Ribbon, a startup that makes cash offers on behalf of homebuyers, announced today that it has raised $30 million in cash as well as secured $300 million in debt.

In a statement, Ribbon said that it plans to use its vast new funding “to facilitate the company’s expansion into new markets, and accelerate product development efforts.” The cash infusion comes from a Series B fundraising round led by Silicon Valley venture capital firm Greylock Partners, while the company received its debt financing through Goldman Sachs.

Shaival Shah

Ribbon CEO Shaival Shah said in the statement that he was grateful for investors’ confidence and “excited about the opportunity to bring our products and services into new markets and design new product solutions.”

“We are expanding our platform to help even more families who have homes to buy and sell and families who are buying their first home,” Shah added.

Ribbon aims to make consumers who need financing more competitive when they go up against all-cash buyers. So, would-be homeowners can make offers on homes with the backing of Ribbon; if the buyer’s financing comes through as expected, Ribbon doesn’t pay anything. However, if any sort of problem arises that derails or delays the financing, Ribbon steps in and buys the home itself. The company then sells the home to the buyer when his or her financing comes through.

Build client relationships one unexpected detail at a time

Making the small things count to make your clients feel valued READ MORE

Build client relationships one unexpected detail at a time

Making the small things count to make your clients feel valued READ MORE

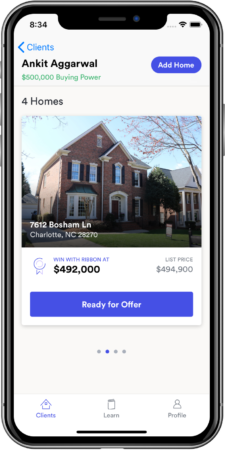

Ribbon’s app. Credit: Ribbon

Shah has in the past compared this approach to a credit card, which ensures that both consumers get goods and retailers get cash immediately.

The idea, when it comes to the housing market, is that all-cash offers have an advantage because they involve greater certainty. Ergo, buyers who bring the promise of an all-cash offer are also more competitive and win more bids.

Charlotte-based Ribbon launched in 2018 and now operates in eight markets across Georgia, Tennessee, North Carolina and South Carolina. According to the company’s statement Tuesday, it plans to expand into 20 new markets by the end of next year.

Almost exactly one year ago, Ribbon raised $225 million in debt and equity.

In addition to Greylock, The latest funding round involved previous investors Bain Capital Ventures, NFX and NYCA. In a statement Tuesday, NFX partner Pete Flint said that Ribbon is “proving that superior technology and data plus capital is what it will take to truly transform the real estate industry.”

“As Ribbon continues to expand across the US,” Flint added, “buyers and sellers are the real winners.”

Source: click here