Have suggestions for products that you’d like to see reviewed by our real estate technology expert? Email Craig Rowe.

Endpoint is digital title and escrow software for all parties affiliated with the closing process.Platforms: Browser; iOS, Android Ideal for: Buyers, sellers, agents and title companies

Top selling points: Mobile app Simple timeline event tracker Banking connections Terms explanations Digital, plus human, experience Top concerns:Primarily, adoption. This will largely come down to the habits and technological growth of the collective vendor teams associated with getting a deal closed. But as the acceptance of e-closing gains steam, apps like this should move quickly through the market.

What you should knowI was surprised at what I saw in this app — in a good way.

There are still some hybrid elements to this (some documents needing wet signatures), such as in-person notarizations and the company’s on-call escrow assistant team.

I’m OK with this for now; because if the goal is to make the process of closing on a home less intimidating, Endpoint has reached it.

The app is the handheld offspring of a joint effort between First American and Boston Consulting Group’s venture capital branch

It eschews clinical, document-driven experiences common so far in other emerging e-closing products in favor of a transparent, consumer-facing look and feel.

The interface is comfortable; it’s not going to frighten away users with the perceived weight of a closing.

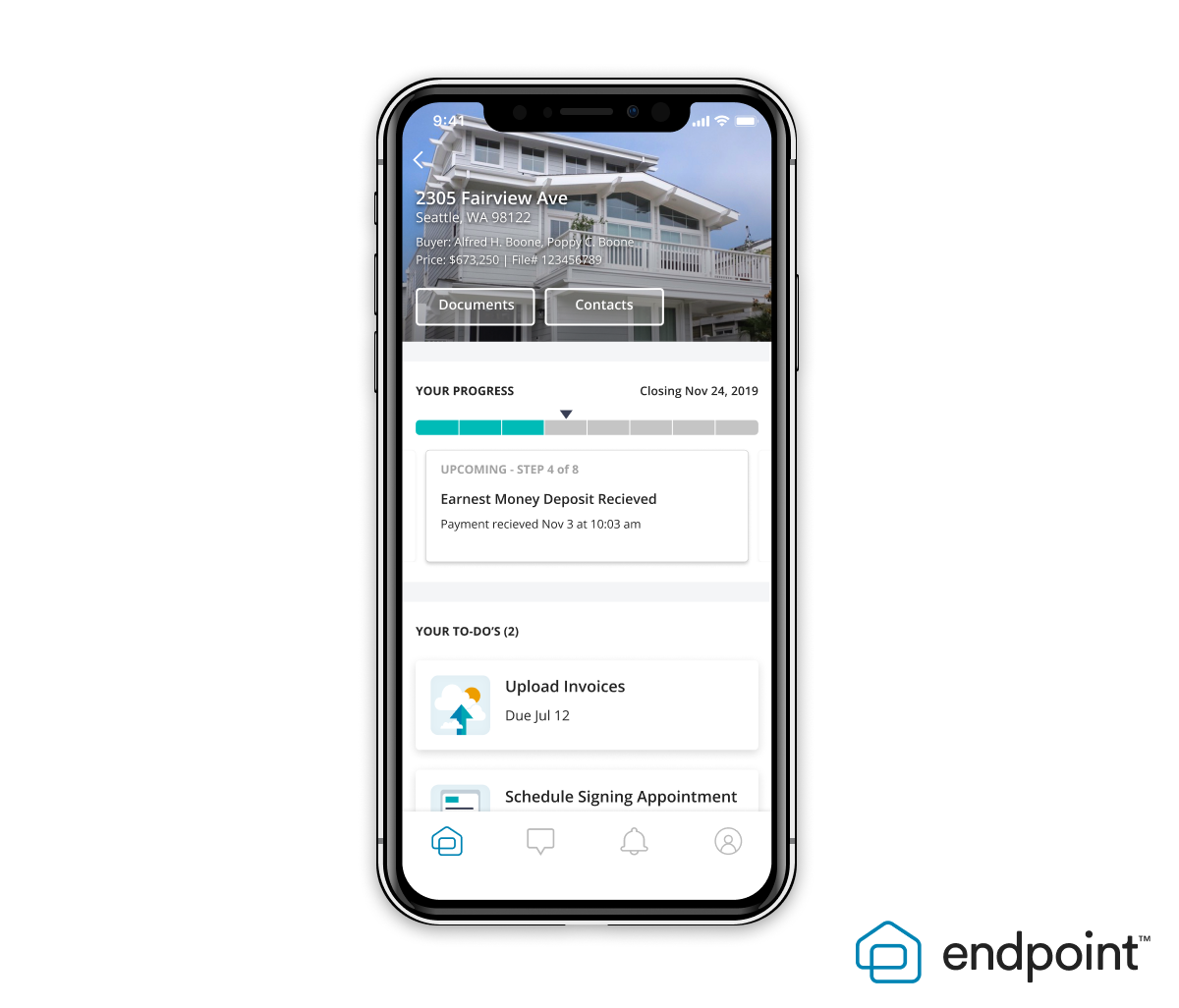

The on-demand team is there, should questions arise or if a particular party isn’t engaging. The app uses a simple, shaded timeline to indicate to users what’s happening when and who is responsible for it.

Each benchmark is accompanied by a clear description of its legal role in the transaction, nicely distilling the polysyllabic legalese of closing documents so the consumer can swallow it in bites, not whole.

Agents can choose to record a personal video explaining each step, too. That could be a nice touch. I don’t recommend sacrificing the app’s native value for an extra bit of branding. The deal is already in escrow, after all.

Agents can view their list of current transactions in an image-first scroll, needing only to tap on a home’s image to access escrow details and monitor where things stand. It looks like a home search app, and thus, it encourages interaction and helps flatten the learning curve.

Buyers clearly get the most value out of Endpoint — which is exactly who should; because every time a deal goes well for them, it’s a reflection on their agent.

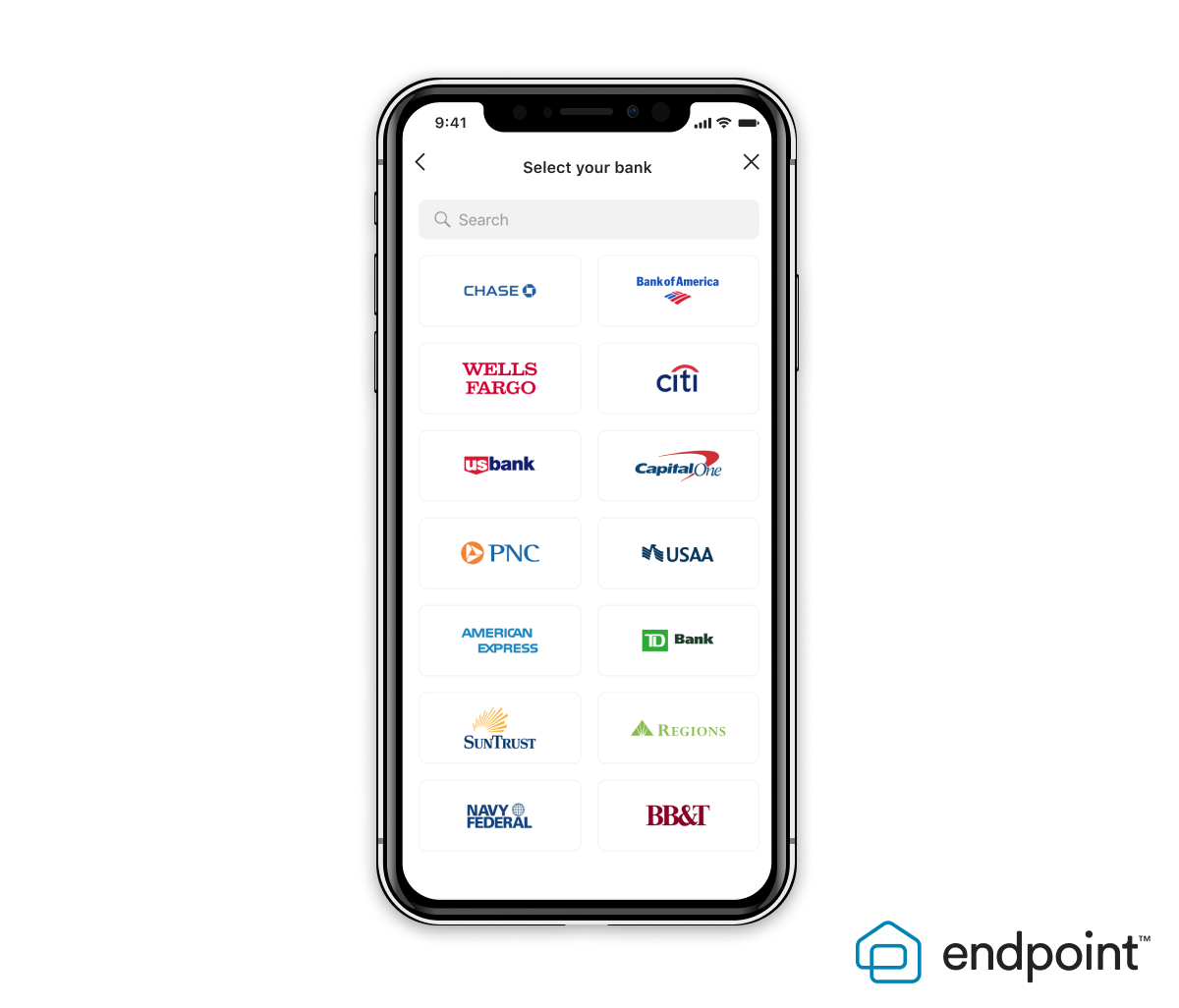

Once the contracts are signed and uploaded, buyers can send their earnest money deposit using the app through a wide array of national banking integrations. It’s done entirely in-app using existing personal banking login credentials, helping eliminate wire fraud concerns, which is something that doesn’t seem to be going away.

Those familiar with PayPal know that the online merchant’s tool sometimes sends you out of the retail experience to sign in separately before jumping back to the store to finalize your shopping. Who hasn’t made the decision to not buy at this point? Or had a connection burp or experience some other form of interruption?

Remember, every physical process in a real estate deal — especially check-writing — gives the buyer a reason to rethink something. And, as I always say: Time kills deals.

By making everything easier, you make everything faster.

Endpoint does all it can to reduce the number of opportunities for emotional speed bumps, those unseen hurdles that can send a home purchase careening outside the white lines. Ask any experienced agent.

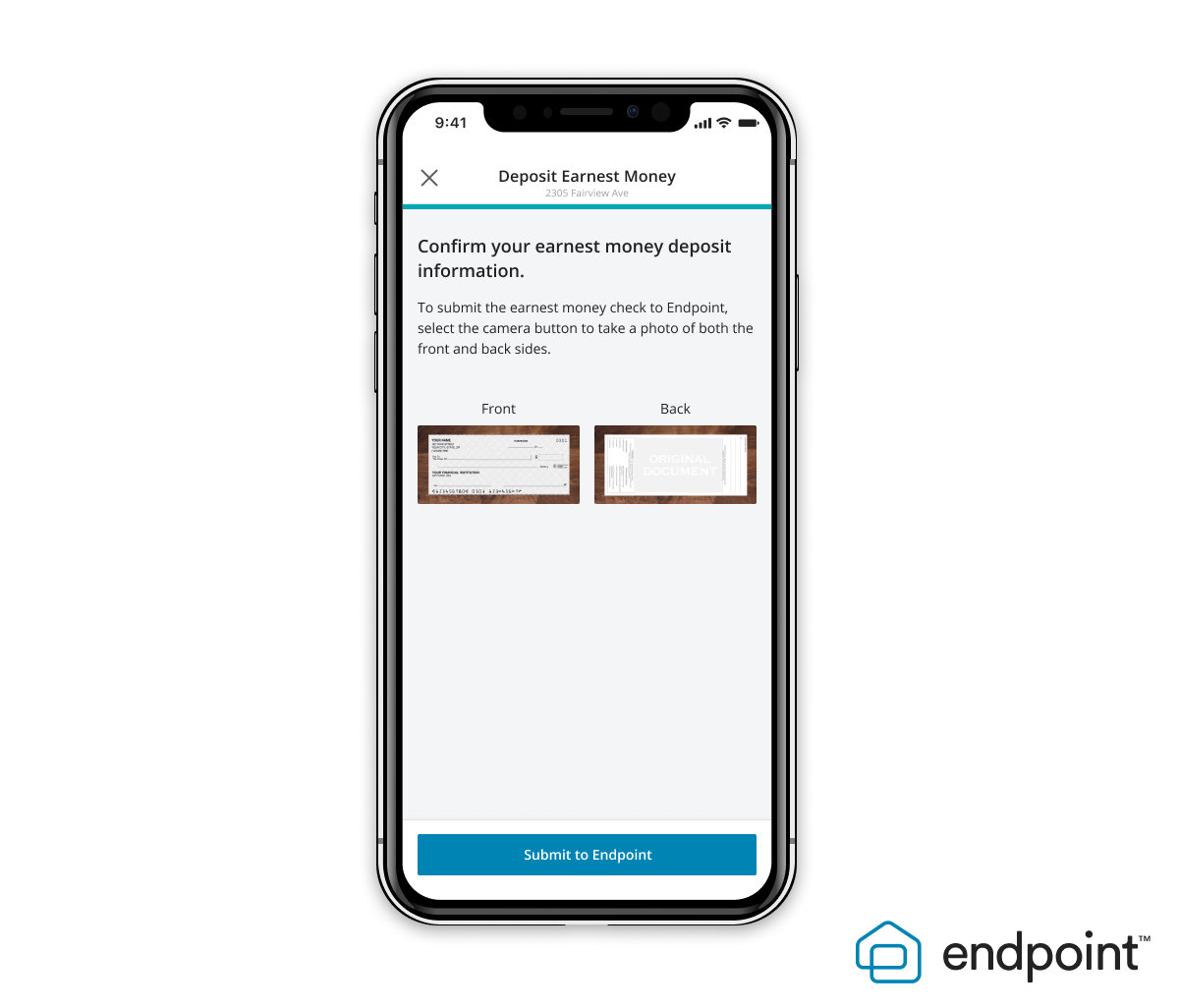

Endpoint does allow users to deposit funds via check image scanning, as many do with their banking apps. The seller will interact with the app as well, but to a much lesser degree. They’re asked to verify ownership with a social security number, verify address and confirm citizenship.

Endpoint isn’t fully on board with remote online notarization yet. The company instead partners with notary companies that can send a professional to witness and stamp. If that entity offers RON, then the buyer is free to take advantage of it.

The company uses an integration with HelloSign for payoff authorization.

Behind the ones and zeros is an on-call staff to assist buyers with any snags that may come up before move-in. It’s also their job to handle consumer onboarding, taking app training away from the agent. I was told the “rate of engagement” among buyers and sellers was 90 percent.

For e-closings to gain the traction the industry needs, consumers have to be made front and center. A complicated, signature-heavy business process needs to be minimized, made mobile and marketed.

And thankfully, a company the size of First American was willing to take a big first swipe at it.

Far be it from me to let a good pun at the expense of the industry go to waste: I suggest swiping right on Endpoint. (Sorry.)

Have a technology product you would like to discuss? Email Craig Rowe

Craig C. Rowe started in commercial real estate at the dawn of the dot-com boom, helping an array of commercial real estate companies fortify their online presence and analyze internal software decisions. He now helps agents with technology decisions and marketing through reviewing software and tech for Inman.

Source: click here