As home prices continue to rise, some homeowners are holding off on selling in the hopes of reaping even bigger rewards down the road.

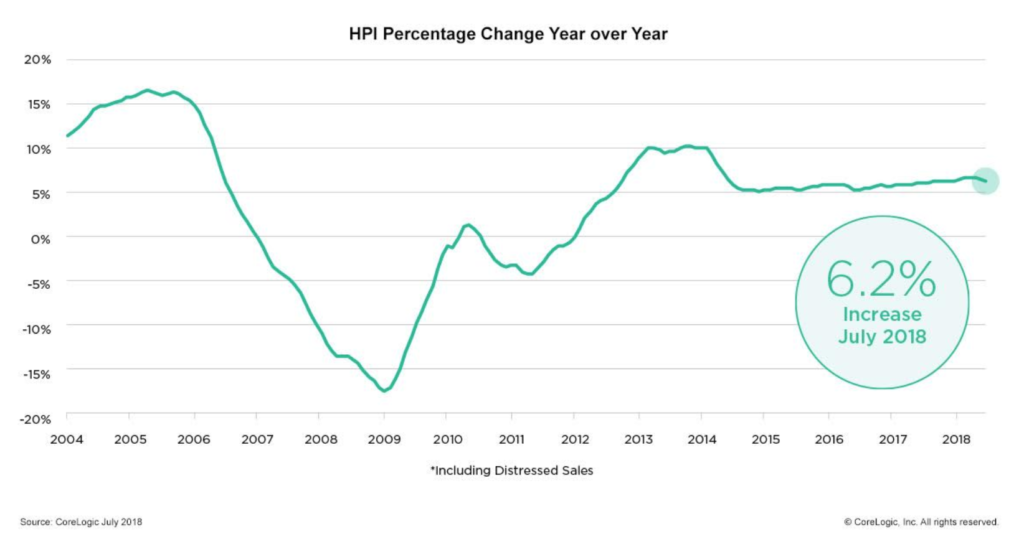

Home prices grew 6.2 percent in July year-over-year, with average single-family homes now commanding $285,700, according to the CoreLogic Home Price Index and Forecast, released Monday. Over the past month, home prices grew by 0.3 percent — an growth trend that has remained unbroken since 2012.

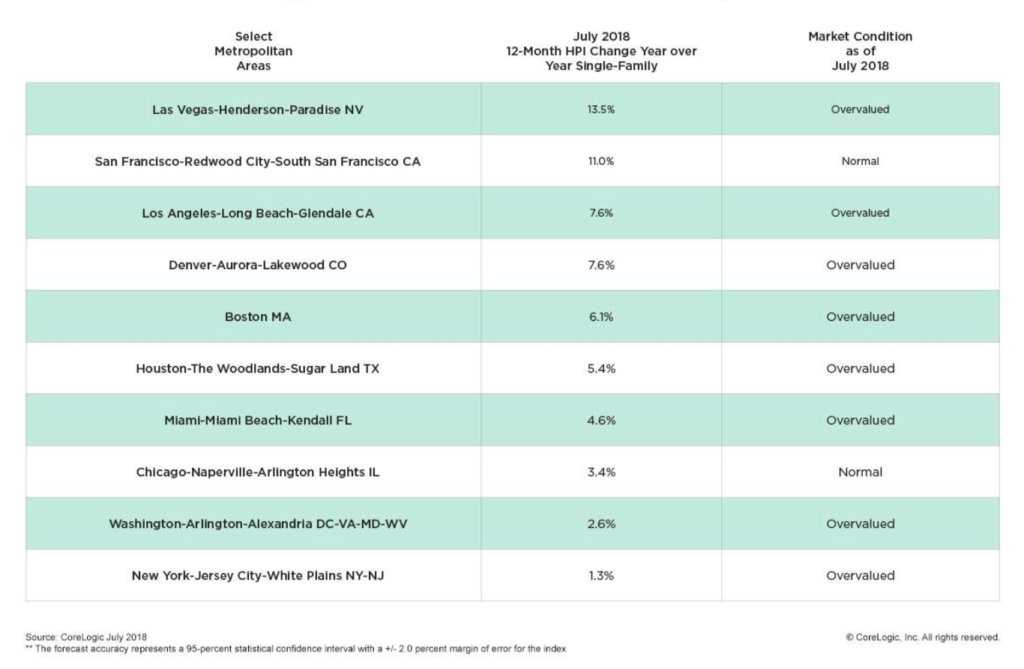

In Washington, Nevada and Idaho, growth is even more pronounced with home prices in those states growing by more than 10 percent over the past year.

Courtesy of CoreLogic

As a result, many homeowners are confident in the housing market and are holding off on selling. According to CoreLogic’s analysis of homeowners’ attitudes, 62 percent of residents in high-growth markets believe their house will be worth more within three years, compared to 55 percent of residents in markets with no growth or negative growth.

“Many consumers see their homes as good investments,” said Frank Martell, president and CEO of CoreLogic. “Our consumer research indicates homeowners, especially those in high-price growth markets, are confident that by waiting to sell, they will receive a greater return on investment than they would today.”

Shift your identity. Change your life.

Tom Ferry digs into what holds most people back from taking action READ MORE

Shift your identity. Change your life.

Tom Ferry digs into what holds most people back from taking action READ MORE

That said, home prices are not growing as quickly as they were during the same period last year, due in part to overvalued markets. In Seattle, home value growth dropped by more than 5 percent. CoreLogic predicts home prices will only grow by 5.1 percent by July 2019 and drop by 0.2 percent in August.

“With increased interest rates and home prices, the CoreLogic Home Price Index is rising at a slower rate than it was earlier this year,” said Dr. Frank Nothaft, chief economist for CoreLogic. “While markets in the western part of the country continue to experience rapid home-price growth, many of those metros are overvalued, and will likely experience a slowdown soon.”

Courtesy of CoreLogic

But even as some experts predict a slow sales turnaround in the future, inventory shortages and rising prices continue to quell homeowners’ desire to sell.

“In other words, sellers are largely staying put,” Martell said. “With fewer homes on the market, price pressure will continue to rise.”

Source: click here