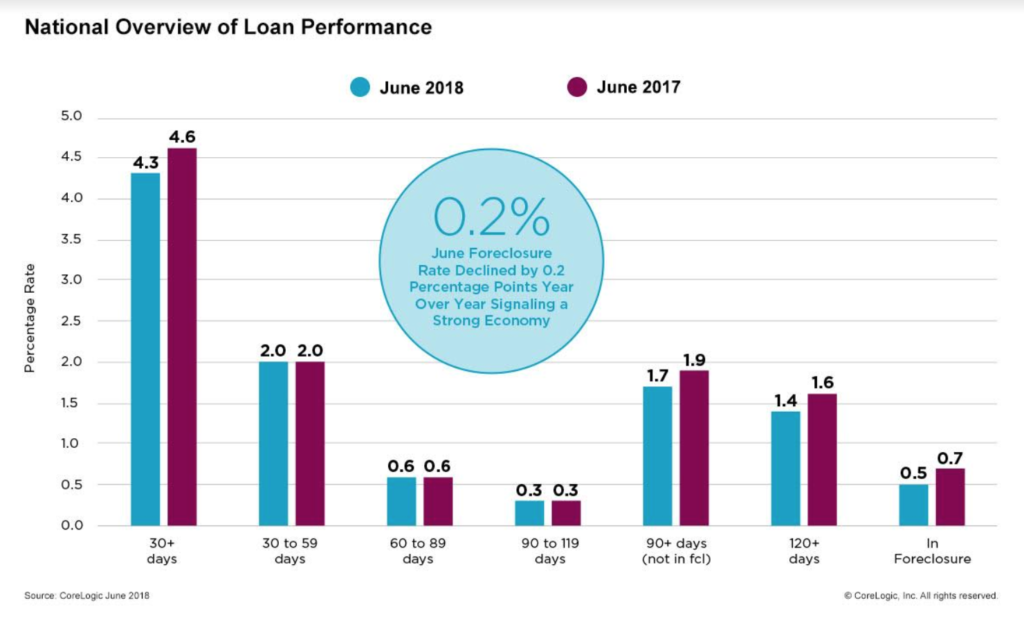

In June, home delinquency and foreclosure rates dipped to a 12-year low, according to the latest CoreLogic Loan Performance Insight report released on Tuesday.

Measuring the number of homeowners who were late on their mortgage payments by more than 30 days, the monthly analysis found that only 4.3 percent of mortgages in June were delinquent nationwide — compared to 4.6 percent the year previous and the same 4.3 percent in March.

Foreclosure rates, in which one’s house is seized by the government due to failure to make payments, were also at a low — 0.5 percent now compared to 0.7 percent in June 2017.

Courtesy of CoreLogic

While the downtick may seem small, the number of Americans failing to make payments on their homes has been falling steadily over the past decade. Neither the delinquency rate nor foreclosure rate has been this low since 2006.

High employment rates and growing home equity are largely responsible for the positive news. The national unemployment rate is now at 4 percent, “the lowest for June in 18 years,” according to CoreLogic Chief Economist Frank Nothaft.

5 fantastic objection handlers you can use today

Watch Tom Ferry role play how to overcome the most common objections you hear READ MORE

5 fantastic objection handlers you can use today

Watch Tom Ferry role play how to overcome the most common objections you hear READ MORE

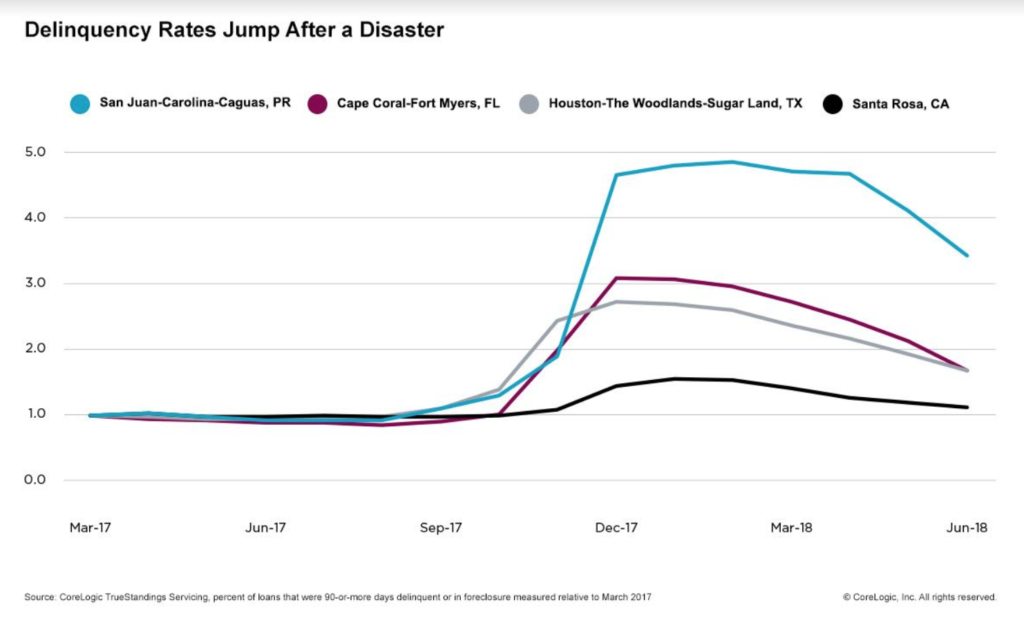

Nonetheless, national delinquency remain higher in states hit by hurricanes and storms in 2017. After hurricanes Harvey and Irma, Florida and Texas have seen 30-day delinquency rates soar. The property analytics provider found that delinquency rates typically spike after a natural disaster because homeowners who suffered property damage usually need time to figure out whether to sell or make repairs.

“While this has helped reduce delinquencies nationally, delinquency rates in areas hit by wildfires, hurricanes or other natural disasters have jumped as families deal with financial disruption and tragedy,” Nothaft said. “The loss of housing and displacement of families also tends to drive up local rents and reduce vacancies.”

Courtesy of CoreLogic

And sadly, each year seems to bring its own round of delinquencies following natural disasters. CoreLogic predicts that the recent volcanic eruption in Hawaii and the wildfires in California put those states at risk over the coming year.

“Neighborhoods impacted by similar disasters in 2018 should also expect to see a spike in delinquencies in the coming years,” said Frank Martell, president and CEO of CoreLogic, in a statement. “With storms and wildfires currently impacting multiple areas of the country, homeowners, lenders and servicers should remain vigilant of potential impacts, particularly those in California, Hawaii and the Rocky Mountain and Gulf Coast states.”

Source: click here