Mortgage interest rates are approaching 5 percent, but could they soon be cresting?

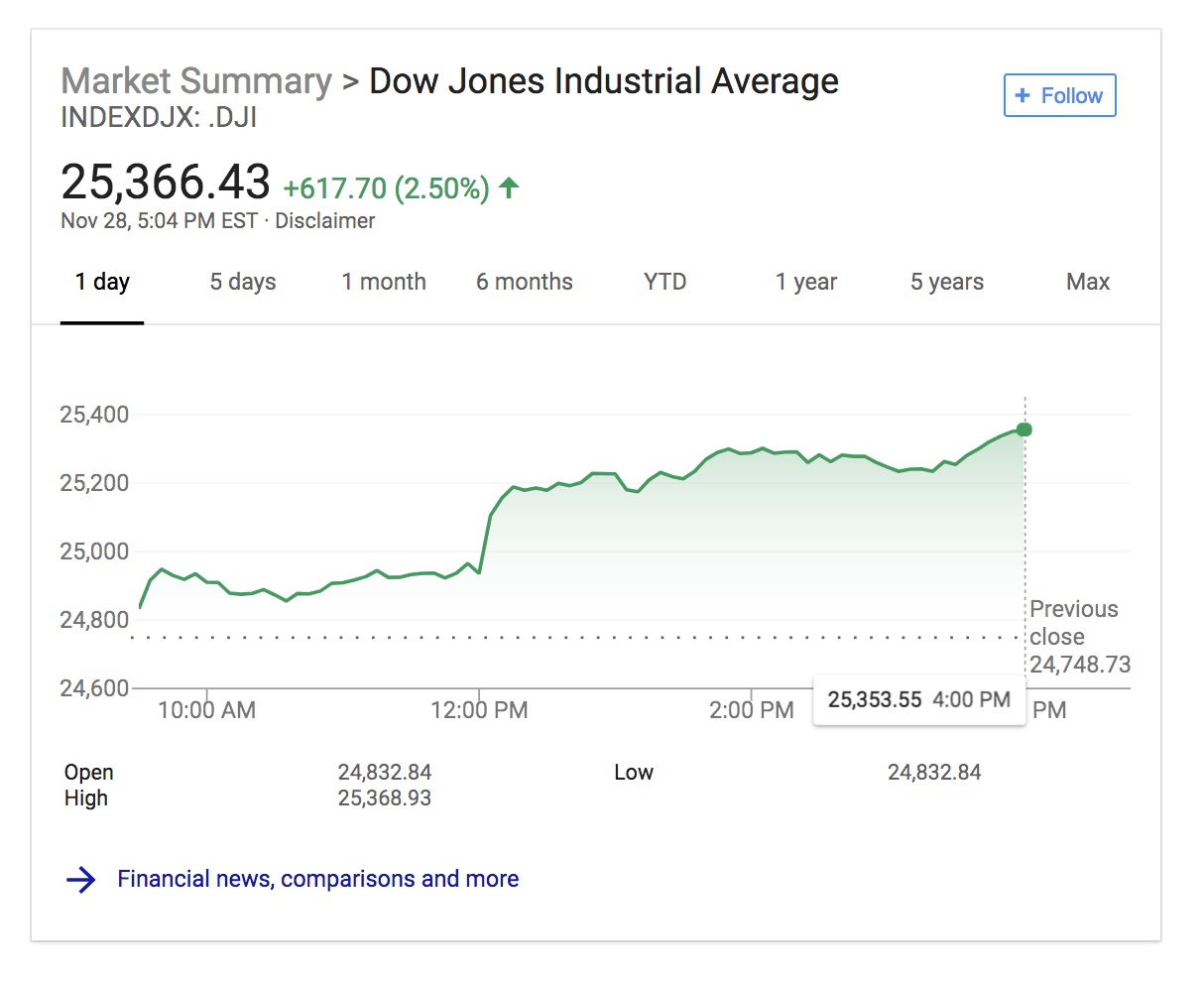

Comments made by Federal Reserve Chairman Jerome Powell seem to have investors convinced that the Fed is getting close to finished with its recent cycle of benchmark interest-rate hikes. The Dow Jones Industrial Average closed up 617 points today, 2.5 percent, at 25,336.45.

Credit: google/Yahoo Finance

What did Powell say to spark such enthusiasm?

“Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy — that is, neither speeding up nor slowing down growth,” Powell said at the Economic Club of New York, as NPR reported.

Earlier in October, Powell said interest rates were “a long way” from neutral.

The questions you’re not asking your tech vendor

Protect your brokerage before you make a purchase READ MORE

The questions you’re not asking your tech vendor

Protect your brokerage before you make a purchase READ MORE

The Fed has hiked the interest rate three times already in 2018, first from 1.5 percent to 1.75 percent in March, then from 1.75 percent to 2 percent in June, and finally from 2 percent to 2.25 percent in late September. Now traders think that the Fed may just institute one additional rate hike for all of 2019, according to CNBC.

The Fed doesn’t directly influence mortgage interest rates, however: instead, mortgage interest is more tied to the 10-year Treasury note, which can be affected by the Fed’s rate, but which usually prices it into trading before it actually happens, based on reports of a looming hike.

What does this all mean for prospective borrowers and homeowners? Mortgage interest may still rise more into next year — a Realtor.com study predicts they could climb as high as 5.5 percent in 2019 — but the Fed isn’t looking to be the fuel for that fire, nor does it wish to slow down the economy too much.

Source: click here