While the number of homeowners failing to make their mortgage payments continue to hit new lows, portions of the country hit by natural disasters are struggling.

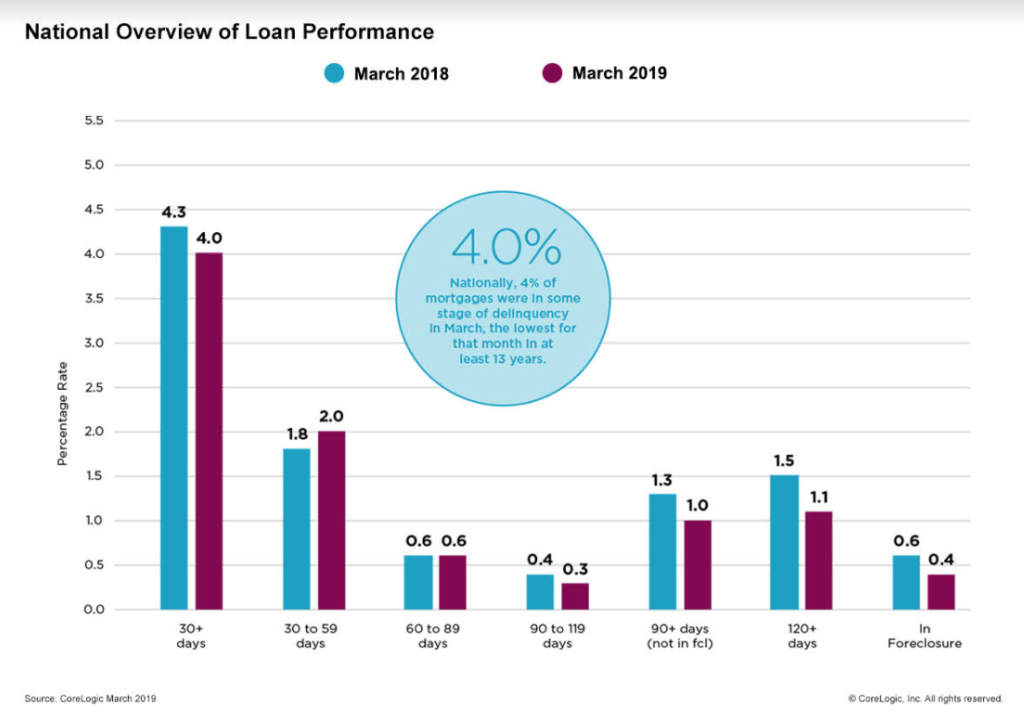

Across the United States, 4 percent of U.S. homeowners fell into some sort of delinquency on their mortgages in March, down from 4.3 percent a year earlier and the lowest level for the month of March in 13 years, according to the latest CoreLogic analysis, released Tuesday. Foreclosure rates, in which one’s home is seized by the government due to inability to pay, is at 0.4 percent, down from 0.6 percent in March 2018.

Such a small number of homes have not been foreclosed since January 1999.

Courtesy of CoreLogic

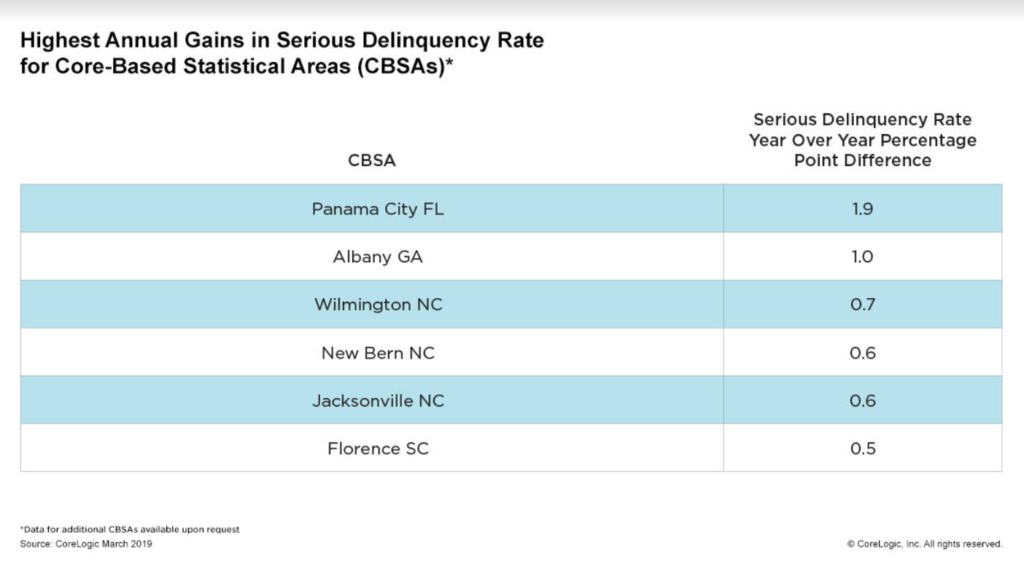

Despite the good news, however, some parts of the country are continuing to struggle. Overall delinquency rates have risen somewhat in 42 percent of the country. Panama City, Florida and Albany, Georgia saw some of the highest rises in serious delinquency rates, or payments that are due by more than 90 days, across the country. According to CoreLogic, such numbers are the result of homeowners getting caught off guard with higher-than-expected payments in certain times of the year.

“The increase in the overall delinquency rate in 42 percent of states most likely indicates many Americans were caught off guard by their expenses in early 2019,” Dr. Frank Nothaft, chief economist at CoreLogic, said in a prepared statement. “A strong economy, labor market and record levels of home equity should limit delinquencies from progressing to later stages.”

Four things to consider when choosing your first brokerage

It’s a big decision, so keep these questions in mind before you make the commitment READ MORE

Four things to consider when choosing your first brokerage

It’s a big decision, so keep these questions in mind before you make the commitment READ MORE

Courtesy of CoreLogic

Nonetheless, the largest gains in foreclosure and delinquency rates came from areas that have been hit by natural disasters in the past two years. Houston, which was ravaged by Hurricane Harvey in September 2017, and southern Florida, which was hit by Hurricane Michael just a few weeks later, both have some of the highest delinquency rates in the country. In many cases, homeowners whose property suffered damage fall delinquent on their mortgage as they take time to figure out whether to make repairs or sell.

“Delinquency rates and foreclosures continue to drop through March and should decline further in the months ahead barring any serious dislocations from recent flooding in the Midwest or a severe Atlantic hurricane and/or wildfire season on the coasts,” said Frank Martell, president and CEO of CoreLogic, in a prepared statement.

How do you stay ahead in a changing market? Inman Connect Las Vegas — featuring 250+ experts from across the industry sharing insight and tactics to navigate threat and seize opportunity in tomorrow’s real estate market. Join more than 4,000 top producers, brokers and industry leaders to network and discover what’s next, July 23-26 at the Aria Resort. Hurry! Tickets are going fast, register today!

Thinking of bringing your team? There are special onsite perks and discounts when you buy tickets together. Contact us to find out more.

Source: click here