How do you thrive in today’s luxury market? Don’t miss Inman’s Luxury Connect, October 15-17, 2019, in Beverly Hills, California. Walk away with the marketing, technology and luxury intelligence to grow your business while expanding your referral network with built-in networking sessions. Join 500 of the most notable names in luxury real estate. Reserve your spot here.

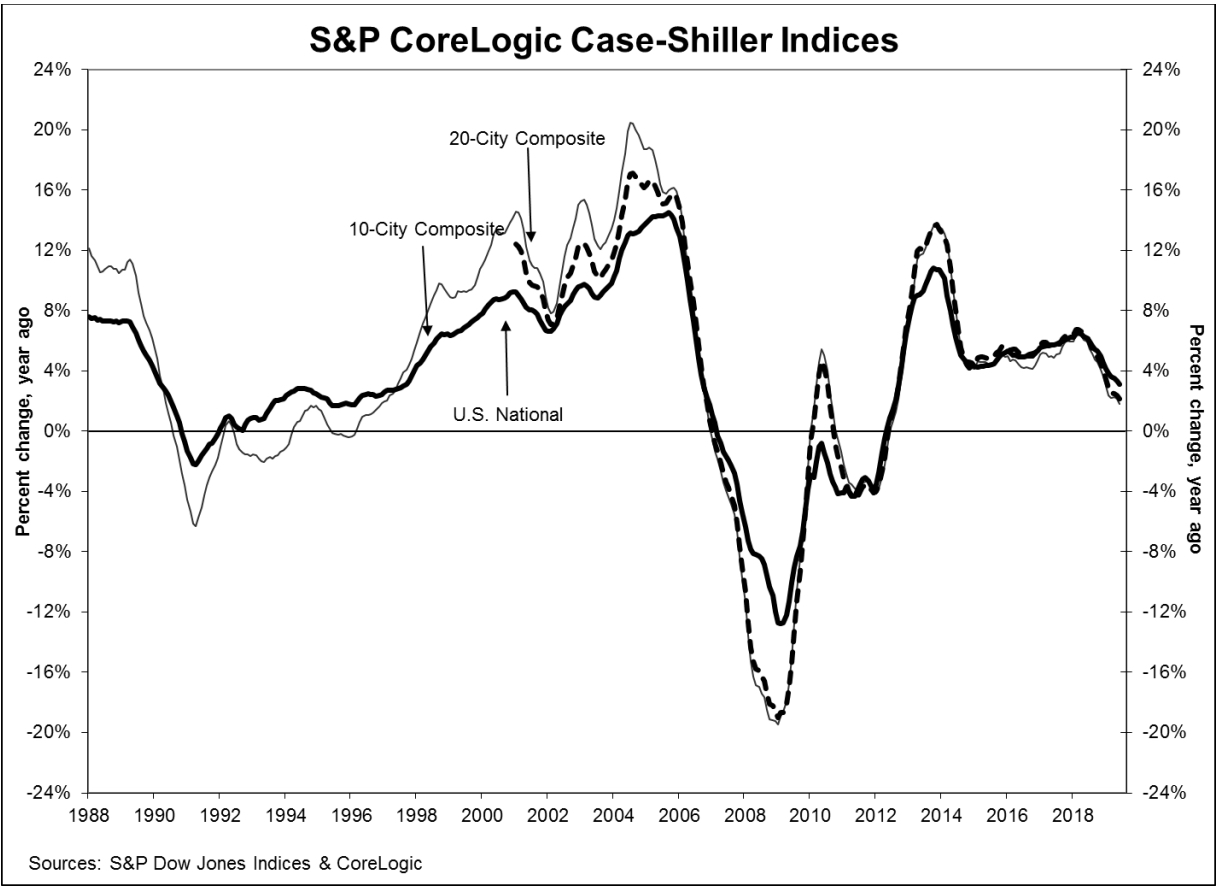

Annual home price gains continued to slow in June, according to the latest S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, released Tuesday. Home prices, on average, achieved an annual 3.1 percent gain in June, down from 3.3 percent the previous month.

“Home price gains continue to trend down, but may be leveling off to a sustainable level,” Philip Murphy, managing director and global head of index governance at S&P Dow Jones Indices, said in a statement.

The overall average price gain slowed, Murphy said, but one less city experienced lower year-over-year price gains than in May.

“The Southwest – Phoenix and Las Vegas – remains the regional leader in home price gains, followed by the southeast – Tampa and Charlotte,” Murphy said. “With three of the bottom five cities – Seattle, San Francisco, and San Diego – much of the West Coast is challenged to sustain year-over-year gains.”

Industrial on ice

How same-day delivery impacts warehouse demand READ MORE

Industrial on ice

How same-day delivery impacts warehouse demand READ MORE

George Ratiu, realtor.com’s senior economist, believes the latest economic forecasts may have a silver lining for potential home buyers.

“Although recent economic news has prompted discussion of an impending recession, there’s a silver lining for buyers: more buying power,” Ratiu said. “As we head into the fall season, buyers can expect to see their dollar stretch further due to the downward trend in mortgage rates, as well as the seasonal slowdown in home prices.”

Reserve your spot at Luxury Connect here. Thinking of bringing your team? There are special onsite perks and discounts for team who register together. Just contact us to find out more.

Source: click here