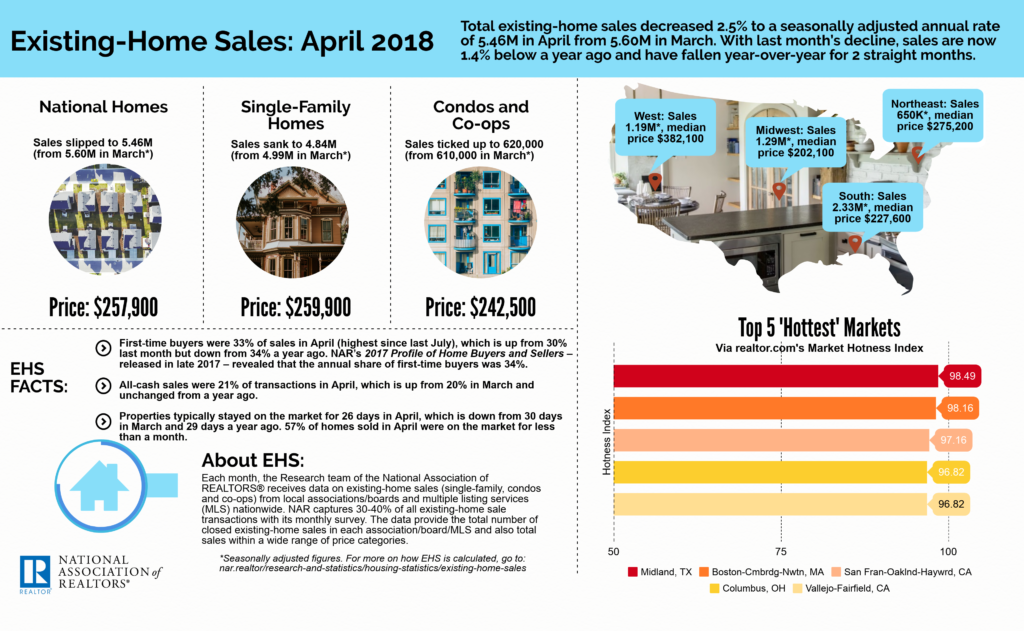

Existing homes sales fell 0.4 percent month-over-month to a seasonally adjusted annual rate of 5.43 million after declining last month too, due to low inventory, according to the National Association of Realtors. The median existing home price in May 2018 was $264,800, a record high and up 4.9 percent from $252,500 May 2017, according to the data.

Year-over-year, the number of existing home sales also fell 3 percent, the third straight month of such a decline.

“Closings were down in a majority of the country last month and declined on an annual basis in each major region,” said Lawrence Yun, NAR’s chief economist. “Incredibly low supply continues to be the primary impediment to more sales, but there’s no question the combination of higher prices and mortgage rates are pinching the budgets of prospective buyers, and ultimately keeping some from reaching the market.”

May’s increase in the median existing home price marks the 75th straight month of year-over-year gains, according to NAR.

Housing inventory shot up 2.8 percent to a total of 1.85 million existing homes, but that total is still below last May’s 1.97 million and has fallen year-over-year for 36 consecutive months, the report says. Properties that did hit the market typically stayed on the market for 26 days, unchanged from a month ago and one day sooner than May of last year.

“Inventory coming onto the market during this year’s spring buying season – as evidenced again by last month’s weak reading – was not even close to being enough to satisfy demand,” added Yun. “That is why home prices keep outpacing incomes and listings are going under contract in less than a month – and much faster – in many parts of the country.”

The high cost of homes is an impediment to first time homebuyers entering the market, according to Bill Banfield, Quicken Loans’ executive vice president of capital markets.

The high cost of homes is an impediment to first time homebuyers entering the market, according to Bill Banfield, Quicken Loans’ executive vice president of capital markets.

“Sustained inventory constraint continues to be the main driver in higher home prices, with the median home price now at an all-time high,” he said. “First-time homebuyers remain on the sidelines as they watch prices surge and housing options decline in the entry-level portion of the market.”

There’s very little relief on the horizon, for the high-cost, inventory-strapped market according to Sam Khater, Freddie Mac’s chief economist.

“While this is the best economy in the last 20 years, many potential buyers have been sidelined and unable to purchase,” he said. “The more worrying concern is that relief is not coming anytime soon.”

“The inventory of unsold homes has shrunk for 36 consecutive months, even in the presence of much higher prices, which in past cycles typically led to more inventory being listed for sale,” he added. “The problem is not just related to construction, but many buyers from last decade who purchased their 1st home have not traded up. Therefore, renters trying to get on the housing ladder are stuck and unable to take their first step.”

Home sales increased in the northeast, the only such region to see an uptick in sales. Despite the 4.6 percent month-over-month increase, home sales in the northeast were still down 11.7 percent versus last year. Existing home sales declined 2.3 percent in the midwest, 0.4 percent in the south and 0.8 percent in the west, month-over-month.

Source: click here