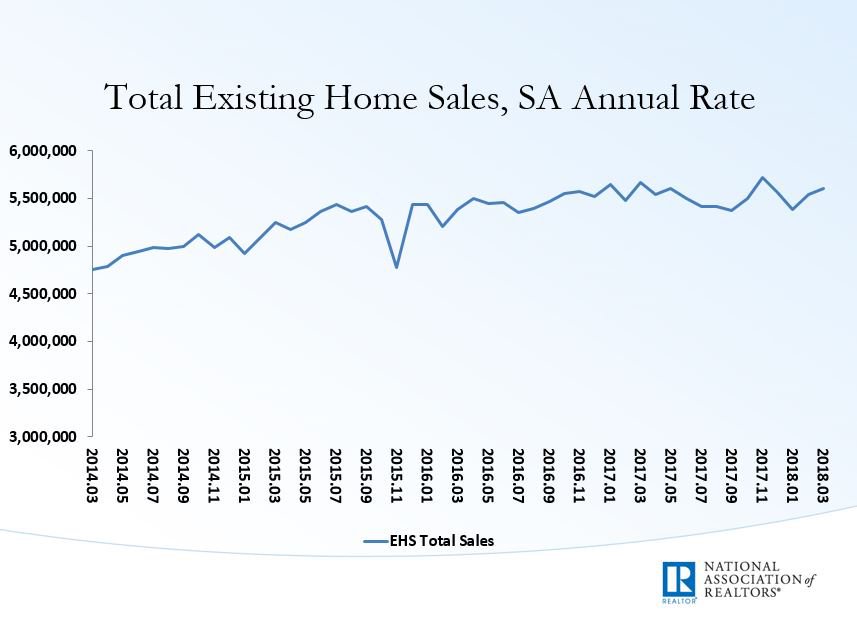

Existing-home sales continued to trend upward in March for the second straight month, the National Association of Realtors reported on Monday.

Existing-home sales jumped 1.1 percent, climbing to a seasonally adjusted annual rate of 5.6 million. In spite of low inventory challenges that have persisted into 2018 and increasing home prices nationwide, it’s the second month in a row during which existing home sales rose, following two straight months of declines.

“Robust gains last month in the Northeast and Midwest — a reversal from the weather-impacted declines seen in February — helped overall sales activity rise to its strongest pace since last November at 5.72 million,” said Lawrence Yun, chief economist at NAR. “The unwelcoming news is that while the healthy economy is generating sustained interest in buying a home this spring, sales are lagging year-ago levels because supply is woefully low and home prices keep climbing above what some would-be buyers can afford.”

Lawrence Yun says Realtors throughout the country are seeing the seasonal ramp-up in buyer demand this spring but without the commensurate increase in new listings on the market. As a result, competition is swift and homes are going under contract in roughly a month. #NAREHS

— NAR Research (@NAR_Research) April 23, 2018

How to win the listing before you arrive

Tom Ferry’s 5 winning pre-listing appointment rituals READ MORE

How to win the listing before you arrive

Tom Ferry’s 5 winning pre-listing appointment rituals READ MORE

Low inventory problems have plagued the housing market for the past few years due to a multitude of factors including rising construction costs, a decline in skilled labor and dwindling land availability.

High prices have accompanied low inventory, especially in entry-level homes. The median existing-home price for all housing types in March was $250,400 — a 5.8 percent rise from March 2017, according to the report. That correlation should continue, according to Ruben Gonzalez, chief economist with Keller Williams.

“If inventory conditions remain restrictive we also expect to continue to see home price appreciation accelerate,” said Gonzalez. “Based on data and anecdotal evidence the most restrictive inventory conditions currently exist for entry level housing, and this is also where we anticipate the most acceleration in home price appreciation.”

Gonzalez forecasts that existing home sales in 2018 will be at or slightly below 2017 sales. A meaningful increase in interest rates could change that forecast, but Gonzalez anticipates mortgage rates will increase slowly from the current level for the remainder of the year.

Existing-home sales rose for the second straight month. Data courtesy NAR.

Existing-home sales rose for the second straight month. Data courtesy NAR.

Homes that are hitting the market are moving more quickly this month, according to the report. Properties typically stayed on the market for just 30 days in March and half of the homes that sold in March were on the market for less than a month.

“Realtors throughout the country are seeing the seasonal ramp-up in buyer demand this spring but without the commensurate increase in new listings coming onto the market,” said Yun. “As a result, competition is swift and homes are going under contract in roughly a month, which is four days faster than last year and a remarkable 17 days faster than March 2016.”

The Northeast saw the biggest growth with existing-home sales rising 6.3 percent, followed closely by the Midwest with a 5.7 percent uptick. Existing-home sales declined in the South and West, falling 0.4 percent and 3.1 percent, respectively.

Source: click here