an accurate housing market, others are incredibly overvalued — and subsequently, are due for market crashes in the near future.

“Low affordability already poses one of the biggest risks to property values in urban centers,” Claudio Saputelli and Matthias Holzhey write in the introduction to the report. “If employees cannot afford an apartment with reasonable access to the local job market, the attractiveness and growth prospects of the city in question drop.”

UBS

Use public relations to tell your property’s story

PR can be used to great effect, as real estate professional Scott Carvill has seen across his luxury listings READ MORE

Use public relations to tell your property’s story

PR can be used to great effect, as real estate professional Scott Carvill has seen across his luxury listings READ MORE

These are the North American cities UBS deemed most at risk of a housing crash:

Toronto, Canada2019 bubble index score: 1.86

The fourth largest city in North America has seen an incredible spike in cost of living over the past 10 years — rent prices have, according to UBS, tripled between 2000 and 2017. But while real estate values have been spiking fast, low new construction and affordability problems have been causing many to hold off on buying.

This could, in the coming years, create a situation in which houses sit on the market for months as incomes and demand fails to keep up with the uber-high home values.

“As in Vancouver, local authorities introduced a foreign-buyers’ tax, rent controls and tighter mortgage standards to tackle worsening affordability,” reads the report. “Eventually, the housing frenzy abated and inflation-adjusted prices have stagnated over the last four quarters.”

Vancouver, Canada2019 bubble index score: 1.61

The western Canadian city by the mountains and the ocean has long been heralded for its stunning natural beauty — and, much like Seattle and San Francisco, has seen home values skyrocket over the past decade.

But demand for housing is not growing as fast as the prices and, even as city officials tried to curb affordability issues by introducing vacancy fees and a foreign buyer tax, the city’s market has started to stagnate.

“Due to increasing regional housing supply, a turnaround is unlikely for now, especially as real prices are still 75 percent higher than a decade ago,” reads the report. “However, downside risks are mitigated by still attractive financing conditions, as the Bank of Canada has lowered the qualifying mortgage rate for the first time since 2016.”

Photo Taken In San Francisco, United States. Credit: Victoria Semenjak / EyeEm, Getty Images

San Francisco, California2019 bubble index score: 1.15

San Francisco’s notoriously high real estate prices have by now made real estate lore.

As Silicon Valley and big tech took over our world and made San Francisco its hub, home prices rose so fast that an average worker in some counties would now need to spend 116.8 percent of his or her annual salary to afford a home in the same area.

But many experts say that a period of such rapid growth has finally come to an end — and the market is (albeit very slowly) starting to stabilize.

“The weakness in the Bay Area’s housing market is exacerbated by diminishing foreign demand and the historic low affordability for the working middle class,” reads the report. “With the highest number of housing permits since the late 1980s, the supply shortage may start to ease and potentially accelerate the price correction.”

Los Angeles, California2019 bubble index score: 0.99

The largest city in California may not see as drastic of increases as its seaside neighbor to the north but Los Angeles is still struggling to curb rising unaffordability. UBS does not predict a sharp price decline any time soon, but the city’s high demand for housing is somewhat offset by its rising home prices.

“Despite a booming local economy, affordability has worsened as real prices have surged by more than 50% since 2012, surpassing real income growth,” reads the report. “We expect demand to weaken in 2020 given the area’s exposure to international trade.”

New York City, New York2019 bubble index score: 0.50

New York, has been seeing a major shift in recent months. While sky-high rents still plague Manhattan, home prices are not growing nearly as fast as they are in other parts of the country.

The New York market is still overvalued relative to other cities but new real estate regulation bills and high taxes have made many hold off on buying — and curbed the kind of growth necessary for continuing market expansion.

“Since then rents have increased by almost 60% in inflation-adjusted terms, with income growth also surpassing inflation,” reads the report. “But despite the improved affordability, a price rebound seems unlikely in the short term as the financial center in Manhattan lacks economic stimulus.”

Anthony Delanoix | Unsplash

Boston, Massachusetts2019 bubble index score: 0.36

Although Boston is in a healthy state compared to other North American cities on the list, it could still see a future real estate bubble due to growing income-price discrepancies that might not necessarily be offset by slowing price growth.

“Prices have been increasing continuously since 2012, but growth rates have abated recently,” reads the report. “Over the last four quarters, prices have risen by 3 percent in inflation-adjusted terms, in line with the national average. The economic appeal of Boston and a catch-up in price levels have triggered the relatively strong rise in prices.”

Chicago, Illinois2019 bubble index score: -0.77

Chicago was the one undervalued city to make the list. Even though some growth has been happening, its real estate prices are more than 25 percent lower than they were in 2006. The city is affordable but, according to UBS, not growing on the jobs and economic front. As a result, the city’s market is currently at high risk of experiencing major stagnation.

“Overall, rental and income growth could keep pace with house price increases,” reads the report. “The city’s high indebtedness, sluggish employment growth and a declining population will likely continue to hinder significant price increases.”

Source: click here